HDFC Bank is expected to deliver a muted performance for the July–September quarter (Q2FY26), as higher credit costs and the full impact of the June repo rate cut are likely to put pressure on its margins. India’s largest private sector lender will announce its Q2 results on October 18, 2025.

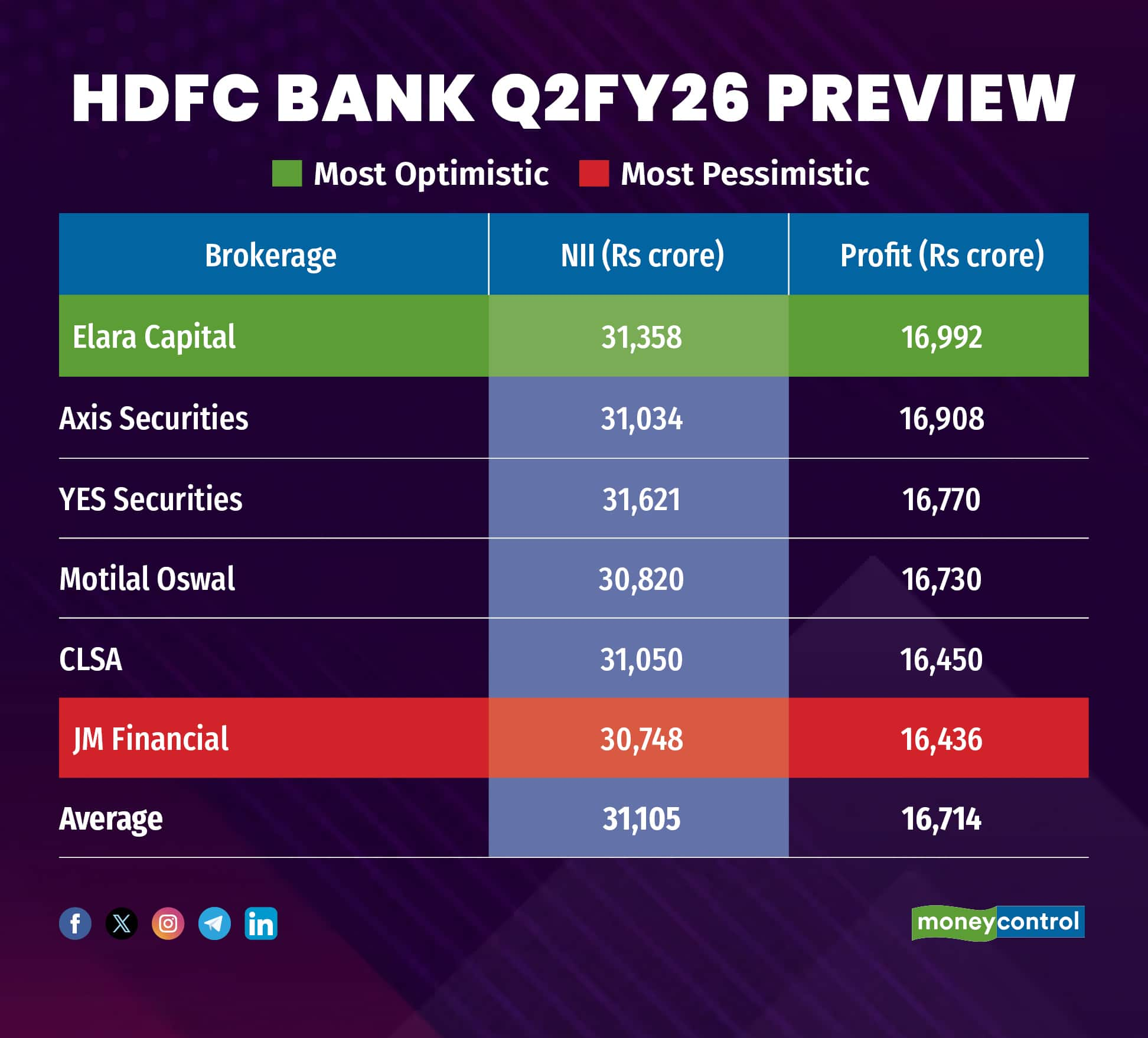

According to Moneycontrol’s poll, HDFC Bank’s net interest income (NII) is projected to rise modestly by 3 percent year-on-year (YoY) to Rs 31,105 crore in Q2FY26, compared to Rs 30,111 crore in Q2FY25. Meanwhile, the lender’s profit is estimated to decline by 0.6 percent YoY to Rs 16,714 crore in Q2FY26, from Rs 16,821 crore in the same period last year.

Estimates of analysts polled by Moneycontrol are shown to be in a narrow range, meaning any positive or negative surprises may elicit a sharp reaction in the stock price. Among the brokerages polled, Elara Capital rolled out the most bullish projections while JM Financial forecasted the slowest growth for HDFC Bank.

What factors are driving the earnings?Strong loan and deposit growth: In its pre-quarterly update, HDFC Bank reported that total advances grew 9.9 percent YoY to Rs 27.69 lakh crore for the quarter ended September FY26. Meanwhile, the private lender’s period-end deposits rose 12.1 percent YoY to Rs 28.01 lakh crore during the same period, reflecting sustained traction in its core banking operations.

Stable asset quality: Analysts at Motilal Oswal Financial Services expect the bank’s asset quality to remain largely steady, with gross non-performing assets (NPA) at 1.4 percent YoY in Q2FY26, and net NPA slightly higher at 0.5 percent YoY.

Margin compression: CLSA analysts estimate that HDFC Bank’s net interest margins (NIMs) may contract by 20 basis points (bps) to 3.1 percent in Q2FY26, compared with 3.3 percent in the corresponding quarter of the previous year, reflecting the full effect of the recent policy rate cut.

What should investors keep an eye on this quarter?Investors are likely to keep a close eye on trends in deposit growth, loan growth, and net interest margins, which will serve as key indicators of the bank’s financial strength and profitability outlook in the coming quarters.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.