Ruchi AgrawalMoneycontrol Research

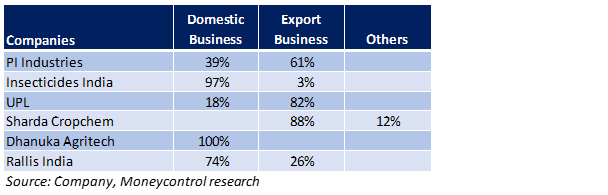

Performance of companies in the agrochemical space remained largely mixed in Q3FY19. Few companies like PI industries, UPL, Sharda Cropchem and Insecticides India started showing green shoots with improved performance. However, others such as Dhanuka Agritech, Rallis India and Coromandel International continued to be hit by global raw material supply shortage and weak domestic demand.

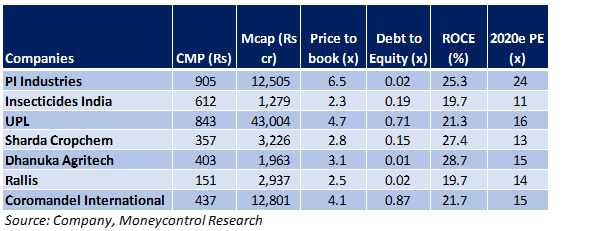

Of the agrochemical stocks, we find PI Industries and Insecticides India on track for growth and would recommend to keep these on radar and accumulate for long term portfolio in a staggered manner.

Key Industry trends

Domestic market growth remains muted – performance in the domestic market remained largely muted. The Rabi acreages were down due to deficit northeast monsoon and low soil moisture content. Despite a normal monsoon and a healthy crop production in the preceding kharif season, crop yields remained low due to lower than MSP (minimum support price) sale price of produce. This resulted in a stressed cash situation with farmers impacting domestic volumes. While the domestic demand growth remained muted, the export segment of companies showed growth.

High raw material costs – margins of most companies continued to be impacted due to high raw material costs. Since 2017, a large number of Chinese agrochemical manufacturers were driven out due to stricter environmental norms which resulted in raw material shortage thereby pushing up prices and impacting margins. Price hikes remained limited due to high inventory in channels and stressed competitive landscape. However, most management indicated there has been a relative easing in the supply situation with new suppliers coming in different parts of the world.

Backward integration - Companies such as Rallis India, Tata Chemicals, Insecticides India etc. have also taken steps towards backward integration in order to reduce supply anomalies, bring cost savings and take advantage of the scarcity situation. Improvement in the supply situation should be positive for the margins of the companies.

New product launches – Banning of 20 chemicals in 2018 (that kicks off in 2020) resulted in an expectation of reduced volumes for companies with exposure to these products. However, most companies are working towards greener chemistry and have a healthy line-up of product launches in the upcoming year. Products launched in 2018 have also seen a good response.

Government initiatives – There has been a lot of focus from the policy front in order to support the farm sector and improve farm incomes. While on paper the new policies favour the overall development of the industry, a lot of it would be dependent on the grass root implementation. Implementation of the MSPs remained weak in the kharif season. Strong implementation stands to benefit the sector.

Stocks

PI Industries - Strong Q3 with healthy growth in topline and margins. The product pipeline is rich along with a strong order book and a debt free balance sheet. The export business has seen a strong upsurge and we expect this to continue.

Insecticides India – Encouraging growth in Q3. A healthy line up of new products to offset the impact of molecule ban (three of the company's molecules, around 15 percent of topline in the ban list). High demand for banned products to benefit near term volumes. Backward integration to smoothen input costs and supplies and strategic shift to high margin branded products to improve margins.

UPL – Healthy Q3 results, though the net margins were impacted due to one off exceptional expenses. While the synergies related to the Arysta deal will start benefitting the performance after 2-3 years, we see expenses and higher leveraging to impact margins in the near term. Substantial exposure in various geographies increases the weather and currency related risks.

Sharda cropchem – Non-core belts division drove a healthy Q3. Operating and net profits too reported a strong improvement on a consolidated basis. China supply disruption has been a major overhang on the stock. Though there is an expectation of some relief on that front, we believe it would take time before it normalizes.

Dhanuka Agritech – Q3 performance was disappointing with margin contraction. New launches, price hikes and branded portfolio to drive growth in future. Asset light model facilitates concentration on brand development. More than half of its sales come from speciality molecules with higher margins. Low penetration of herbicides and fungicides in India augurs well for the company’s growth.

Rallis – Performance continues to be impacted due to high input costs. Speciality products with higher profitability should help improve margins Announcement of capex (which was not there since past 3-4 years), suggest that the group might turn around from the current mess in the long term. However, the company is currently impacted by the external operating environment, and we believe the overhang would continue in the near term.

Coromandel International – Disappointing performance with margin contraction owing to increased input costs and inability to take sufficient price hikes. Though we expect the pressure on margins to continue in the short term, we expect improved growth in the long period owing to the growing share of the non-subsidy business, greater operating leverage and visibility of growth in the crop protection business.

Outlook

After a period of an adverse operating environment, the industry situation seems to be stabilising a bit now. With projections of a normal south-west monsoon in 2019, we expect the performance of the sector companies to improve. With clearer inventory channels, companies are better positioned to take price hikes to a certain extent. The overall policy environment is also favourable for the sector and improved farm incomes would benefit volumes.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!