When oil heats up, the entire country begins to perspire, and in buckets. But, why?

What each one of us knows is that soaring petrol and diesel prices jack up our monthly bills. They quietly creep into our home budget by making daily-use articles expensive and we don’t even understand why. For the underprivileged, they make even basic necessities such as an LPG cylinder unaffordable.

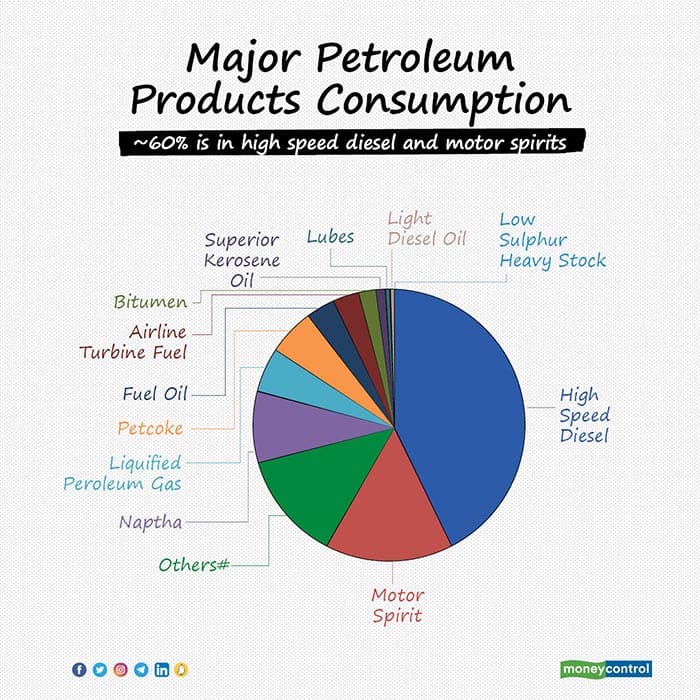

But how are oil prices determined? Crude oil is a global commodity, meaning it is produced in nations that have oil deposits and is exported to other nations that do not have it. Thus, its prices are determined by global demand and supply. Any increase in the commodity’s global price will weigh on the economies and thus on the final consumer, heavily. Goods and services will become costlier, with higher input costs and freight charges. Think of the areas where crude is used – it’s all pervasive (Chart).

Crude-oil products such as jet fuels keep flights in air, asphalt lines our roads, paraffin wax insulates electrical wiring and coats our medicines, and, most importantly, petrol and diesel powers not just our cars and bikes but all kinds of automobiles from the vegetable trucks to freight vehicles. Then, there are LPG and kerosene that power your kitchen.

Therefore, any rise in crude prices will hurt the average Indian–oil prices determine ~12.5% of our out-of-pocket expenses.

That said, the price we pay for oil products is not a simple rupee translation of global crude prices. It’s complicated.

