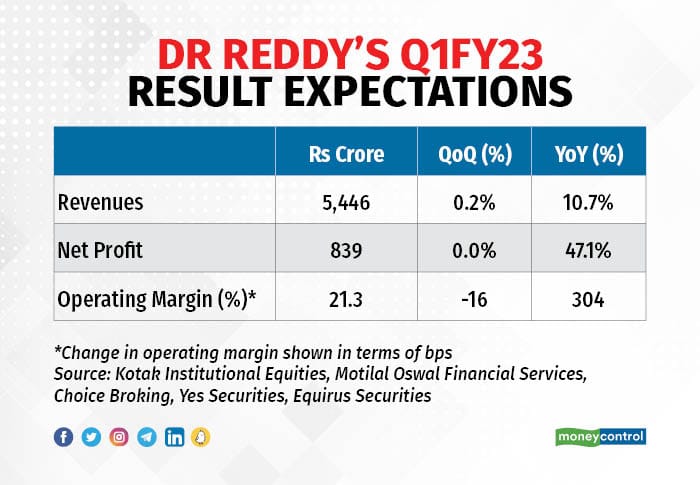

Dr Reddy’s Laboratories may post a 47-50 percent growth in consolidated profit after tax for the first quarter of FY22 and a 11-12 percent increase in consolidated revenue, a poll of brokerages showed.

On a sequential basis, PAT and revenue are likely to be little changed.

The Hyderabad-based drug maker is expected to report a consolidated PAT of Rs 840 crore on revenue of Rs 5,446 crore in the three months ended June, according to the average of estimates of five brokerages polled by Moneycontrol. The company reported a PAT of Rs 571 crore and revenue of Rs 4,919 crore a year earlier.

PAT during the previous quarter was Rs 87.5 crore, which had an impairment loss of Rs 751.5 crore. Adjusting for the impairment, PAT would have been Rs 839 crore while revenue was Rs 5,437 crore.

The brokerages forecast a healthy year-on-year growth in revenue from its US business, which is likely to grow 15 percent to $260-270 million. The growth was aided by the ramp-up in prescription share of generic versions of Vascepa (a drug to treat high triglyceride levels), Vasostrict (to increase blood pressure in adults), Ciprodex (for ear infections) and other recently launched products, offsetting a volume decline in Suboxone, a drug to treat both pain and addiction to opioids.

On a sequential basis, the US business is likely to remain flat on account of lower sales of Vasopressin, the generic version of Vasostrict, as well as base business erosion.

Domestic sales, however, are likely to dip 5-10 percent on a high Covid base during the same period last year. The acquisition of the Cidmus brand supported domestic business growth to some extent during the quarter.

Kotak Institutional Equities expects low to mid-single digit YoY growth in Europe and the rest of the world, and in the pharmaceutical services and active ingredients segments.

“While underlying Russia sales will decline sequentially on account of stocking up in Q4FY22, we expect appreciation of Rouble over USD to support more than 30 percent YoY growth, albeit down 34 percent on a sequential basis,” Kotak Institutional Equities said in a report.

The brokerages expect the gross and EBITDA (earnings before interest, tax, depreciation and amortisation) margins to remain largely flat on a sequential basis while they are seen improving by 1.5-3 percent from a year earlier.

During the current quarter, Dr. Reddy’s stands to get $72 million from the settlement of the Suboxone dispute with Indivior.

The outlook for the pharmaceutical services and active ingredients segments, given the global volatility related to raw materials and logistics costs, remains a key monitorable, along with the outlook for business in Russia and the CIS (Commonwealth of Independent States).

Dr Reddy’s gained 1.7 percent to Rs 4,285 at the close on the NSE on July 27. The stock has declined 11.5 percent over the past one year.

Disclaimer: The views and investment tips of investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.