BUSINESS

Five Star Finance raises $234 million from Sequoia, KKR, valued at $1.4 billion

The non-banking lender becomes India's fourth unicorn in 2021after Digit Insurance, SaaS firm Innovaccer and business to business marketplace Infra.market.

BUSINESS

Decoding the origins of IPO-bound Policybazaar

Yashish Dahiya, co-founder and Group CEO of Policybazaar, talks about the company's origins, why he is different and why he was dead sure it would succeed.

BUSINESS

Dream11 parent valued at $5 billion in $400 million secondary funding round

Dream Sports' valuation doubled to $5 billion in less than six months

BUSINESS

Zetwerk buys back $8.3 million ESOPs

Zetwerk is the latest among a bunch of growth stage startups to give early employees a financial windfall with ESOP buybacks.

BUSINESS

Exclusive: Moglix valuation to triple to $1 billion, Falcon Edge to invest

Industrial goods marketplace will be India's fifth unicorn- billion dollar private companies- in the third month of 2021. Its valuation is set to triple from less than two years ago. Its investors includr Ratan Tata, VC firms Accel, Sequoia Capital and Tiger Global

BUSINESS

Indian tech unicorns get $225 million SPAC from top investors

According to a filing with the US Securities and Exchange Commission, Think Elevation Capital Growth Opportunities is looking to raise $225 million in an IPO.

BUSINESS

5-minute pitches, 2-day deals and tons of money—welcome to the 2021 startup party

A startup funding frenzy is on in India but is it a sign of a bubble? What is different this time from 2015? Will a bust follow this boom or is it a sign of things to come?

BUSINESS

Book Review: Kevin Roose’s Futureproof is superb entry point into crucial AI debate

How will AI affect our jobs and lives? How is it already affecting our jobs and lives? And what can we do about it? New York Times columnist Kevin Roose tries to tackle these questions and provide a manual for how to live in the age of automation

BUSINESS

Last week in startup funding: Policybazaar’s pre-IPO round, space tech funding and more

Here's a snapshot of startup funding for the week ended March 19, 2021.

BUSINESS

A year after 'black swan' warning, Sequoia tells founders to step on the gas

A year after Sequoia's ominous warning to its portfolio companies about bracing for the worst, it is now saying this is the time for entrepreneurs to be aggressive once again.

BUSINESS

IVCA Conclave 2021: IPO markets are hot but you can't always time it

At the IVCA Conclave 2021, top PE investors spoke about re-imagining the exit scenario in India.

BUSINESS

IVCA Conclave 2021: Investors say pandemic was life changing but brought tech to the forefront

In a panel titled, Managing Turbulence: Scanning the Venture Capital industry in India, VCs spoke about what the past year has been like and how things have changed from the beginning of the Covid-19 pandemic to today

BUSINESS

Indian investors give Govt's move to widen capital pool a thumbs up

The Finance Ministry, in a circular on March 17th, 2021, allowed privately managed provident, superannuation, and gratuity funds to invest up to 5 percent of their corpus in alternative investment funds (AIFs) such as SME funds, venture capital funds, social venture capital funds, and infrastructure funds.

BUSINESS

In 2020, VC exits fell 70% while SaaS matured: Report

Venture capital exits fell 70% in 2020- a result of the pandemic, but SaaS emerged as a rapidly maturing space for startups.

BUSINESS

Exclusive: Five Star Finance seeks $1.2 billion valuation, Morgan Stanley may exit

Morgan Stanley may sell part of its stake for close to $100 million to Sequoia Capital’s Global Growth Fund. Till 2004, Five Star had a loan book of less than Rs 1 crore, which grew to Rs 100 crore by 2012. The lender’s real growth has come since 2012, and it has grown 20 times since.

BUSINESS

India has 100 unicorns, a Credit Suisse report with unique methodology claims

The growing number of unicorns, and the increasing pace of reaching that valuation can be attributed to a buoyant funding environment over the years.

BUSINESS

An ecosystem without its own wealth is a colony: Blume Ventures’ Fafadia

In an exclusive interview with Moneycontrol, Ashish Fafadia, Managing Partner at Blume Ventures, holds forth on the mechanics of the VC’s latest fund, why it was challenging, why India should not become a colony for foreign funds, and whether Blume can repeat its success.

