Jitendra Kumar Gupta

Moneycontrol Research

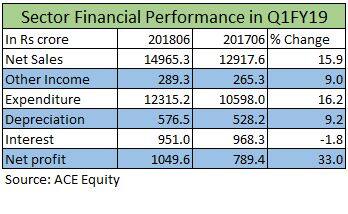

The quarter-ended June was quite impressive for the entire construction sector, particularly companies in the road construction space. On an aggregate basis, 14 companies that we covered under this study have reported 33 percent year-on-year growth in net profit, which is quite encouraging for a sector that was completely written off sometime back. Many companies posted profits above street expectations. Dilip Buildcon, reported 108 percent growth in earnings, followed by 56 percent growth by J Kumar Infraprojects and 43 percent in the case of HG Infra.

Execution drives growth

Strong order book and pick up in execution is driving growth. During Q1 FY19, companies in our study posted 16 percent revenue growth on an average. Dilip Buildcon reported a 46 percent growth in revenue, followed by close to 50 percent growth for others like J Kumar.

The biggest improvement was reduction in interest cost, which resulted in huge savings and strong improvement in profitability. Companies have been able to reduce their debt and cut interest cost through re-financing. Companies like MEP Infra reported a mere 1.24 percent increase in interest cost, despite a 117 percent increase in revenue.

Heading for a robust year

The trajectory remains strong as most companies are sitting on an order book of close to 2.5-3 times sales. Companies like J Kumar are sitting on an order book of close to Rs 8,500 crore, which is 4.2 times revenue. NCC reported an order inflows of close to Rs 23,300 crore in FY18, taking its order book to Rs 30,000 crore by June-end or over 4 times revenue.

The project pipeline remains strong as the government continues to spend on road and other construction activities to drive growth and complete key projects before general elections next year. Managements have guided at better execution and indicated that the period before election would see the government pushing for completion of projects, which means execution would only improve leading to higher revenue in coming quarters. This is also the reason why most companies have guided to about 25-30 percent earnings growth in the current fiscal, indicating strong visibility.

Top picks from the construction sectorThe correction in midcaps has bought many construction companies to reasonable-to-attractive valuations. At the current juncture, we prefer companies like Dilip Buildcon, which has received strong earnings visibility led by robust order book. The stock is trading at 12 times FY19 estimated earnings, despite a 30 percent return on equity and 25-28 percent earnings growth over the next two years.

Another company that is looking good at this point in time is J Kumar. The company has the highest revenue visibility, with order book-to-sales of about 4.2 times and expected earnings growth of 22-25 percent over the next two years. This stock is trading at an attractive 12 times and 10 times FY19 and FY20 estimated earnings, respectively.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!