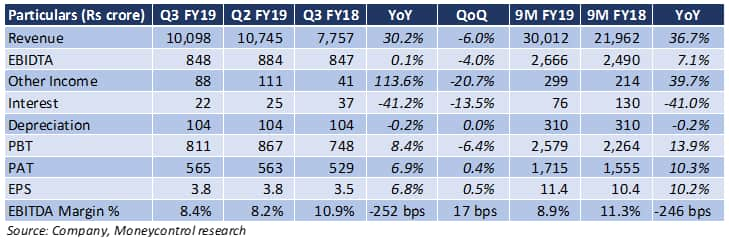

Petronet LNG (PLNG) reported a subdued performance with a noticeable year-on-year (YoY) contraction in earnings before interest, tax, depreciation and amortisation (EBITDA) margins and net margins despite a strong YoY uptick in revenue and a slight surge in profits.

- The revenue grew 30 percent YoY but the topline contracted 6 percent sequentially. The growth was despite a contraction in volumes and was driven by 11 percent YoY (+2 percent sequentially) rise in the regas charge at Dahej with a sharp uptick in spot regas charge.

-Lower tax charge helped in proving support to the net profits.

-The company was able to bring in a substantial 41 percent cut in the finance costs which is a healthy sign. Other expenses were down almost 7 percent YoY.

Key Negatives-EBITDA remained largely flat on a YoY basis for yet another quarter. However, there was a noticeable 4 percent dip quarter-on-quarter (QoQ).

-While EBITDA margins slightly improved sequentially, there was a 252 basis point YoY contraction on the back of higher raw material costs and a surge in employee expenses. Though the employee expenses were up YoY, there was some cooling off during the quarter after a very sharp surge in the Q2FY19.

-Utilisation at Dahej moderated to 103 percent and Kochi to 8 percent. Volume at Dahej declined 7 percent sequentially due to lower offtake from power and petchem industries in November 2018.

-The expansion of the Dahej terminal from the current 15 mtpa (million tonnes per annum) to 17.5 mtpa is expected to get commissioned by Jun 2019 post which there is an expectation of a volume ramp-up in H2FY20 subject to demand.

-New tanks and third jetty commissioned at the Dahej terminal are expected to enhance the capacity further to 19.5 mmtpa in the next 3-4 years.

-The Bangladesh expansion is now facing challenges. While the Bangladesh government wants PLNG to bid for the project, the company wasn’t a G2G deal with proper safety nets to ensure smooth demand. The terminal location has been changed due to naval requirements, which would mean a new feasibility study for the new location and will entail a delay in the project.

-PLNG is also considering new LNG terminals on the east coast of India along with exploring expansion opportunities in Qatar and US.

-The commissioning of GAIL’s Kochi-Mangalore pipeline which is the key to the Kochi terminals growth is expected to get delayed from the scheduled February 2019 to June 2019 due to monsoons in Karnataka and Kerala towards the end of 2018.

-In order to boost up the volume at the Kochi terminal, the management indicated there might be an earlier-than-expected cut in the tariffs.

-The company is participating in the 10th round of PNGRB CGD (city gas distribution) bidding focusing on South Indian geographical areas (GAs)

OutlookThe stock corrected after the subdued performance and is trading around 19 percent below its 52-week high at a 17x 2020e (estimated) price to earning (PE).

While the company’s performance has been impacted due to varied reasons we see several catalysts like brownfield expansion in Dahej, commissioning of the Kochi pipeline and progress on the uniform pipeline tariffs which we believe would help to improve the performance in the coming terms, though the international expansion plans seem to be slowing down a bit.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.