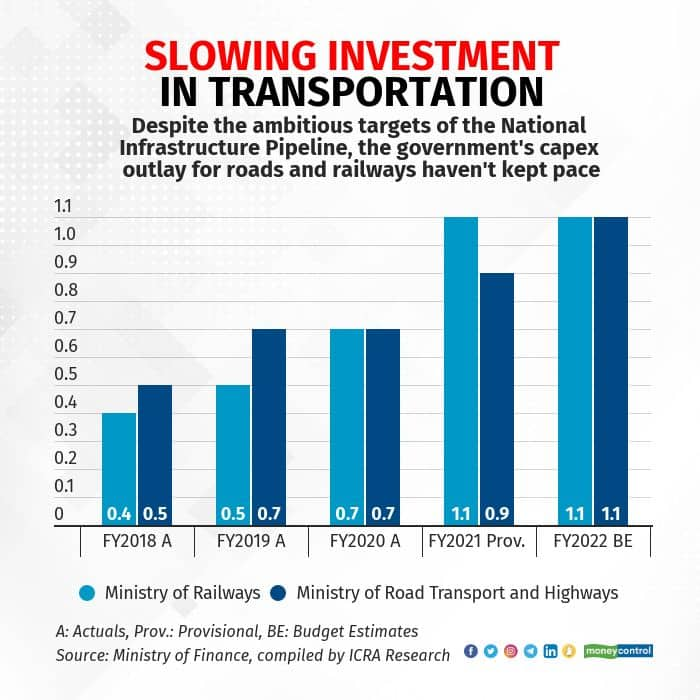

Compensating for two lost years of capacity expansion in the transportation sector, Finance Minister Nirmala Sitharaman announced a massive increase in the government’s allocation for the roads and railways in her Budget 2022 speech in Parliament on February 1, Tuesday.

The Budget outlay for the Ministry of Road Transport and Highways has risen 68.5% to Rs 1.99 trillion (from Rs 1.18 trillion in FY22). The government-run National Highways Authority of India’s budgetary outlay in the coming fiscal is set to rise by 133% to Rs 1.34 trillion from Rs 573.50 billion in FY22. Allocations to the government’s flagship scheme for rural roads - the Gram Sadak Yojana - have risen to Rs 19,000 crore in FY23, from Rs 15,000 crore in FY22 budget estimate.

The Ministry of Railways’ budget allocation for FY23 is set to rise by 27.5%, to Rs 1.40 trillion in FY23 from Rs 1.10 trillion in FY22. The minister also said that 2,000 km of rail network will be brought under the indigenous world-class technology KAWACH, for safety and capacity augmentation.

In her speech, Sitharaman focused on the inter-ministerial cooperation required to implement the PM Gatishakti masterplan. “PM GatiShakti is a transformative approach for economic growth and sustainable development. The approach is driven by seven engines, namely, Roads, Railways, Airports, Ports, Mass Transport, Waterways, and Logistics Infrastructure. All seven engines will pull forward the economy in unison,” she said.

“The projects pertaining to these seven engines in the National Infrastructure Pipeline will be aligned with PM GatiShakti framework. The touchstone of the Master Plan will be world-class modern infrastructure and logistics synergy among different modes of movement – both of people and goods – and location of projects. This will help raise productivity, and accelerate economic growth and development,” Sitharaman said.

Catch all live updates on Budget hereBoth highways and railways feature prominently in the union government’s two flagship infrastructure programmes - the National Infrastructure Pipeline (NIP) and the National Monetisation Programme (NMP). The NMP aims to raise Rs 6 trillion by 2025 by selling a host of publicly-owned assets across the infrastructure spectrum. This capital, along with annual increases in budgetary allocations, will then be recycled to keep the NIP afloat - a programme announced in 2019 to build Rs 111 trillion of infrastructure projects by 2025.

In her Budget speech, the Finance Minister said that the national highway network will be expanded by 25,000 km in FY23 and Rs 20,000 crore in funds will be mobilised in addition to budgetary resources. At first glance, this target of 25,000 km of highway construction next fiscal appears very ambitious as it is 29% more than what was constructed in the past two fiscals, which was 6,185 km in the first 9 months of FY22 and 13,200 km in FY21, and requires highway construction to grow to twice the speed (approximately 38-40km a day) that it is at presently.

The minister also said the government will launch 400 new generation Vande Bharat trains with more efficient service parameters in the coming three years.

Since COVID has tempered private sector appetite for buying out large infra assets, sector analysts had estimated that gross budgetary support towards the infrastructure sector had to increase by 15-20 percent with focus on roads, railways and urban infrastructure segments to keep the NIP viable. Dedicated allocations for specified large infrastructure projects, such as high-speed rail (including bullet trains), Bharat Mala, dedicated freight corridors etc, can help expedite these projects.

The budgetary allocation to the newly set-up development finance institution – National Bank for Financing Infrastructure and Development (or NaBFID, which is expected to start lending to infrastructure projects in FY2023) is unclear. The newly-incorporated National Bank for Financing Infrastructure and Development bank is targeting a financial assistance of Rs 1 lakh crore in its first year of operations. The allocation to the National Investment and Infrastructure Fund has remained consistent at Rs 5003 crore for FY23.

The industry had also expected an announcement from the government that would encourage the issuance of infrastructure bonds or long-term tax-free bonds to support funding availability for the infrastructure sector. This is believed to be necessary to revive private sector interest in taking up new projects, along with measures towards further improvement in the regulatory environment and the resolution of disputed claims.

The railway ministry has sought additional capex allotments to be directed towards long-term infrastructure projects like the freight corridors and speedier trains, electrification of all routes, overhauling the signalling systems and for modernising the fleet with the introduction of new-age trains, wagons and locos. Last year’s allocation had been the highest ever for the railways—with Rs 1.07 trillion as gross budgetary support and a further Rs 1 trillion from extra-budgetary resources.

Shares of railway-related companies such as Indian Railway Catering and Tourism Corporation (IRCTC), IRCON International, and Rites and private firms like Titagarh Wagons, Hind Rectifiers, Siemens, Kernex Microsystems, NBCC, and Texmaco Rail are likely to be influenced by these announcements.

Shares of companies in highway construction like IRB Infrastructure, Ashoka Buildcon, Dilip Buildcon, PNC Infratech, Sadbhav Engineering, Gayatri Projects and Madhucon Projects are likely to see movement as well.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.