Foreign institutional investors (FIIs) turned net buyers in the second half of November, reversing their substantial selling in Indian equities during October and the first half of November. This shift led to a marginal improvement in FIIs' assets under custody in November, with their share in the equity market rising to 16.09 percent after slipping below 16 percent in October.

In the second half of November, foreign institutional investors (FIIs) purchased around Rs 1,311 crore, contrasting sharply with their heavy selling of Rs 23,913 crore in the first half of the month. In October, FIIs had offloaded a significant Rs 87,590 crore. Despite these fluctuations, FIIs' assets under custody (AUC) rose to Rs 71.88 lakh crore in November, up from Rs 71.08 lakh crore in October, reflecting a marginal recovery.

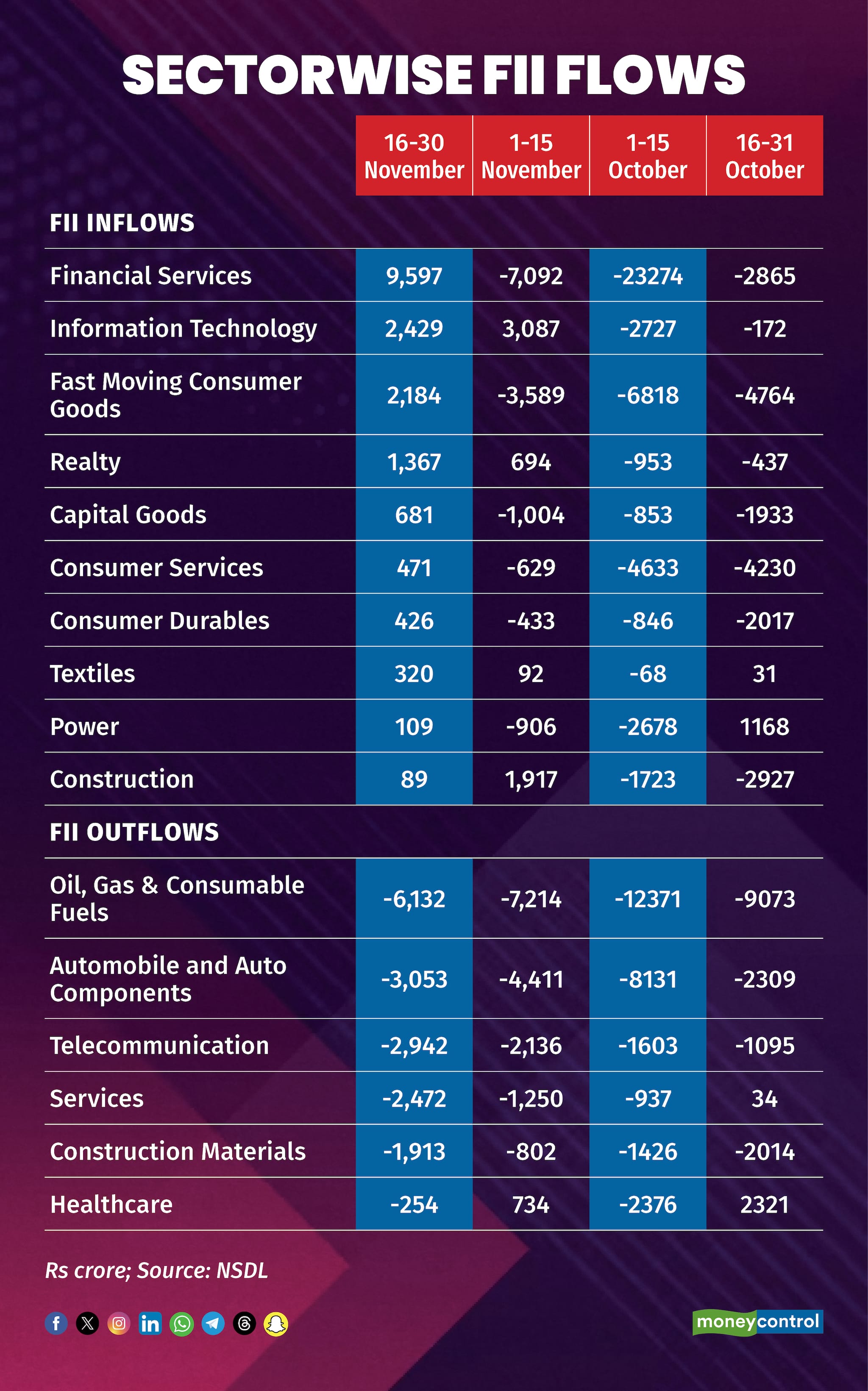

FIIs invested Rs 9,597 crore in financial services in the second half of November, followed by Rs 2,429 crore in information technology (IT) and Rs 2,184 crore in FMCG. In contrast, during October and the first half of November, FIIs had heavily sold Rs 26,139 crore and Rs 7,092 crore in financial services, Rs 2,899 crore in IT (October), while buying Rs 3,087 crore in early November, and Rs 11,582 crore and Rs 3,589 crore in FMCG during October and early November, respectively.

Other sectors where FIIs turned buyers in the second half of November included realty (Rs 1,367 crore), capital goods (Rs 681 crore), consumer services (Rs 471 crore), and consumer durables (Rs 426 crore).

Interestingly, FIIs had sold Rs 1,390 crore in realty during October but reversed to buying Rs 694 crore in early November. In capital goods and consumer durables, FIIs had sold Rs 2,786 crore and Rs 8,863 crore in October and remained net sellers of Rs 1,004 crore and Rs 433 crore in early November, respectively.

Despite the shift in some sectors, FIIs maintained their selling stance in oil & gas, auto, telecom, and construction materials. In oil & gas, FIIs sold Rs 6,132 crore in the second half of November, adding to Rs 21,444 crore sold in October and Rs 7,214 crore in early November.

In automobiles and telecom, FIIs sold Rs 3,053 crore and Rs 2,942 crore, respectively, in the second half of November, following Rs 10,440 crore and Rs 2,698 crore in October and Rs 4,411 crore and Rs 2,136 crore in early November.

In construction materials, FIIs sold Rs 1,913 crore in the second half of November after offloading Rs 3,440 crore in October and Rs 802 crore in early November.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.