Ruchi Agrawal

Moneycontrol Research

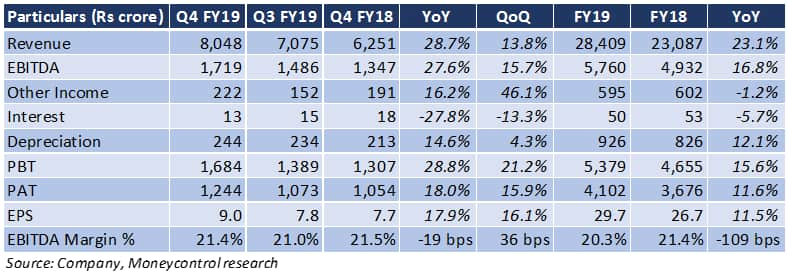

PI Industries churned out a strong quarter with a healthy revenue growth, coupled with profits growth and stable overall margins. Commercialization of new molecules and a decent growth in exports helped.

Key Positives

- The 29 percent year-on-year (YoY) growth in revenue rode on the back of commercialisation of new products and 39 percent jump in CSM (custom synthesis) exports, along with a ramp-up in existing offerings.

- The quarter saw improved utilisation at 90 percent and uptick in shipments.

- The company launched 2-3 molecules in FY19, which saw a robust response. It has plans to launch another 2-3 molecules in FY20.

Key Negatives

- Growth in domestic business remained largely subdued at 4 percent YoY after a lacklustre Rabi season, which led to low incidence of pest infestation and crop diseases and lower acreages.

- Raw material costs were up almost 33 percent because of the uncertainty in the Chinese supply. The company has significantly reduced its dependence on China by sourcing its key raw materials from alternative suppliers. The management believes that the situation in China has not normalised yet. However, it expects improvement in gross margins from the current levels, driven by new sourcing avenues.

Other comments

- The management highlighted that products under development are moving from research and development phase to one of commercialisation. This is expected to benefit top line in coming quarters.

- Commissioning of new capacities (one in February and the other in June) will drive export volumes in FY20.

- The management highlighted visibility of around 25 percent revenue growth in the CSM business for the next 4-6 quarters. Since bulk of this business revenue is contingent on long-term contracts, it is assured of growth.

- The company is looking to launch seven new products in FY20, of which 3 would be in the domestic segment. Four new molecules are expected to be commercialised in the CSM space.

- The agri-sciences firm plans to invest Rs 400-450 crore in FY20 on capacity enhancement, infrastructure investment and R&D.

Outlook

The company has reported a healthy demand surge in exports, with a strong product portfolio in domestic and export markets. It’s also banking on a strong order pipeline and working with innovator partners to roll out new products.

With a solid product line up and supportive policy environment, the domestic business is expected to maintain the current traction. Further pick-up of recent product launches along with new molecules lined up for a launch suggest that volumes are expected to improve.

The export business has seen a strong build-up and reported a healthy traction with inflows coming in from the order book. We expect this to continue. With increased inquiries and higher translation into firm orders, we also expect the growth in exports to sustain. The company has an aggressive line-up of new molecules with which it aims to scale up volumes in this segment.

Post strong results, the stock has seen a sharp uptick and is close to its 52-week high, valuing the company at 28x FY20e earnings. With a strong future order book and the removal of current hiccups, we see the stock maintaining its good run.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.