Neha DaveMoneycontrol Research

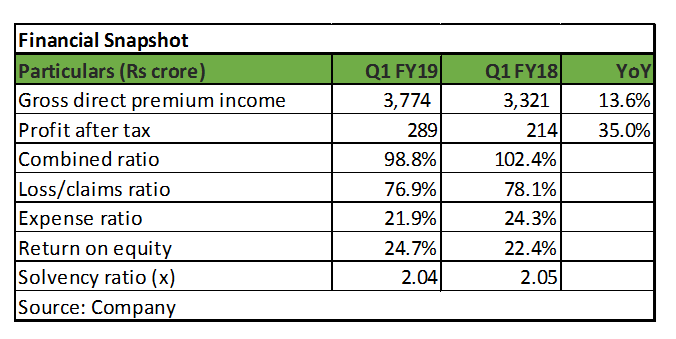

ICICI Lombard General Insurance reported a 13.7 percent year-on-year (YoY) growth in gross direct premium income (GDPI) as against the industry average of 12.2 percent in Q1 FY19. Its market share increased to 10.1 percent, further consolidating its position as the largest private non-life player and the fourth largest in the general insurance industry. Despite the inherent volatility in its core risk underwriting business, opportunities for the sector and ICICI Lombard’s vantage positioning makes it a stock worth looking at.

Healthy growth in premiums

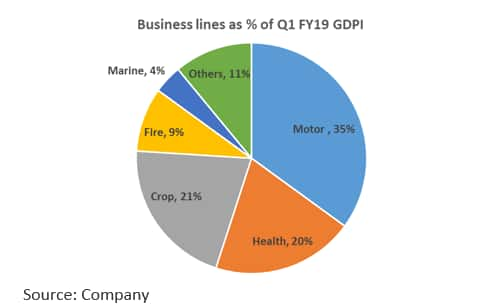

GDPI increased to Rs 3,774 crore in Q1, translating in a 13.7 percent growth. If we exclude the crop insurance segment, growth was better at 14.1 percent. Growth in premium was broad-based as it maintains a diversified portfolio spread across motor, health and personal accident, crop and property insurance. Thanks to the four-fold increase in crop insurance premiums in FY17, contribution from crop insurance in total GDPI stood at 21 percent, emerging as the second largest segment after motor (35 percent).

The management expects to continue to grow at 15-20 percent in the medium to long term. Going forward, it sees health, motor and corporate (fire, marine cargo and engineering) segments driving growth. The company sees profitable growth opportunities in the retail segment, especially in health, which will remain its key focus area. The insurer remains cautious on government-related business segments like crop and mass health.

Improvement in operating metrics

The combined ratio, a measure of the insurance company’s profitability expressed as total cost to revenue, improved to 98.8 percent in Q1 from 102.4 percent YoY. The improvement in combined ratio was aided by a fall in claims/loss ratio as well as expense ratio to 76.9 percent and 21.9 percent in Q1, respectively.

Business segment-wise, overall performance was dragged lower by high claims ratio in the crop segment at 117 percent. Motor insurance segment showed an improvement with the claims ratio falling to 75.1 percent from 77.9 percent last year.

Despite the modest underwriting performance, the insurer has been profitably supported by healthy investment income: interest and dividend and profit from sale of investments.

Investment assets grew 23 percent YoY to Rs 19,873 crore but realised return on the book was slightly less at 2.7 percent for the quarter gone by versus 3 percent last year. Investment income in Q1 increased to Rs 507 crore from Rs 455 crore a year ago. ICICI Lombard’s investment performance continues to be consistent.

Going forward, rising interest rates will benefit the insurer as 80 percent of its book consists of fixed income securities. As the portfolio is mainly held till maturity, the insurer doesn’t have to take a mark-to-market hit, while its investment income improves with rising rates.

Capitalisation is adequate for ICICI Lombard as reflected in its solvency ratio at 204 percent against the regulatory requirement of 150 percent.

Sectoral tailwinds to drive growth

The general insurance industry in India has witnessed compounded annual growth rate (CAGR) of 17 percent in GDPI in the last 16 years. There are several growth levers that will drive high-teen growth over the next few years as well. India continues to be grossly underpenetrated market with a non-life penetration at one-fourth of the global average in 2016. The insurance density (non-life insurance premium per capita) also remains significantly lower than other developed and emerging market economies.

We see multiple opportunities for underlying segments as well. Higher cost of healthcare and rising incidences of critical illness is likely to increase health insurance penetration. Increase in new vehicle sales will be a key growth driver for the motor insurance segment. The passage of the Motor Vehicles (Amendment) Bill, 2016, a legislation which is currently being evaluated by Parliament, is expected to improve long term profitability of insurers in the motor segment.

Premium valuations to sustain

ICICI Lombard is well poised for earnings growth, with an increase in insurance penetration, focus on profitable segments and improvement in operating efficiency. The current valuation appears rich as the stock is currently trading at 7 times its trailing book with a return on average equity at 25 percent.

Leading companies in the sector tends to trade at higher multiples for long periods. In the absence of suitable and comparable listed peer, ICICI Lombard trades as a proxy for the sector, commanding a higher valuation. While the premium valuation will sustain, the near term upside in the stock price is limited.

For investors with a long term horizon and wanting to participate in growth in the general insurance sector, the stock is worth a consideration.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!