Despite a volatile August, the benchmark Sensex rose to new highs last month, underscored by a 12-session gaining streak that helped erase all the losses to eke out a higher monthly close.

Come September, the big question is: will the record-setting streak continue? Many analysts are cautioning investors about high valuations, which has been the case for quite sometime. What is concerning is that markets have lesser odds of a higher September, if one goes by the monthly returns over past 10 years.

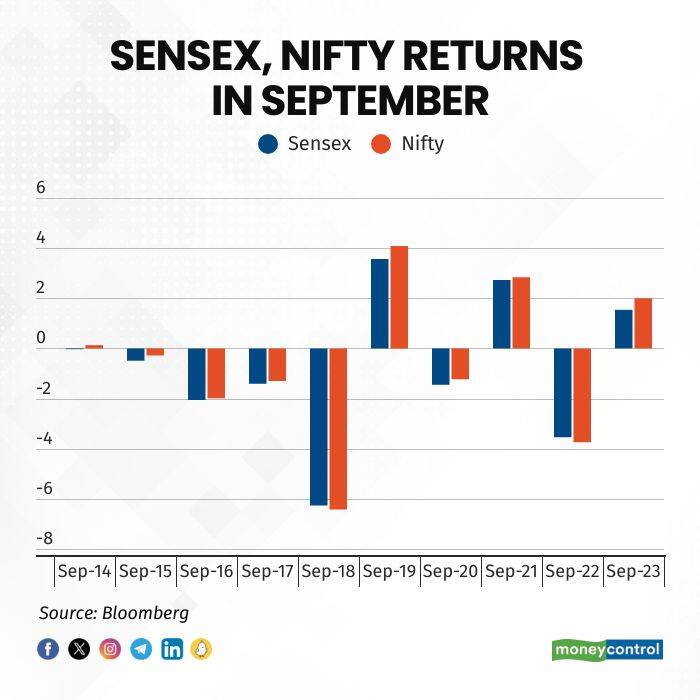

Since 2014, Sensex has delivered negative returns in September seven times, with an average loss of 0.74 percent. There were exceptions - thrice - in September 2023, 2021, and 2019, when it gained 1.5 percent, 2.7 percent, and 3.6 percent, respectively. But if one excludes these, the average loss for September stands at 2.18 percent.

How Markets Behaved In September - Data Shows a Volatile Trend

How Markets Behaved In September - Data Shows a Volatile Trend

FOMC - The Key Factor This September

This September has begun with the anticipation of a rate cut by the US Fed, and the expected volatility around the event. The August US payroll data too is likely to move US stocks, and will be released by the end of the week. The US PCE index growth has aligned with street expectations, supporting the case for a Fed rate cut.

Profit Booking Not Ruled Out

Back home, analysts foresee a minor correction as the 12-session gaining spree may lead to some profit taking. While Foreign Institutional Investors (FIIs) do not yet have a consensus view on Indian flows, the upcoming MSCI EM index adjustment is expected to drive some dollars towards India in the coming weeks.

Expert Takes

"We expect a flat to slightly lower market this week, mostly due to some reversion to mean after the record-breaking 12-day upmove. For the month, the key market moving event will be the US FOMC meeting outcome on Sep 18th, which will start the rate cut cycle. This will have global ramifications, impacting other central bank policies, currencies, carry trades and flows into various asset classes", said Ajay Bagga, an independent analyst.

As rate cuts take effect, analysts expect some weakness in the dollar index and increased flows into emerging markets (EMs) for both equities and debt, which India is likely to benefit from. Additionally, the consensus is that the US economy will see a soft landing, supported by a large fiscal deficit, serving as a global stimulus. Strong US consumer numbers continue to provide a buffer against any potential slowdown, analysts said.

Aside of the US FOMC meeting on September 17-18, key data to watch will be the US August payrolls data on September 6, followed by the US CPI data on September 11.

Emkay predicts a Fed rate cut in September is likely, with a 100 bps reduction by December. The RBI may follow - possibly in October or December - along with a shift in liquidity stance. However, this is expected to have minimal impact on India's real economy and aggregate demand, due to low leverage. The 37 percent rise in NSE 500 index since last October suggests some rate easing is already factored in. Autos, Real Estate, and NBFCs might benefit, and IT could gain from US optimism, the Emkay note said.

"This time history won’t repeat, despite data showing markets have delivered negative returns in September seven times since 2014, but this year would be different, with high volatility ahead of the Fed meet due on 18th," Prashanth Tapse, Senior VP and Research Analyst at Mehta Equities said.

Prashanth Tapse expects the upcoming festive season to be a major booster for consumer spending. "The economic boom triggered by festivals stimulates various sectors, from retail to tourism to infrastructure development and governments leverages such events to foster economic growth. Indian festivals are not just joyful occasions, they are powerful engines of economic prosperity and catalysts for sustainable development," Tapse added.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.