The much-awaited Air India order for planes, announced in two phases on February 14, comprises 220 Boeing aircraft on firm order, with 70 options. The planes include 190 737 MAX aircraft, including the 737-8s and yet uncertified 737-10s; 20 787-9 Dreamliners and 10 777-9s. The options are for the MAX (50) and the Dreamliner (20).

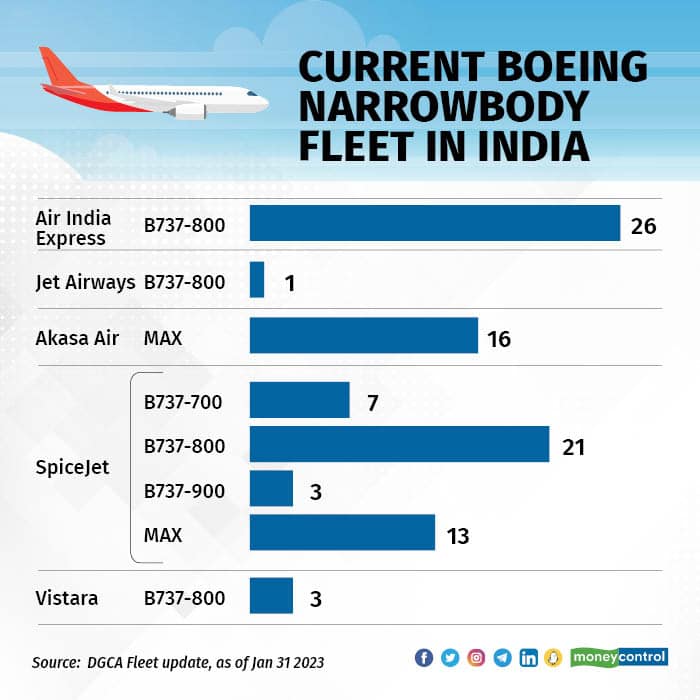

The order for narrowbody aircraft is more than double the number the American planemarker has in India, a segment that is heavily dominated by Airbus. Boeing has just 90 narrowbody aircraft flying passengers for scheduled Indian airlines.

Bagging part of this order has meant that Boeing is making further inroads in India on the narrowbody front and has found an even more stable customer than Akasa Air -- which was its last large deal in India. However, with Air India ordering the Airbus A350s, it has challenged its full domination of the widebody market in India.

All the widebody aircraft in India are Boeings, but widebody comprises only 6.7 percent of the total fleet in India and even with the new order, it is unlikely to go beyond 10 percent of the total fleet in future.

What do the numbers say?

There are currently a little fewer than 700 commercial planes in the country. A staggering 65 percent of these are Airbus aircraft. Split between types, close to 80 percent of all aircraft in India are narrowbody and 83 percent of these are the A320 family, both CEO and NEO. The share for Boeing in narrowbody is less than 13 percent and that is where this order is a “comeback” for Boeing.

In fact, not just India, most of the neighbourhood is also dominated by Airbus. Sri Lankan, Pakistan International Airlines and Nepal Airlines are all Airbus customers.

Implications for Boeing?

Boeing has been plain unlucky in a few ways. Jet Airways went down while SpiceJet’s financial troubles continued, leading to little room for growth. In fact, SpiceJet has lost fleet and market share in the country and its promises to induct additional MAX aircraft have not materialised. While Airbus, too, took a hit from the fall of Kingfisher Airlines, IndiGo more than compensated for the European planemaker’s dominance to continue.

Boeing's first breakthrough was with Akasa Air in November of 2021. Akasa Air has since then taken the title of the fastest growing Indian carrier in terms of fleet and will be the fastest airline ever to reach 20 aircraft in terms of time taken. While Akasa Air is well capitalised with a plan to order even more planes in the near future, in Air India, Boeing will find a steady and stable partner like no other. The Tata group is not new to Boeing and vice versa. Both the companies have been working and are Joint Venture partners too in both defence and civilian programmes.

While Akasa Air was a step in the door, the deal with Air India seals the future of the fleet in India in terms of which airline is operating which type. The only change that could happen, and a big coup for Boeing, is if IndiGo decides to split its fleet and induct Boeing in addition to Airbus.

While every aircraft manufacturer supports its customers, the order from Air India group and a possible follow-on order from Akasa Air will mean SpiceJet could run out of antics to show how it is the only major Boeing customer in India.

Interestingly, the tenders released yesterday show the MAXs in Air India livery. As Air India works with different consultants and in-house experts for rebranding and deciding on the strategy for Full Service Carriers (FSC) and Low Cost Carriers, the final livery could well be very different.

Tail Note

The order gives a further boost to fleet renewal efforts in India where 68 percent of the narrowbody fleet is either MAX or NEO, the new generation planes from Being and Airbus, respectively. Both large aircraft manufacturers are working hard towards moving to Sustainable Aviation as a future and investing billions towards research with the first phase being improvement of fuel consumption, led by a re-engined version of their popular planes.

Boeing has been working with the Tatas for defence and civilian programs. It needs to be seen if there is more work which will come to India and Tata’s?

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.