Highlights

-Dip in crude prices triggers duty hike in retail fuel

-Excise duty on petrol and diesel hiked by Rs 3 per liter

-Additional revenues expected mostly in FY21-Benefit in FY20 limited

-------------------------------------------------------

Rising fears of an economic slowdown owing to the coronavirus pandemic coupled with rising demand supply disequilibrium have had a sharp impact on crude oil prices. Brent crude prices have plunged from $65 per barrel in January 2020 to $25 per barrel currently. With pressure from both the demand and the supply side, the current momentum remains bearish.

Excise duty hike

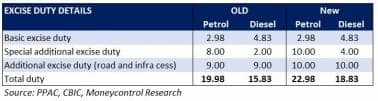

Amid the sharp fall in prices, the central government had announced a hike in the excise duty on petrol and diesel in order to shore up its coffers. It increased the levy on petrol and diesel by Rs 3 each starting March 14. With this increase, the total excise duty on a litre of petrol is Rs 22.98 and that on a litre of diesel Rs 18.98.

Since 2014, the central government has hiked the excise duty on petrol and diesel several times. In 2014, when the Modi government took charge, the tax on petrol was Rs 9.48 per liter and that on diesel was Rs 3.56 a liter. In total excise duty has gone up sharply by Rs 13.5 per litre on petrol and Rs 15.2 on diesel since 2014.

Impact on govt finances

The hike in excise will help strained government finances. The government is expecting to collect additional revenues of around Rs 39,000 crore in FY21. The benefit in the current year FY20 is, however, limited to under Rs 2,000 crore.

The Union Budget had projected the fiscal deficit for FY21 at 3.5 percent of GDP. However, this was predicated on a portion of revenue targets being met by divestments in government enterprises. With volatile markets, these assumptions become very shaky.

Remember that in the current year, the government has divested Rs 34,845 crore till date against a revised target of Rs 65,000 crore (original target Rs 1.05 lakh crore) and is expected to miss the revised target. The divestment target for FY21 is set at a steep Rs 2.1 lakh crore.

Given the uncertainty in the divestment route and the tight fiscal position, additional revenues will provide some comfort to the exchequer.

Impact of excise hike on retail prices

This hike in excise duty will naturally lead to higher fuel prices for retail customers. While crude prices have almost halved in the last one month, the retail prices of diesel and petrol have seen only a 3-4 percent dip. The table explains how retail fuel prices are built.

Outlook

The crude price dip has resulted in a substantial flow of funds globally and has created ripples across markets. The dip is positive for the Indian economy as the country imports more than 80 percent of its crude oil requirement. The fall in prices will the balance of payments situation and also provides a cushion for Indian downstream marketing companies. Downstream companies usually use the marketing margin on retails fuels to adjust for low margins on the refining segment and provide for inventory fluctuation.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.