Pharmaceutical major Sun Pharmaceutical Industries is slated to release its October-December earnings on January 31. Steady double-digit growth in the company's India as well as US business is likely to drive a mid-teen increase in net profit.

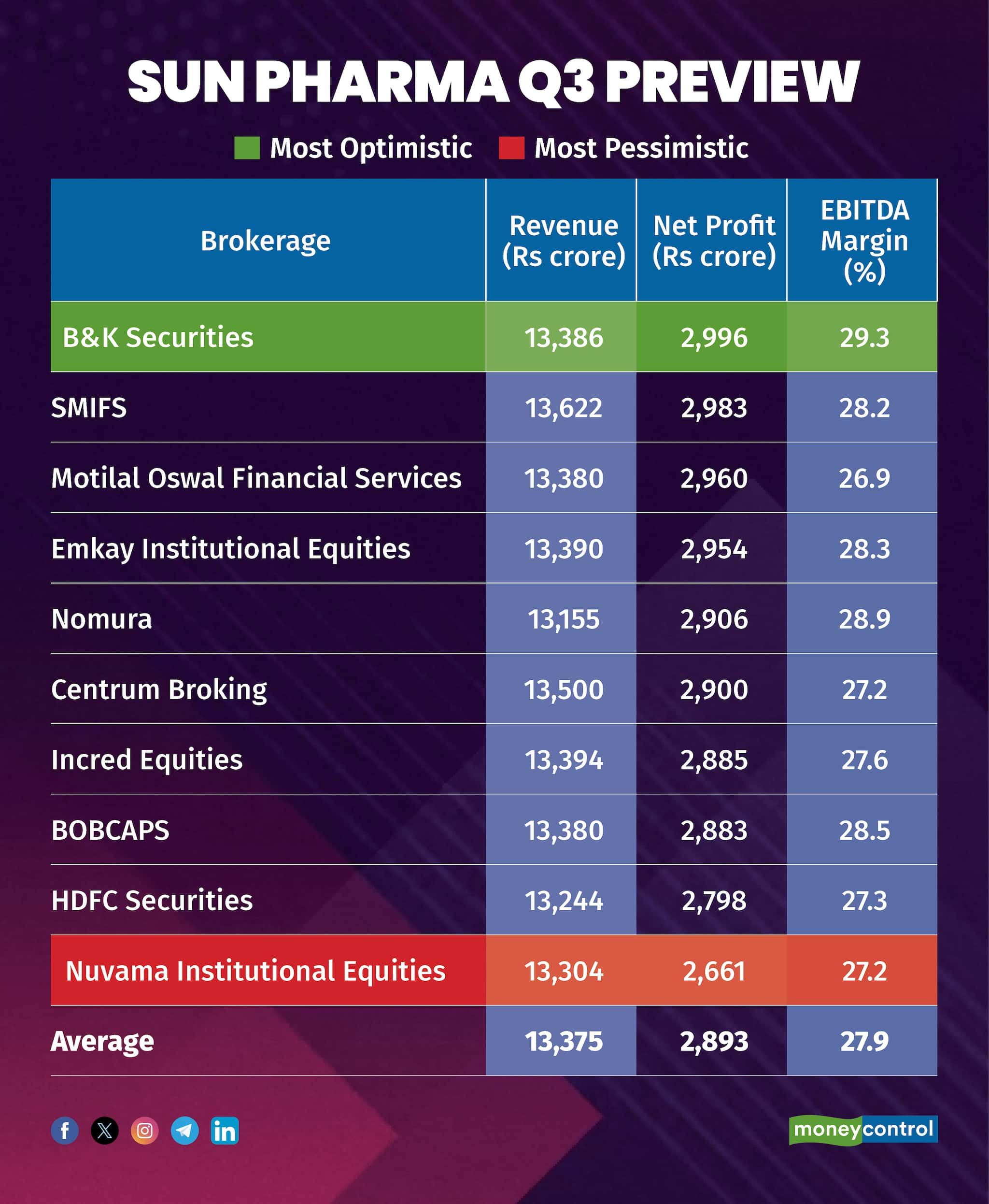

According to a Moneycontrol poll of 10 brokerages, Sun Pharma's net profit is pegged to grow 15 percent at Rs 2,893 crore, up from Rs 2,524 crore reported in the same quarter of the last fiscal. Revenue is likely to register a 10 percent increase to Rs 13,375 crore in the December quarter as compared to the Rs 12,157 crore that it clocked in the preceding year.

Despite that, operational performance is expected to go through a blip due to lower contribution from cancer drug Revlimid. As per the forecasts collated by Moneycontrol, Sun Pharma's EBITDA margin may see a 20 basis points decline on-year to 27.9 percent in Q3.

Estimates for Sun Pharma span over a wide range. The most optimistic projections, from B&K Securities, sees Sun Pharma's net profit surging close to 19 percent, while the most pessimistic estimates, from Nuvama Institutional Equities, forecasts a marginal 5 percent increase.

What factors are impacting the earnings?

The drugmaker is expected to enjoy seasonal strength for its US specialty business, along with steady double-digit growth in the India market.

Domestic formulations sales: Nomura Holdings expects Sun Pharma's India formulation business to grow slightly ahead of the broader market, driven by its large chronic presence and sales force expansion in the recent past. Nuvama Institutional Equities forecasted a 12.5 percent rise in sales for the domestic market.

Steady US growth: A seasonal uptick in the US specialty, and commencement of supply from Sun Pharma's Mohali plant are tailwinds for the US business in the quarter gone-by. While the contribution of Revlimid may ease due to a high base of last fiscal, the other tailwinds are likely to offset much of its impact.

Margin performance: While growth in revenue and net profit are expected to come in double-digits, likely lower contribution from Revlimid and higher research and development spends may hurt the company's margins, albeit marginally. The drugmaker is likely to allocate 8 percent of its Q3 revenue towards R&D to make up for the lag seen in the first half of FY25.

What to look out for in the quarterly show?

Analysts will closely monitor updates on the approval and launch timeline of alopecia areata drug Deuruxolitinib in the US market. Aside from that, further updates on the ramp-up of Sun Pharma's specialty portfolio and clinical trials for major products under development will also be in focus. Another key update that investors will closely track will be progress on the patent lawsuit against dermatology drug Leqselvi.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.