India’s companies had fixed their balance sheets by deleveraging in the aftermath of a debt binge that ravaged them and banks during 2015-2018. Having lightened their debt burden, the companies improved their debt-servicing capacity.

However, this capacity is now up for a test in an inflationary environment that is crimping profit margins and as rising interest rates increase the burden of cost further.

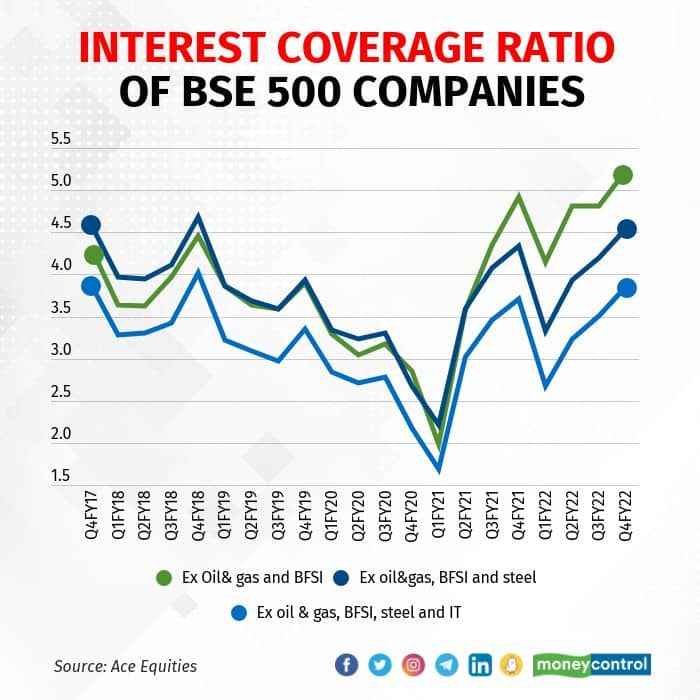

The interest coverage ratio (ICR), a gauge of how comfortably a company can meet its interest payment obligations, has improved in a big way. A Moneycontrol analysis of BSE 500 companies, excluding banks, financial services, insurance (BFSI), and the oil and gas sector, showed that at the aggregate level, operating profit was more than five times the interest cost.

In short, companies generated enough earnings to cover 5.23 times their interest payment pile. A ratio of less than 1 spells doom because it shows that companies didn’t make enough profit to cover even their interest payments.

A combination of shedding costly debt, a sharp fall in interest rates, and a quick recovery in earnings after the initial pandemic-related lockdowns contributed to this improvement. Indian companies were already debt-light before the pandemic, having consistently deleveraged for almost five years.

The pandemic brought down interest rates sharply. Bank loan rates fell more than 150 basis points while bond yields dropped more than 100 bps in FY21, encouraging companies to refinance their borrowings.

As the adjoining chart shows, interest costs declined for six consecutive quarters before growing 3 percent in the fourth quarter of FY22. At the same time, the operating profit of BSE 500 companies grew in high double-digits.

Sector and size

Even if the steel sector is excluded, the interest cover continues to be robust. Steel companies had a windfall in terms of revenue and profit in the past one year due to a surge in steel prices globally.

Excluding steel, the interest coverage for 320 BSE companies worked out to 4.54 times the aggregate operating profit. Further, if the cash-rich information technology companies are omitted, the ratio dips to 3.85 times the aggregate operating profit.

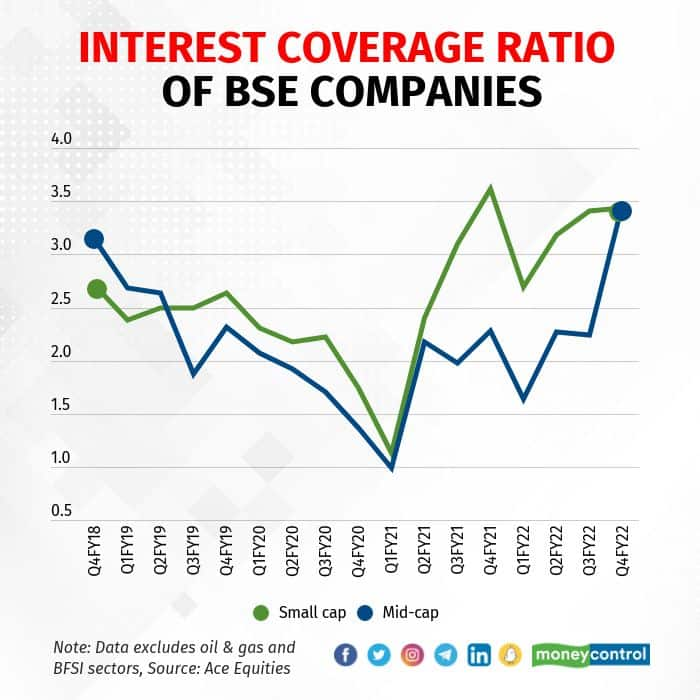

Aggregates tend to show a biased picture because large companies skew the final result and small firms’ troubles are seldom seen. Then again, the ratio for BSE small cap companies is at a robust 3.44. Mid-cap companies also show a strong ability to cover their interest costs. Simply put, Indian companies have shown improvement across size, sector and sensitivity.

Testing times

However, testing times lie ahead. The cost of money is on the rise as the Reserve Bank of India hiked its repo rate by 50 basis points on June 8 after increasing it by 40 bps on May 4. One basis point is one-hundredth of a percentage point.

Economists expect the central bank to increase its policy rate by another 75 bps by December. That will translate into higher bank loan rates as transmission into lending rates will be quick.

State Bank of India, the largest lender, has hiked its loan rates twice in two months and HDFC Bank has already increased its lending rates by 35 bps.

Bond yields have climbed sharply in the past two quarters and are expected to rise further as the RBI continues its rate-hike spree to fight inflation. The upshot is that the cost of borrowing for companies is set to go up and the benefit of low interest rates is in all probability over.

At the same time, input cost pressures are pressuring the profit margins of companies. In all probability, the interest coverage ratio peaked in the fourth quarter of FY22 and from here on, it is likely to drop.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.