Nykaa’s (officially, FSN E-Commerce Ventures) debut on the stock markets on November 10 was eye-popping to say the least. Shares of the company closed at Rs 2,206.70 apiece on the Bombay Stock Exchange (BSE). This represents as much as 96 percent increase from the issue price of Rs 1125 per share.

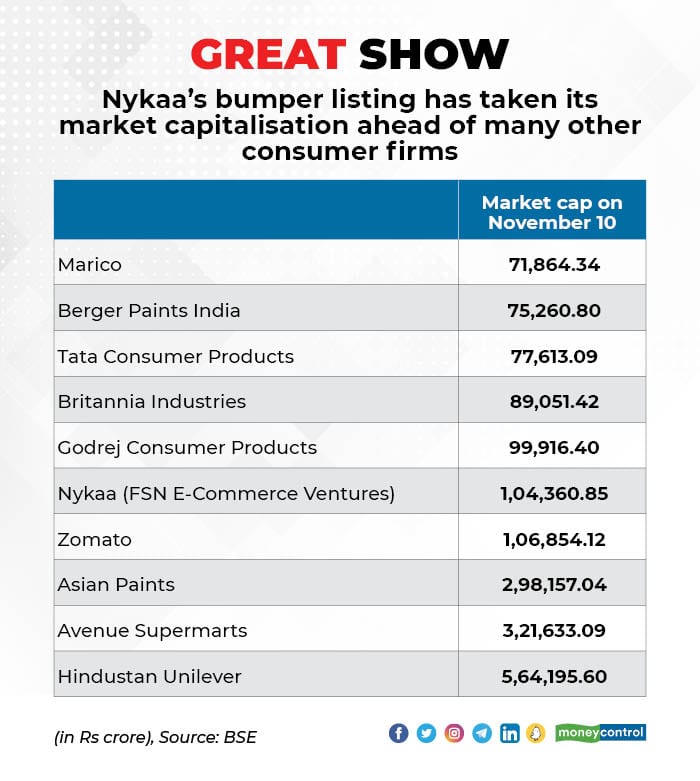

The stunning listing took Nykaa’s market-capitalization to Rs 1,04,438.88 crore on November 10 - much ahead of many consumer firms such as Marico and Berger Paints India. The adjacent chart has the details. Of course, these companies are not strictly comparable.

Nykaa is a digital e-tailer that is making profits, although substantially lower than many other consumer firms. Karan Taurani, analyst at Elara Securities (India) said: “Companies such as Nykaa are in the aggregation business whereas consumer companies are selling their own brands. On the other hand, Nykaa is a one stop shop for many brands and the scalability is immense.”

Also read: Nykaa CEO Falguni Nayar: Not choosing growth over profitability, will try to achieve both

Many experts reckon the scope for growth is huge for internet/ digital companies. Nitin Rao, founder of alphaideas.in, an investment blog said, “It is worth noting that the other consumer-related firms are not going to grow at 40-50 percent every year and they are predominantly offline plays. In comparison, Nykaa’s expected potential growth rates are much higher and it is a digital play.”

The covid-19 pandemic has accelerated the adoption of digital services platforms and in keeping with that, companies such as Nykaa stand to benefit. Nykaa is a multi-brand beauty and personal care (BPC) platform in India with a formidable presence in this segment. In 2018, it expanded into the fashion segment under Nykaa Fashion.

Rao also added, “Moreover, the Chinese government's tech crackdown will prompt global investors to look for other options and accordingly, they may well find the Indian market attractive.”

It also helps that Nykaa is profitable unlike other internet firms such as Zomato (an online food delivery firm) or One97 Communications (Paytm). In FY21, Nykaa’s net profit was Rs 62 crore and EBITDA (earnings before interest, tax, depreciation and amortization) margin stood at 6.6 percent. Fortunately for investors, margin outlook is upbeat. “We believe Nykaa can sustain a CAGR of about 35 percent in sales, 50 percent in EBITDA over coming few years with double digit margins,” said analysts from Prabhudas Lilladher Pvt. Ltd in a report on October 26. CAGR is compound annual growth rate. For perspective: over FY19-FY21, Nykaa’s revenues have increased at a CAGR of 48 percent. During the same period, gross merchandise value (GMV) CAGR stood at about 57 percent.

While these factors augur well, it goes without saying that Nykaa’s valuations are expensive. Elara’s implied target price for the Nykaa stock five years from now based on FY27’s estimated revenues is Rs 1880 apiece. Nykaa’s share price has now surpassed this. Using Elara’s FY27 estimated revenues, the stock is now trading at a market capitalization to sales ratio of about 8 times. According to Taurani, “Investors would have to watch execution in the fashion segment, the success of which would be key for valuations ahead.” Investors would also have to keep a close eye on the pace of growth.

On Thursday when the broader markets were weak, Nykaa’s shares fell about 1 percent to Rs 2187 apiece on BSE at 12.51 pm

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.