Madhuchanda Dey

Moneycontrol Research

Cyient reported a soft Q1 FY19 that saw an expected drop in revenue from design led manufacturing (DLM) as well as an unexpected lacklustre performance from its core service business. The drop in margin was rather stark. What’s reassuring was the confident commentary of an inline FY19 with no change in its full year guidance. In the past 3 months, it has outperformed the Nifty as well as the IT index. After a soft quarter, consolidation in the stock can provide an opportunity to build positions for the long term.

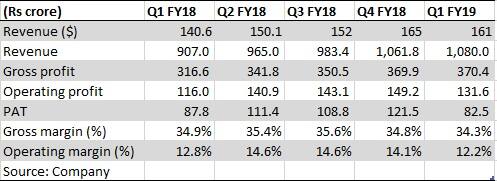

Quarter at a glance

In the quarter gone by, Cyient reported dollar revenue of $161 million, a sequential (quarter-on-quarter) decline of 2.3 percent and year-on-year (YoY) growth of 14.3 percent. Core service revenue (89 percent of total revenue) grew 1.1 percent in constant currency terms and was weaker than expectation. Performance of the DLM business was soft, de-growing 17.8 percent and was on expected lines.

Why the miss?

While the management exuded confidence on the outlook of its key vertical - aerospace and defence, it did mention that the other important vertical of communication faced headwinds in the quarter gone by, which is expected to be short-lived.

The revenue disappointment was attributed to the utility and geospatial business. In the utilities business, while project ramp down was as per expectations, the same was not compensated by a project ramp-up, something that wasn’t factored in earlier. The management is looking at a revival from the second or third quarter of FY19.

The telecommunication and semiconductor vertical performed well. It is important to note that while the acquisition of Belgium-based AnSem (a company specialised in designing and delivering state-of-the-art analog and mixed-signal integrated circuits) had a positive effect on semiconductor revenue. Even if one were to exclude the same, organic performance was strong.

Lower other income and higher tax rate due to one-offs and adverse shift in profit mix contributed to lower profitability.

Margins disappoint

Weak revenue impacted operating margin, which declined 187 basis points sequentially to 12.2 percent. While the wage hike (negative impact of 70 bps) was more or less compensated by a favourable currency movement (positive impact of 60 bps), additional headwinds came in from lower offshore mix and utilisation (negative 120 bps) as well as M&A (negative 40 bps) and sales and marketing expense absorption (negative 30 bps) due to lower revenue. The company expects to recoup 200 bps of margin once the revenue is back on track.

Despite the significant softness in reported numbers, the management commentary with respect to outlook for different verticals and the deal pipeline remains strong. In fact, notwithstanding the miss in Q1 FY19, it has retained its erstwhile full-year guidance.

Guidance: No reason to worry

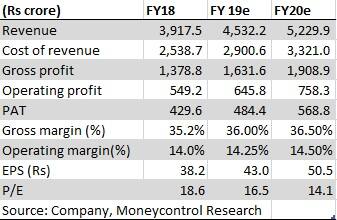

The company expects double-digit growth in the services business. The legacy DLM business is expected to grow around 20 percent (overall around 35 percent including B&F Design acquisition) and low single-digit margin improvement.

The company expects its operating margin to remain flat in FY19 which is rather perplexing given the opportunities from a depreciating rupee-dollar. The management said the improvement over Q1 levels will be driven by operational improvements and upsides from exchange rates, but the same could be offset by investments. Cyient expects a 200 bps reduction in effective tax rate in FY19 as well.

While maintaining margin itself will call for a decent jump in operating performance in the coming 3 quarters, its cautious outlook on margin remains a soft spot in an otherwise strong outlook.

Should you buy?We expect the stock to consolidate following a weak quarter. However, we are confident about Cyient’s domain expertise, supplemented by the right acquisition and execution capabilities. We continue to expect the rupee-dollar movement to provide positive opportunities going forward. Hence, the weak phase may be a great opportunity to build up positions in the counter.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!