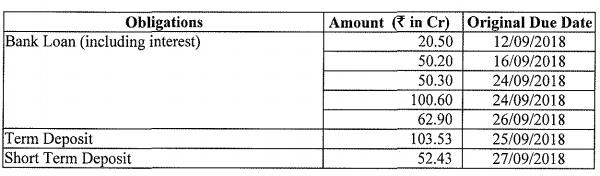

IL&FS Financial Services defaulted on seven debt repayments between September 12 and 27, the financial services arm of IL&FS informed the stock exchange.

The defaults include five bank loans, one deposit and one short-term deposit.

Even on September 27, the day it intimated the exchange, the company defaulted on a short-term deposit worth Rs 52.43 crore.

Bank loan defaults between September 12 to 26 totalled Rs 284.5 crore. while defaults on term deposits due on September 25 totaled Rs 103.53 crore.

On September 26, IL&FS Financial Services said it had defaulted, the fourth time in the month, on interest payments on Commercial Papers (CP) due on that day.

IL&FS group in financial trouble

The first signs of trouble emerged in June when IL&FS defaulted on inter-corporate deposits and commercial papers (borrowings) worth about Rs 450 crore. Over the next two to three months, at least two rating agencies downgraded its long-term ratings.

As a result, the infrastructure giant, which is credited for building the longest tunnel in the country (the Chenani-Nashri tunnel), no longer carries an investment grade rating. This makes it difficult for the company to raise money in the future.

IL&FS group is facing a liquidity crisis and has defaulted on interest payment on various debt repayments since August 2018. The groups have over Rs 91,000 crore in debt.

The company needs an immediate capital infusion of Rs 3,000 crore and is planning a Rs 4,500-crore rights issue. Its largest shareholder Life Insurance Corporation of India (LIC) could offer a lifeline to IL&FS if the firm is able to give a roadmap for a reduction in its debt in the next three to four months.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.