At the end of the December quarter (Q3), the Rs 8,051 crore exposure of India's largest insurer Life Insurance Corporation of India (LIC) to the debt instruments of Yes Bank saw a downgrade from almost all major rating agencies. But even as the Yes Bank crisis deepens and the RBI restrictions on withdrawals from the bank spook the market, LIC may stay unperturbed.

LIC invests in debt and equities across its three segments: life fund, unit-linked fund and pension fund. Though the insurer’s exposure to Yes Bank may look like a large sum to a layman, it is notable that its overall exposure to corporate debt securities is less than 15 percent of its total investment corpus of Rs 32 lakh crore.

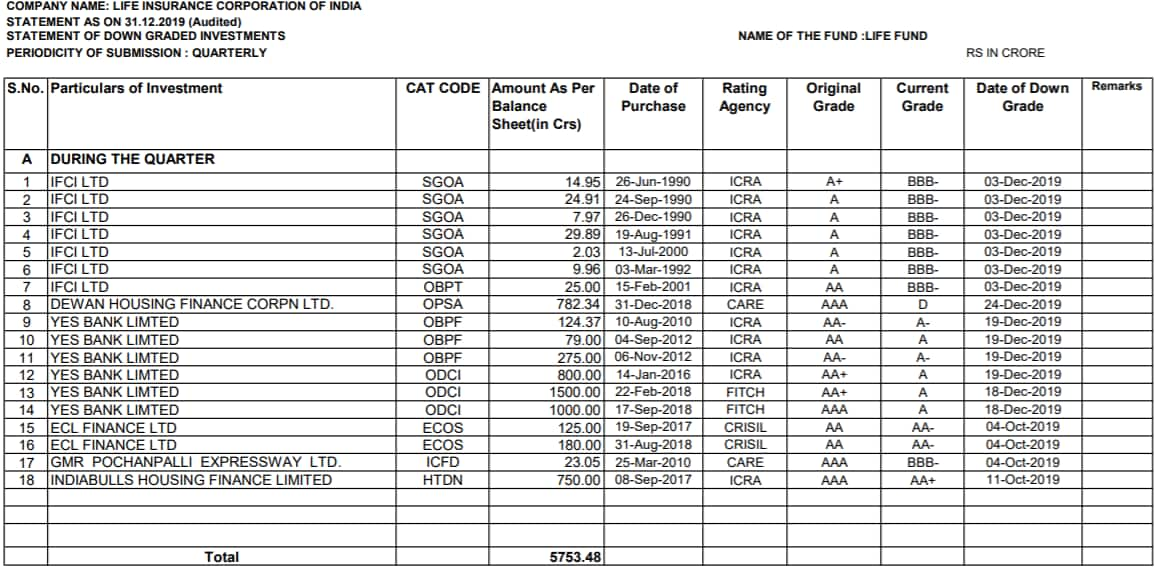

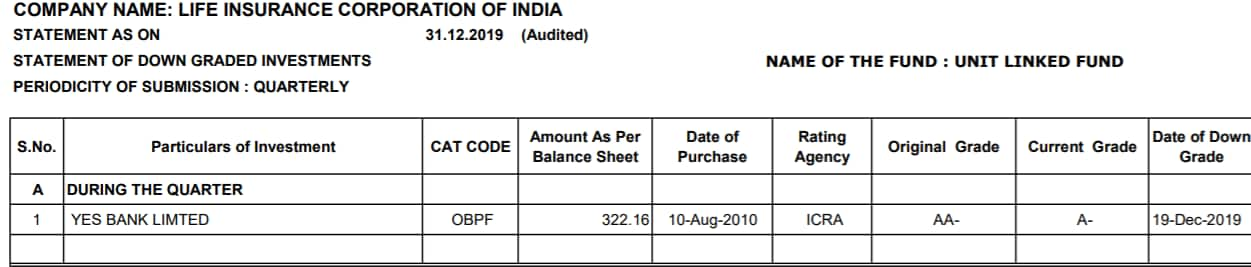

Among its different funds, LIC’s life fund had an exposure of Rs 3,778 crore to Yes Bank instruments that saw a rating downgrade in Q3. In the unit-linked fund, LIC had exposure to Yes Bank’s securities worth Rs 322.16 crore that was downgraded.

