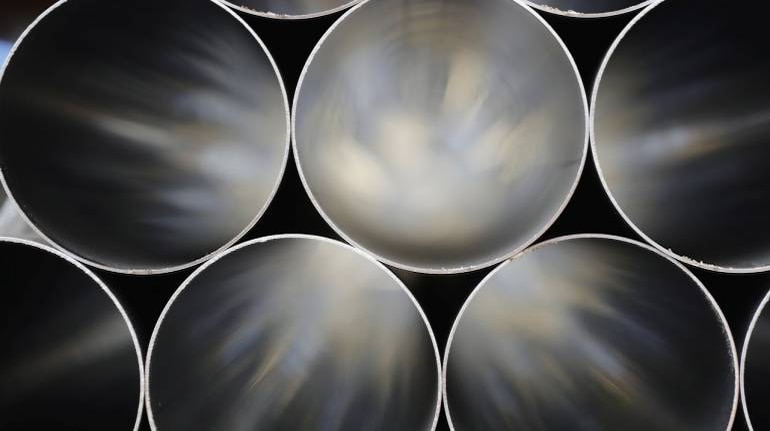

Indian stainless steel players are bearing the brunt of heavy influx of cheaper Chinese imports, causing almost 30-35 percent of medium and small businesses in Gujarat to shut shop between July-September last year, said Rajamani Krishnamurti, President, Indian Stainless Steel Development Association (ISSDA), in an interview with MoneyControl. Gujarat represents 80 percent of the MSMEs in the sector.

Many other MSMEs have trimmed their capacities to stay afloat.

Cheaper Chinese imports are putting pressure on the margins of domestic stainless steel players, causing the industry to file a petition last year urging the government to impose countervailing duty (CVD) on Chinese stainless steel products. Steel imports were subject to duty till the 2021 union budget removed it. Since then, most MSMEs are operating on a smaller scale, while others have become traders.

Krishnamurti added that 20 out of 80 induction furnace companies in Ahmedabad have ceased operations, while more than 100 re-rollers (those who make different objects, like utensils) have closed down due to cheaper imports.

Below are edited excerpts from the interview.

How has the stainless steel sector fared in 2023, and what were the growth drivers?

In 2023, the consumption of stainless steel grew by nearly 6 to 7 percent (based on H1 data available with us). However, production remains the same as last year because many establishments don't run on full capacity due to heavy imports, particularly from China.

How has the industry responded to higher imports from China?

We submitted a CVD application to the Director General of Trade Remedies (DGTR), and the authority did recommend a CVD of almost 20 percent to be imposed on China. Unfortunately, the finance ministry turned it down for reasons known best to them.

The 200 series (a type of corrosion-resistant stainless steel) is used in utensils, which are predominantly made by MSMEs. But (since their manufacture is no longer viable) a majority of these units have shuttered operations. The steel ministry is very supportive, but unfortunately, they don't decide on duties.

Are Indian MSMEs in the stainless steel space shutting shop due to cheaper Chinese imports?

That's right. China gives you a lot of subsidies, they have excess production, they don't have the required domestic market. I was given to understand that almost 20 of the 80 induction furnaces in Ahmedabad have been shut down, besides about 100-plus re-rollers. The data shows that in June, July, and September 2023, almost 30-35 percent of the MSMEs shut operations because of large imports from China.

(According to reports, imports of Chinese stainless and alloy steel accounted for more than 40 percent of total steel imports. The imports surged by nearly 70 percent year-on-year)

What is the update on the national stainless steel policy? Can you share some proposed features?

We are working on it actually, it is still in a nascent stage. We have already given five drafts to the steel ministry and they have asked for some more inputs. We will submit it to the ministry, and hopefully it (the policy) may happen sometime post March.

We have requested the government to play a key role in securing raw materials for MSMEs by having an arrangement with countries which have an abundance of the commodity, so that we can get a special price with the intervention of the government.

Any opportunities in any other sectors?

We are looking at infrastructure, where we expect good growth in tunnelling. That is one area where there is high corrosion because it's always humid plus there’s water, and stainless steel is corrosion-resistant. So, recently we joined hands with the Tunnel Association of India, an apex body.

What are your expectations ahead of budget 2024?

The expectation is that domestic industry will be allowed to grow. We should be more considerate towards MSMEs, and stop unnecessary dumping by countries like China. The other thing we would like to see is a special policy for the stainless steel industry, which will nurture it, and allow it to grow.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.