Sales of fast-moving consumer goods (FMCG) companies jumped by as much as 14 percent year-on-year in the June quarter compared to the same period last year, showed data from retail intelligence platform Bizom. The impressive growth, however, said Akshay D’Souza, chief of growth and insights at Bizom, was on last year’s low base when the second wave of Covid-19 had hit the country. On the other hand, sequentially, too, sales rose 7 percent in the June quarter over March 2021.

D’Souza added that the growth in sales was price-led. Several FMCG companies have seen decline in sales volumes as inflation hit demand. FMCG major Marico, which houses popular brands such as Saffola and Parachute, in an update to stock exchanges ahead of its quarterly earnings said that its India business volumes declined in mid-single digit in the first quarter of FY23 (April-June quarter).

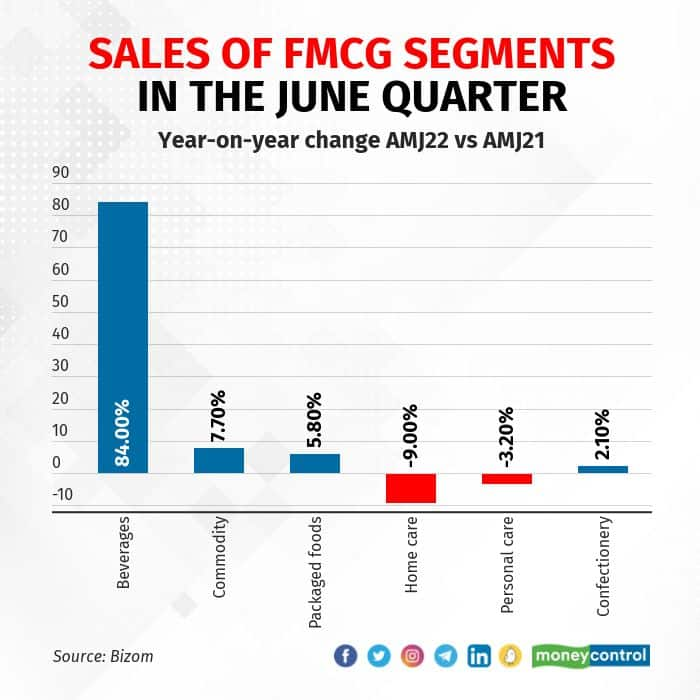

Category-wise, while beverages clocked a massive growth of 84 percent year-on-year (y-o-y) in the June quarter over last year, segments like home care and personal care saw a y-o-y fall of 9 percent and 3.2 percent, respectively, during the quarter, said Bizom.

The data indicates that inflation played a big role in most FMCG companies’ performance. Those operating in categories like beverages, however, have fared well.

The trend was reflected in a quarterly update by Dabur. Its food and beverages verticals, which include the juice brand Real, saw strong double-digit growth in the quarter on the back of improving out-of-home consumption and a decent summer season. But the company said that the home and personal care portfolios are expected to record a high single- to low double-digit growth on a high base in Q1FY22. However, its healthcare and immunity portfolio, which includes brands like Dabur Honey and Dabur Chyawanprash, is expected to report a decline given the high base of the corresponding period last year when the segment grew multi-fold during the second wave of COVID-19.

“Beverages had a phenomenal run this summer and the category has bumped up the sales of the entire FMCG segment as witnessed in sequential numbers. A strong summer definitely helped shore up sales especially in parts of north and central India which saw high temperatures right through the season,” said D’Souza.

According to D’Souza, there are strong signs of an increase in the consumption of higher-value packs for commodities in the June quarter.

“This does indicate that consumers were putting off higher-value purchases in the hope of a price reduction and that seems to be coming back,” he said.

The monsoon remains a key indicator for the economy, especially the rural segment, in the weeks ahead as the income generated from the agri-economy will be crucial to enable consumers to get back towards higher consumption and to increase discretionary spends.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.