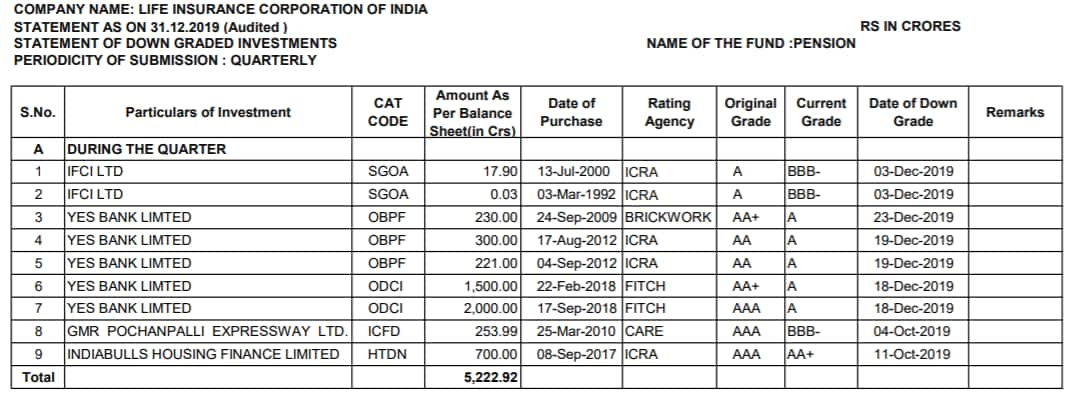

Similarly, in the pension fund, LIC had Rs 4,251 crore of Yes Bank debt securities that were downgraded by rating agencies in the third quarter.

LIC did not respond to a query sent by Moneycontrol. Interestingly, LIC has also reportedly been approached to be part of a consortium with State Bank of India to buy a stake in Yes Bank.

Even if there are rating downgrades or defaults by a few entities in the corporate debt space through the non-convertible debentures (NCDs) or similar instruments, LIC has enough assets to cover it. Policyholder returns will not get impacted.

In fact, data shows LIC earmarked Rs 35,466.10 crore as provisions for doubtful debt in its investment asset statement at the end of Q3FY20, up from Rs 25,825.73 crore provided for in the year-ago period.

When an entity buys a debt instrument from another corporate, the former is entitled to interest payments which is then translated to investment returns. However, since Yes Bank has been put under restriction by Reserve Bank of India that prohibits the lender from making any payments or disburse dues to any investor.

A regular entity invested into Yes Bank securities would have faced a financial impact due to this situation. However, LIC being a life insurer invests a majority of its policyholder funds (more than 65 percent) into government securities that have guaranteed returns. Any defaults can also be offset by the large non-corporate debt book.

Insurers like LIC typically look at the size of the company and its credit rating to make an investment decision, be it purchase of debt securities or equity stake.

The insurance regulator (IRDAI) has now advised insurers to not just rely on the credit ratings of their investments, but also wants them to apply their own judgement.

LIC also has equity and debt exposure to IL&FS where the management was superseded by a government-led board. LIC is also the largest shareholder in IL&FS with a 25.34 percent stake.

IL&FS group which has a cumulative debt of Rs 91,000 crore and its loan woes came into the forefront in 2018 when it defaulted on inter-corporate deposits and commercial papers (borrowings).

What is the Yes Bank issue?The Reserve Bank of India (RBI) on March 5 said it is superseding the board of troubled private sector lender YES Bank with immediate effect.

Former State Bank of India CFO Prashant Kumar has been appointed the administrator.

"This has been done to quickly restore depositors' confidence in the bank, including by putting in place a scheme for reconstruction or amalgamation," the RBI said in a statement.

The central bank has also imposed a moratorium on the private lender till April 3, 2020. Withdrawals from the bank have been capped at Rs 50,000 per depositor. This decision was taken after Yes Bank was unable to find investors for capital infusion.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.