Indian companies found it hard to expand their profit margins in the June quarter of FY23 owing to persistent inflation across commodities, a study of the results of select companies that have been released so far shows.

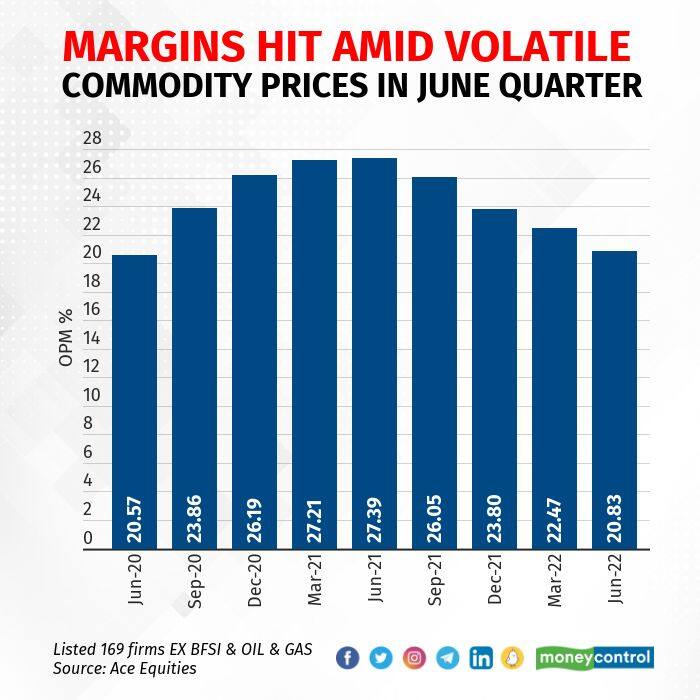

For Q1FY23, operating profit margins expanded at the slowest pace in eight quarters due to record high inflation along with significant volatility in commodity prices.

A Moneycontrol analysis of 169 companies that have announced their June quarter earnings till date and for which data is available for the 25 preceding quarters shows that the aggregate operating profit margin was at 20.83 percent, the lowest growth since June 2020, having fallen for the fourth quarter in a row.

The analysis excluded banking, financial services and insurance, and oil and gas firms as they follow a different revenue model.

Whipped by the commodity storm

Prices of basic raw materials such as oil and metals saw huge volatility in the June quarter. Brent crude rose 10 percent compared with 39 percent in the March quarter.

Aluminium, copper, zinc and lead were down 20-30 percent against a rise of 6-25 percent in the previous quarter. The Bloomberg Commodity Index lost 6 percent over the first quarter, while it had surged 25 percent in the January to March quarter.

"As evident, margins of corporate India have been seriously impacted by rising inflation across energy, hard and soft commodities. As we see inflation peak out in energy and hard commodities, the overall margin profile of corporate India could expand,” said Siddharth Vora, head of investment strategy and fund manager, portfolio management services, at Prabhudas Lilladher.

"Services and wage inflation are likely to persist, so it would take longer for the margins of technology and other services companies to normalise. With the peaking out of inflation, there is hope of a less hawkish monetary policy, which could then support capital market sentiment."

Shrinking margins

Technology firms reported weaker margins amid wage hikes and macro challenges. Margins at Infosys contracted 150 basis points (bps) sequentially, while Tata Consultancy Services reported 23.1 percent margins, well below the company’s target range of 26-28 percent. Tech Mahindra saw margins contract 220 bps on a quarterly basis (411 bps year-on-year) to 11 percent. One basis point is one-hundredth of a percentage point.

For fast-moving consumer goods giant Hindustan Unilever, gross margins continued to remain under pressure with a 309 bps contraction given both crude and palm oil prices were sharply up in most of the quarter.

Asian Paints’ gross margins witnessed a slight dip of 73 bps over the previous year (100 bps quarterly) due to a change in product mix and delay in price hikes. The two factors pushed Bajaj Auto’s margins 73 bps lower year-on-year (100 bps sequentially).

Narendra Solanki, an analyst at Anand Rathi, believes that margins may begin to improve in the coming quarters as inflationary pressures ease. “I think this quarter should mark the end of margin compression for broader companies and margins should increase gradually as commodity prices have fallen somewhat and pass-through is also happening. I think that so long as revenue momentum continues, margins should scale back to normal levels once inflationary pressure recedes,” Solanki said.

Another trend observed is that the majority of the companies was a sequential decline in revenues but this is also a seasonal effect as the fourth quarter is usually the strongest quarter for Indian companies. However, firms saw robust year-on-year growth, largely due to the base effect as the previous year was badly affected by pandemic-related lockdowns.

Net sales at these companies slowed 2.4 percent sequentially, the slowest since the June 2021 quarter, compared to a 10 percent growth in the March quarter.

Net profit, after adjusting for a one-time profit or loss, also slipped 19.1 percent sequentially in the June quarter, its lowest since June 2020, against a rise of 7.4 percent in the previous three months.

Year-on-year revenue jumped 27.22 percent, while net profit declined nearly 10 percent, according to ACE Equities data.

Small and mid-cap worries

Analysts point out that the early trends reflect predominantly large companies and a clearer trend on profitability would emerge once small and midcap firms detail their June quarter performance.

Concerns are that the trend could show considerable weakness. “The real pain will be unearthed thereafter as not all companies will be able to pass the inflation and rising interest test. While we do not expect a big cutback in earnings for Nifty stocks, the small-cap and midcap pack is expected to see a big downward revision in earnings post the first quarter,” said Vinit Bolinjkar, head of research, Ventura Securities.

The overall earnings growth for the first quarter could show double-digit contraction on a sequential basis, warned Siddharth Khemka, head, retail research, Motilal Oswal Financial Services.

He expects earnings growth to show a 21 percent year-on-year growth. Earnings growth is expected to be narrow and led by BFSI (banking, financial services and insurance), oil and gas, auto and consumer goods sectors, Khemka said.

“Excluding BFSI, we expect earnings to record a relatively modest 13 percent year-on-year growth. Excluding OMCs (oil marketing companies) and financials, we expect a 180bp year-on-year decline in EBITDA (earnings before interest, tax, depreciation and amortisation) margin to 20.5 percent. Cement, metals, chemicals, oil and gas, and healthcare are likely to face severe gross and EBITDA margin pressures. The benefit of the recent moderation in commodity costs will accrue only from 2QFY23 and beyond,” Khemka added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.