Neha Dave

Moneycontrol Research

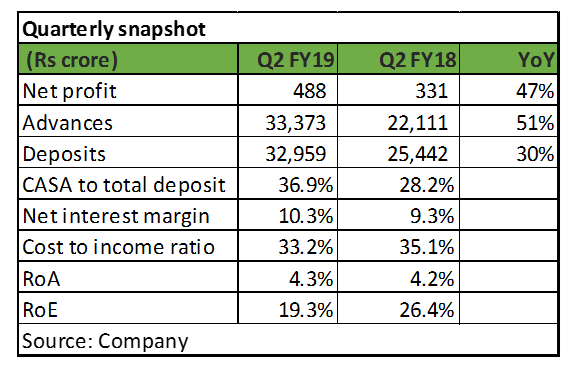

Bandhan Bank, the youngest bank in India, reported strong Q2 FY19 earnings, with net profit increasing 47 percent year-on-year (YoY) on the back of solid loan book growth.

It is a first microfinance company to convert into a full-fledged universal bank, distinct from the 'small finance banks' (SFBs). The bank’s performance has been superior, both in terms of returns profile and asset quality, vis-a-vis the three listed SFBs. It stands out even when compared to new private sector banks.

Superior return ratios, pristine asset quality, strong capitalisation, improving funding profile and highly experienced management and promoter profile clearly makes it an outlier in the microfinance segment. Notwithstanding its premium valuation and impending promoter stake dilution, Bandhan’s vantage positioning makes it a stock worth looking at.

Quarter at a glance

The bank delivered another quarter of impressive performance. The same was apparent in net profit growth of 47 percent YoY, which was driven by strong performance across most operating metrics.

Best in class margins

Its high yielding loan portfolio (as 86 percent of advances is micro lending) and low cost of funds resulted in high net interest margin (NIMs). Despite rising interest rate scenario, NIM in Q2 was stable at 10.3 percent and remains much higher than the industry average.

Improvement in operating efficiency

Along with higher NIM, low cost-to-income ratio at 33 percent is also a key differentiator and profit driver for the bank. Bandhan had lower cost of operations as a microfinance entity (MFI). Even in its banking set-up, it has managed to keep costs under control. This despite the fact that the bank opened 938 general bank branches and added employees in the banking business. As the bank sweats its existing assets more efficiently, cost-to-income ratio trended down to 33 percent from 35 percent last year.

Its superior profits are supported by a strong balance sheet. Moreover, balance sheet strength provides assurance on sustainability of earnings growth.

Robust loan book growth

Advances book in Q2 grew at 51 percent YoY to Rs 33,373 crore. While Bandhan is predominantly a microfinance lender, as 86 percent of its book still comprises of micro banking loans, it is heartening to see continued efforts at portfolio diversification. Non–micro banking assets, which includes SME and other retail loans such as two-wheeler (2W), home and personal, increased by over 80 percent YoY, albeit on a lower base.

Strong deposit base

In three years after receiving the banking licence, Bandhan has built a formidable deposit franchisee. Growth in current and savings account deposits (CASA) at 70 percent YoY outpaced the bank’s total deposits growth of 30 percent as at September-end. Consequently, its CASA ratio improved to 36.9 percent, increasing by almost 9 percent compared to the same period last year.

Superior asset quality

The bank continued to maintain its pristine asset quality, with gross and net non-performing assets at 1.3 percent and 0.7 percent, respectively, as at September-end. Despite operating in an industry that has witnessed couple of big crises in the last decade (crisis in Andhra Pradesh in 2011 and demonetisation), Bandhan has consistently maintained its healthy asset quality. Such a strong asset quality performance is attributable to a long experience in the segment to strong lending, monitoring and collection processes and systems. Having said that, asset quality performance will be a key monitorable.

The management disclosed that it has an exposure of over Rs 300 crore to the IL&FS group, which is currently classified as standard. But it is confident of maintaining credit cost around 1-1.5 percent for FY19.

Promoter stake dilution in the offing

Since the bank was not able to pare down promoter shareholding to 40 percent from current 82 percent as required under licencing conditions by August 23, the Reserve Bank withdrew its general permission to open new branches, following which the stock corrected significantly. Read: RBI’s Bandhan Bank diktat: Here’s what investors need to know

As per the management, the restriction on branch opening will not impact its growth. Investors should note that the bank can open branches with prior approval of RBI. Bandhan Bank had planned to open 1,000 branches by March 2019 and already has 938 of them as of September-end. The maturing of current branches can take care of growth for the next 2-3 years.

There are multiple ways through which the bank can comply with the regulatory requirements and will submit the roadmap/strategy to RBI.

But the biggest concern for an investor is that acting under pressure the bank may end up acquiring an unrelated business or cough out a valuation that turns out to be difficult to digest.

Quality franchise with premium valuationsIn a knee-jerk reaction, the stock price nosedived following RBI’s order and is now down almost 30 percent from its 52-week high.

Even after a big sell-off, Bandhan trades at 4.5 times FY20e book value. As such, the near term upside seems limited. While dilution of promoter’s stake can remain an overhang on the stock, strong return ratios with return on assets (RoA) at 4.3 percent and return on equity (RoE) at 19 percent should support premium valuations.

While microfinance is a relatively riskier asset segment, with inherently weak borrower profile susceptible to socio-political issues and resulting unhealthy credit culture, few in the industry boasts of a track record as Bandhan. Investors looking for high quality business operating at the bottom of the pyramid may look to utilise adverse market volatility, if any, as an opportunity to buy into the stock.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!