UPL Ltd is set to record another quarter of losses in Q3, as weak demand, pricing pressures and inventory destocking hits revenue and continues to hurt profitability. The agrochemical major is slated to release its October-December earnings on February 2.

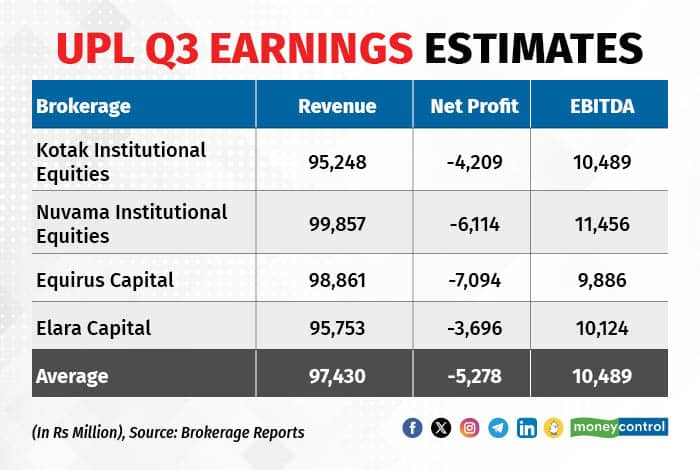

UPL is expected to report a net loss of Rs 527.80 crore in the third quarter of FY24 as against a net profit of Rs 1,326 crore in the year ago period, according to the average of estimates by four brokerages. The Q3 net loss will widen from Rs 189 crore in Q2.

Revenue is also likely to slump nearly 29 percent on year to Rs 9,743 crore in Q3FY24, down from Rs 13,679 crore in the same period a year ago.

Demand remains soft, pricing turns stiff

The company is struggling with a weak demand across most of its key markets like North America, Brazil, Europe and India, which is expected to put severe pressure on its Q3 revenue collections.

Meanwhile, continued destocking of channel inventories across world markets and pricing pressure emanating from the huge influx of products from China will adversely affect UPL's performance in Q3.

“The third quarter was difficult for the crop-protection chemicals industry, with exports likely hurt more than domestic sales amid continued destocking by customers. That said, even the domestic Rabi season was challenging amid low water levels, elevated channel inventories and intense competition,” brokerage firm Kotak Institutional Equities stated in a report.

Kotak also expects UPL to be the worst hit by customer destocking and pricing pressures as it has the largest global presence within the industry.

Nuvama Institutional Equities also expects UPL to see pressure on topline and margins for yet another quarter as liquidation of inventories continues.

"Though we expect volume growth to moderate, a sharp price decline on a year-on-year basis to impact revenue growth. With pressure on margins, we expect EBITDA to decline and with negative operating leverage, we expect UPL to post losses," Nuvama added.

Profitability to take a hit

With pressure on revenues and a drop in prices as the company offers higher rebates and discounts on collections, UPL's operating margin is expected to contract significantly in Q3.

In addition, Equirus Capital also anticipates higher forex losses and higher interest expenses to further weigh on UPL's profitability. Most brokerages pegged a contraction of around 1,000-1,2000 basis points for UPL's EBITDA margin in Q3.

Meanwhile, the government also lowered complex fertiliser subsidy rates for the second half of FY24 by more than 40 percent, which would lead to pressure on EBITDA per tonne, believes Elara Capital.

Debt and debt reduction guidance to be in focus

The company's staggering debt levels as it remains caught in a demand downcycle remains the biggest cause of worry for investors and analysts. On top of that, the lack of clarity over the company's debt reduction targets has already pushed the stock into a pool of downgrades over the last few quarters.

UPL's net debt stood at Rs 262 billion (Rs 26,200 crore) as of June. Even though the management announced a cost reduction drive of $100 million (Rs 8,304.2 crore) within two years, earlier this fiscal, they have not given a clear guidance on the debt reduction target for FY24.

In such a scenario, stakeholders and analysts will remain focused on the company's commentary to find any clues on UPL's debt reduction guidance for Q4 as well as FY24.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.