Madhuchanda DeyMoneycontrol Research

IndusInd Bank, an otherwise consistent and predictable performer saw the impact of the IL&FS crisis on its Q2 FY19 reported numbers. The bank created a contingency provision to take care of the exposure to IL&FS and group companies. Except for this, the results weren’t a surprise. Business growth was robust, asset quality pristine and margins were a tad soft. The bank is gearing up for a merger with microfinance lender Bharat Financial. The bank's stock price has corrected nearly 19 percent in the past two months to inch closer to its 52-week low. With most of the near-term negatives priced in, we derive comfort in the valuation at 3.2x FY20e (estimated) standalone book and recommend accumulation in this weak phase.

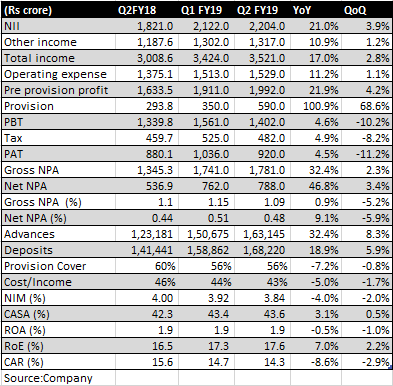

Quarter at a glance

Net interest income (the difference between interest income and expenses) grew 21 percent, driven by a 32 percent growth in loans and a tad soft interest margin at 3.84 percent. While core fee income grew by 20 percent, the decline in treasury gains by 43 percent resulted in softer growth in non-interest income.

Despite lower credit costs (relating to non-performing loans), the provision line grew as it contained a contingency provision of Rs 275 crore on account of the bank’s exposure to IL&FS and its group companies.

In this quarter, we expect many of the prudent entities to create contingency provisions on account of IL&FS exposure.

Consequently, the reported net profit grew in the low single digit.

Traction in loan book – The bank is witnessing good activity on the corporate side, as well as on the commercial vehicle lending business. Despite selling over Rs 8,500 crore of corporate loans, the overall loan book grew by over 32 percent driven by 35 percent growth in corporate and 29 percent growth in retail.

We feel the void created by the troubles in the public sector banking space has been well capitalised by smarter well-capitalised entities like IIB.

Market share gains – IndusInd Bank is well-capitalised (Capital Adequacy Ratio 14.28 percent) and has gained market share in incremental businesses, in both loans and deposits. The bank’s market share in the incremental business of deposits and loans in the past one year stood at 3 percent and 4 percent, respectively which is much higher than its absolute share of 1.4 percent and 1.8 percent, respectively, thereby suggestive of market share gains at a fast clip.

CASA stable & NIM tad softer – Reversing the trend of falling low-cost deposits, the bank saw stable CASA (current and savings accounts) as the sequential (quarter on quarter) growth in CASA outpaced that of term deposits.

The exceptionally high incremental credit to deposits ratio (at 133 percent) and the slower repricing of retail advances compared to the relatively quicker repricing of funds contributed to the softness in interest margin. The management is confident of maintaining the margin and we feel access to high yielding assets of Bharat Financial as well as efforts to add new depositors base should help realise this objective.

Asset quality – no complaint: Asset quality showed stability with the slippage falling to a normalised quarterly level of Rs 419 crore after the spike witnessed in the final quarter of FY18. In fact, the total delinquency (gross NPA plus restructured assets) remained stable at 1.20 percent.

No incremental stress from the acquisition of IL&FS Securities – The management clarified while the acquisition by IL&FS Securities is still pending regulatory approval, the bank will not on board any liability of the IL&FS group on account of this acquisition.

Management also said it has done a thorough review of its NBFC (non-banking finance company) portfolio and remains confident of its exposure to this segment. It is also reasonably certain of reporting no divergence in RBI’s audit of its FY18 financials.

Albeit the minor headline blip, we see this quarter as a continuation of the well-charted out strategy of building a solid business with a focus on high yielding/good quality assets backed by retail-focused low-cost liability.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!