HDFC Bank, which is scheduled to announce its June quarter numbers on July 16, is likely to report strong growth in profits and net interest income (NII), said analysts tracking the company.

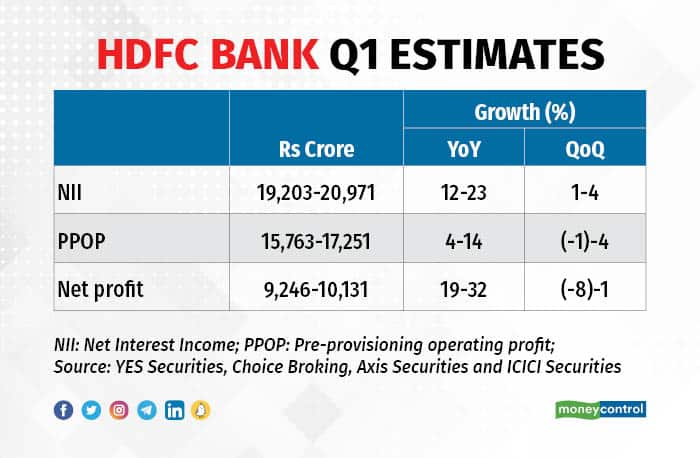

Analysts expect the most valued private bank to report 12-23 percent year-on-year (YoY) growth in NII. Net profit growth is likely to be in the range of 19-32 percent YoY. However, sequential growth will likely be flat or negative.

ICICI Securities, which is bullish on the bank’s stocks, said credit growth is expected to remain strong at 21.6 percent YoY to Rs 13.95 lakh crore. Deposit growth is expected at 19 percent YoY and CASA ratio is likely to be at around 46 percent, it said.

“NII growth to be at 12.9 percent YoY to Rs 19,203 crore and expect margins to be flattish quarter-on-quarter (QoQ) at 4 percent. Other income to see improvement YoY and asset quality expected to improve QoQ with gross non performing assets (NPA) at around 1.1 percent levels,” it said. The broker expects provision to decline to Rs 3,208 crore, which will lift net profits up 26 percent YoY to Rs 9,720 crore.

However, sequential growth will not be as spectacular, analysts noted.

According to YES Securities, sequential loan growth would be moderate due to idiosyncratic aspects and the bank bouncing back from the impact of the third wave of Covid-19 in Q4FY22, which would somewhat offset the seasonal impact of a tepid first quarter of the financial year.

“Sequential NII growth would be particularly healthy given yield on advances would have evolved faster than cost of deposits due to repricing of externally benchmarked loans, implying net interest margin (NIM) expansion on sequential basis,” it said.

Analysts said sequential fee income growth, though, would be healthy due to a bounce-back in payments-related fees, which will offset seasonal sluggishness to an extent. Treasury income would be weak, but since it is such a low part of the interest income that it will not have much impact, they said.

After some quarters of relatively weaker numbers, the bank has bounced back in the last couple of quarters, regaining its mojo. And, Choice Broking also believes the mojo will continue for another quarter.

“NII/PAT are expected to grow at 23 percent/20 percent YoY. Meanwhile, the bank has reported 21 percent YoY advances growth during QFY23, which came in line with our estimated growth of 21.5 percent,” it said.

According to Axis Securities and Choice Broking, key things to watch for the bank will be:

- Bank's announcements on digital infrastructure front

- Commentary on its merger with HDFC with respect to regulatory compliance

- NIM guidance

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.