BUSINESS

Exclusive: Trifecta Capital loses partner, eyes shift in strategy

Company plans to slowly widen its scope beyond venture debt and is looking at selective equity investments

BUSINESS

Womens Day 2021: Startups and VCs improving on gender parity but miles to go

In 2020, out of India’s top 150 funded startups, 16.7% had a female founder and co-founder, compared to 10% in 2017, according to Venture Intelligence

BUSINESS

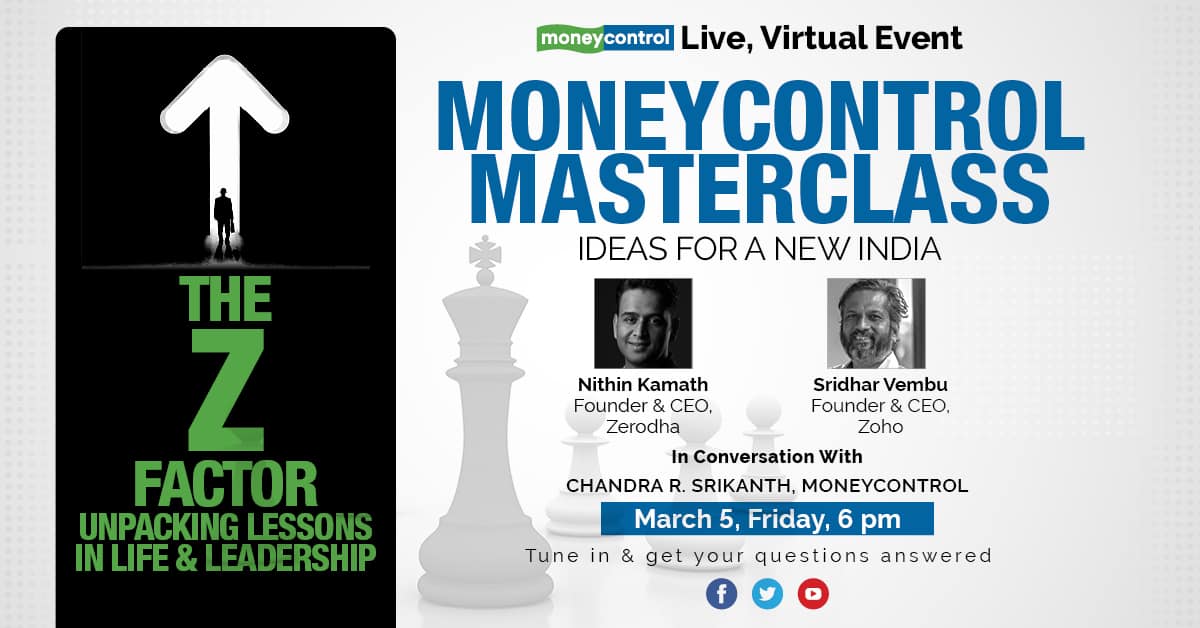

Zerodha’s Nithin Kamath and Zoho’s Sridhar Vembu open up about being bootstrapped, an impending bubble burst and more

Sridhar Vembu, founder of Zoho and Nithin Kamath, founder of Zerodha, opened up in the latest edition of Moneycontrol Masterclass about being bootstrapped, stock market bubbles, the challenges of Twitter and more.

BUSINESS

Last week in startup funding: Edtech, early-stage startups continue seeing traction

In the week ended March 5 2021, edtech continued seeing traction while early stage deals across sectors saw some activity too.

BUSINESS

Blume raises Rs 350-crore secondaries fund in rare startup move

Blume, an investor in Unacademy, Dunzo and Purplle, among others, is raising a secondaries fund in a unique structure in India's startup ecosystem—it is replacing old LPs with new LPs

BUSINESS

Razorpay announces $10-million ESOP buyback

Sequoia Capital and sovereign wealth fund GIC are the investors buying back the ESOPs that will benefit 750 current and former employees.

BUSINESS

Meet India’s newest and most unique unicorn

Infra.Market ties up with contract manufacturers, gets them to utilize idle capacity and manufacture products under its own brand, which it then sells to large infrastructure companies and retail outlets. It is this distinctive template that has led it to be valued at a billion dollars, barely 20 months after its first funding round