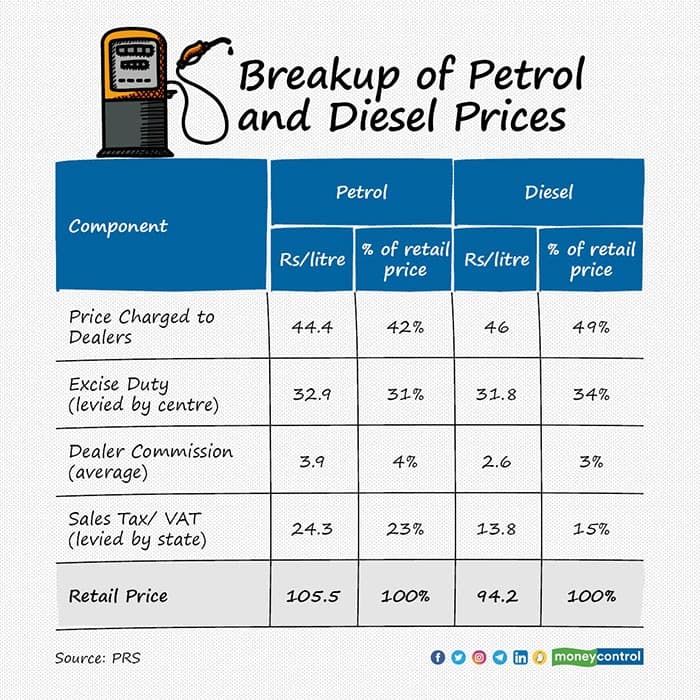

Retail prices of major oil products (think petrol and diesel) are determined after adding the dealer commission, central and state taxes to the price at which the dealer buys it. Dealer prices on their part are determined after converting global crude prices to INR, and then adding gross refining margins or what refineries charge to convert crude into by-products like petrol, diesel etc, and freight charges.

A key component here, as you would note, is taxes.

Fin Min’s tight-rope walk

On the one hand the government clocks revenue from various taxes on oil and oil products, and on the other, it foots the expense bill for subsidising products such as kerosene and LPG.

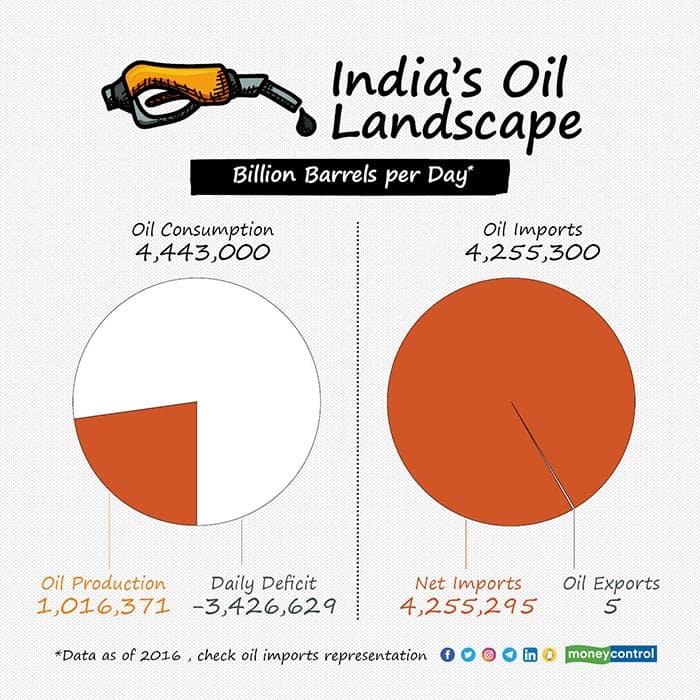

In that sense, crude impacts not just our home budget, it impacts the government’s finances in a big way. The fact that India is a net importer of oil, which means we need dollars to buy oil also complicates the situation.

This dependence, when translated into dollars, looks like this...

Meanwhile, the country's fuel self-suffiency ratio--which measures the volume of oil production against volume of oil consumption--looks like this.

It’s a slippery ground the finance minister has to tread in the upcoming Union Budget.

GoI has been earning a tidy sum through taxes they directly charge on petroleum products–28 percent of the fiscal revenues are from taxes related to oil. It has also been incurring a subsidy bill, to support the kerosene and LPG consumption of the underprivileged, which remained steady around Rs 250 billion from FY17 to FY19 and shot up to Rs 385-390 billion in FY20 and FY21. However, the subsidy amount was cut sharply to Rs 140 billion in FY22–the rationale was that, if the final price to the consumer was maintained, the government could save on the subsidy bill thanks to the pandemic-induced fall in crude prices.

The central government’s net oil revenue (taxes minus subsidy) has risen from Rs 2.5 trillion in FY19 to Rs 3.8 trillion in FY21 (and is expected to grow further in FY22), and stands at 28% of total tax collections (up from ~18% in prior years).

