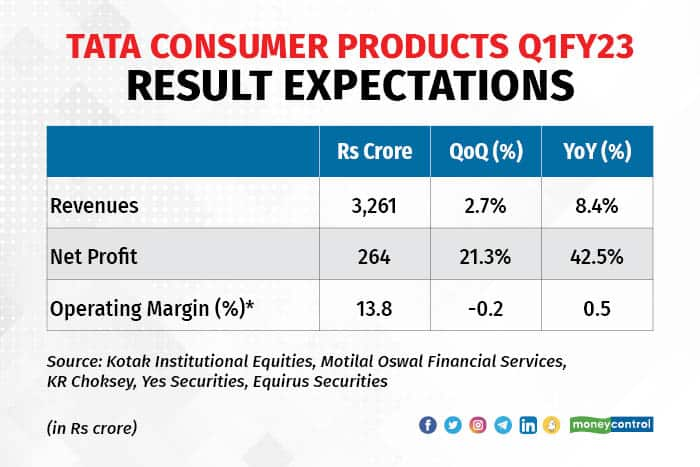

Tata Consumer Products Limited is expected to report a year-on-year growth of 42.5 percent in consolidated profit after tax (PAT) on August 10 when it declares the results for the June quarter. On a sequential basis, the growth in profit is likely to be around 21 percent.

Consolidated revenue is likely to grow 8.4 percent from the year-ago period but sequentially, it is expected to remain flat with a marginal improvement of 2.7 percent.

According to a poll of five brokerages conducted by Moneycontrol, the Tata Group company is expected to report a PAT of Rs 264 crore on consolidated revenue of Rs 3,261 crore.

The growth will likely be driven by an increase in revenues across its tea business in India, domestic foods business, growth in subsidiaries and international coffee business. International tea business is likely to witness a YoY decline in revenue.

During the year-ago quarter, the company registered a consolidated PAT of Rs 185 crore on consolidated revenue of Rs 3,009 crore.

The profit during the January-March period stood at Rs 218 crore, with the company clocking revenue of Rs 3,175 crore.

Experts expect broad-based domestic sales growth aided by domestic beverages and domestic foods, however, international beverages sales are likely to be soft.

“We model 8.6 percent YoY growth in consolidated revenues led by 1 percent YoY value growth in domestic tea business on the back of 4 percent YoY growth in volumes,” said a report from Kotak Institutional Equities.

The brokerage expects India foods business to grow 17.5 percent on year, while the subsidiaries are likely to witness a YoY growth of 8 percent.

“We model around 3 percent YoY decline in International tea and around 4 percent YoY growth in overseas coffee (EOC + Vietnam FDC) in INR terms while the revenues for NourishCo are estimated at Rs 165 crore,” analysts at Kotak said.

An extended summer helped the growth of NourishCo which is focused on building brands in the healthy hydration space and has Himalayan mineral water, Tata Gluco Plus and Tata Water Plus in its portfolio.

The margins are expected to be under pressure sequentially due to rise in inflation.

On a yearly basis, however, the margins may see an uptick on higher tea prices. The significant commodities for the company are tea, coffee and salt but it is not exposed to palm oil, the prices of which had shot up dramatically but have since cooled down.

The company is likely to achieve an EBITDA (earnings before interest, tax, depreciation and amortization) margin of 13.8 percent, a 50 basis point (bp) improvement over last year and a decline of 20 bps over the previous quarter.

One basis point is one-hundredth of a percentage point.

“India branded EBITDA margin would be up 60 bps QoQ to 15.4 percent while the aggregate of subsidiaries (largely overseas): we expect EBITDA margin to contract by 60 bps QoQ”, said a report from Kotak Institutional Equities.

On a consolidated basis, Kotak expect strong EBITDA and earnings growth of a weak base and forecasts minority interest and associate losses for Starbucks and plantations YoY.

The key things to watch in the management commentary would be the update on product launches in the India foods business, supply-chain disruptions, benefits of the shift to the organised sector and expansion of the distribution network.

Tata Consumer Products closed Rs 3.9 higher at Rs 788.70 on August 8 on the National Stock Exchange. The stock has been trading flat over the past year but gained 4 percent in the past month.

Disclaimer: The views and investment tips of experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.