Additionally, oil marketing companies pay income/corporate taxes and dividends. Collectively, this makes the central government heavily dependent on oil prices–both imported crude and the final retail prices--for managing the fiscal position.

Over and above the tax levied by the centre, there are the states’ VAT collections–in FY21, the total collected by all the states came to Rs 2.03 trillion, according to Petroleum Planning and Analysis Cell (PPAC).

At present, total taxes, state and central levies together make up 54% of the final price of petrol. So, for every Rs 105.5 you pay for a litre of petrol, Rs 58 goes to the government.

In fact, despite a structural fall in crude prices, the government has steadily increased the retail price of petrol and diesel to make up for shortfall in tax revenue.

So when crude prices fell from a high of $106/barrel in June 2014 to $30/barrel in January 2016, the petrol price remained nearly the same. As of November 2021, crude prices were 27% lower than in June 2014, but petrol prices were still 43% higher (than in June 2014). Thus, consumers really did not benefit from the fall in global prices of oil, in fact we ended up paying more. But total oil tax collected by the central government tripled from Rs 1.26 trillion in FY15.

India’s taxes are comparable to what is charged in European countries, but are far higher than countries such as the US, Canada and Japan.

The good part of this is that the oil taxes came in handy when the economy began to slow down. The taxes helped limit the gap between government revenue and expenses, when businesses were struggling and overall tax collections went down sharply. Without these taxes, it would have been difficult for the government to fund public investments, which was essential to keep the growth wheel moving when there was a slump in private investments.

Of course, the government could have decided to fund its investments by running a higher fiscal deficit and borrowing more money from the market. But higher deficits and borrowings are risky because foreign investors keep a hawkeye over the government’s ability to service its debt. More debt is bad for the currency, and if the currency depreciates, imports become expensive and all this can disturb the precarious balance in the economy.

So far the oil story has worked out well for the government. But can it, going forward?

One, inflation is becoming a worry. November numbers weren’t comforting–retail inflation was at a three-month high of 4.9% and wholesale inflation shot up to a record 14.23%. India has seven state elections lined up in 2022, so the government cannot afford to let inflation become a pain point. Geo-political tensions also bring an element of uncertainty to oil prices, though the expected slump in demand with the spread of Omicron could put the Opec in a quandary.

Hypothetically, if global crude prices rise or, for that matter, if other components of inflation rise and the government wants to rein it in, it will have to cut excise duty to reduce the retail prices. Given that India consumes 5.2 billion barrell a day (appox 12 billion litres a year), a reduction of Rs 1 in excise duty will cost the government Rs 12 billion. A substantial Rs 30/litre cut could then reduce central excise collections by Rs 360 billion or 55% of a scheme such as PM Kisan Yojana.

The government is thus placed in a tough spot.

What can the government do?

The FY22 Budget calculations are based on the assumption of $64.6/barrel, which the Reserve Bank of India considered as base in April’s Monetary Policy Review.

If global crude prices cool off, the government may have some leeway to reduce prices and still keep earning higher revenue through taxes – a luxury the government has got accustomed to over the past few years.

If the price rise is modest, it will have some leeway to slash duties without impacting overall tax revenues too much, as the impact of the pandemic recedes and tax revenues from other quarters pick up.

But what if global crude prices rise steadily? In this case, the government will have to cut taxes to steady the boat for the economy, and soften the blow ahead of assembly elections.

Cutting taxes on oil will lead to fiscal pressure. Additionally, a high-import bill will cause current account pressures–a double whammy that India had in the FY12-FY13 cycle. This could lead to a tighter monetary policy to curb inflation, which could threaten economic growth--not a desirable outcome at this juncture.

If all of this seems like a lot of bad news, here’s the other side–the chances of highly elevated oil prices is possible, but not highly probable. So if there are no nasty surprises on oil, as economic activity revives and corporate tax/income tax/GST/disinvestments collection goes up, GoI might get more space to cut excise taxes and that means smaller bills for all of us.

Fingers crossed!

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!