“We are trying really hard not to do stupid things,” said a partner of a multibillion-dollar venture capital firm. The partner, who didn't want to be named, has been investing for 15 years and sits on the boards of multiple unicorns. He must know how not to do stupid but it's not that easy anymore—things are a bit wild in the startup world these days.

For the longest time, raising funds was a slow dance of pitching an idea, working on the story and wooing investors—it could take months or longer. Not anymore.

A rise in internet users during the pandemic, startups growing faster than ever and VC firms with billions to spend has led to an early-stage deal-making frenzy. Aggressive valuations for unproven models, merely good ideas being sold as sure-shot bets and founders pitching to VCs in a model similar to speed dating—it is all happening.

“If you have the right idea and the right story, the ecosystem is like a house party right now. The booze is flowing, everyone is light and happy, it’s great,” said a founder from a top accelerator program, requesting he not be identified.

Hello. Okay. Bye

In his nine years of investing, Rutvik Doshi, managing director of Inventus Capital, had the shortest call of his career last week.

The founder, running a business-to-business software firm, was raising $2 million and asked if Inventus would invest through a convertible bond, a short-term debt that gets converted to equity at a later day, a strict no-no for most VC firms.

Doshi said no. The founder said several angel investors were interested, so if Inventus wasn’t, there was no point and hung up. The call lasted five minutes.

“Generally founders and VCs work hard to maintain relationships. They can still help each other later on but in this market, these things happen,” Doshi said. The cut-and-dry call tells a story.

It means that companies are raising funds at an aggressive valuation and are also simultaneously receiving offers at an even higher valuation for no discernible reason except a belief that these can be billion-dollar companies someday.

And these are all seed and Series A rounds , relatively early in a company’s life cycle, much before it has proven or established itself.

Late-stage funding has been robust in India for the last few years and market leaders have been able to raise large rounds at outsized valuations.

But right now, an early-stage funding party is on for entrepreneurs- quite a change from last year. Around this time in 2020, the coronavirus had begun to spread and venture capitalists were advising portfolio firms to cut costs and lay-offs employees—do whatever it takes to survive the upending of the economy. Investors were firmly in control.

Fuzzy metrics

The pendulum has since swung, and how. Record low-interest rates in the US and the government pumping in billions of dollars to shore up the virus-battered economy has led to massive liquidity in the system, which investors are deploying in emerging markets. In India, an anti-China sentiment, entrepreneurs’ abilities to tell a tall tale and fear of missing out on the next big unicorn are seeing VCs flock startups from all directions.

“Honestly, I know that today I can ask for a valuation 30 times of my forward sales and I’ll get at least four term sheets,” said a 27-year-old founder running a two-year-old software-as-a-service firm on condition of anonymity.

A term sheet is a non-binding document that broad strokes the conditions under which an investor puts money in a business.

In another case, a consumer brand pitched to an early-stage investor, asked for a valuation three times its Gross Merchandise Value (GMV), an unreliable metric to begin with. GMV is a revenue metric which includes discounts and sales returns—not providing an accurate picture of a company’s financials

While asking three times the GMV is aggressive by all accounts, this GMV included 25 percent of sales returns, 20 percent discount, and 5 percent GST. So, the company’s actual revenue was nearly half of what it claimed. One investor said no but another VC issued a term-sheet last week, Moneycontrol has learnt.

In another case, the founders of a woman’s fashion brand claimed that they were using artificial intelligence (AI) and machine learning (ML) to come up with new designs and to make customers stick.

After due diligence, an investor found that not only had the company inflated its numbers but neither did the founders nor their team had any knowledge of AI and ML. It was a “blind exaggeration” the investor said, requesting anonymity.

A good year

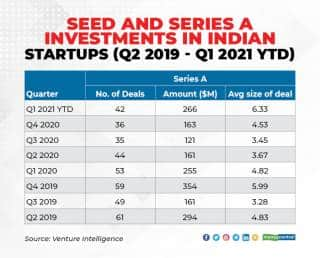

Despite the pandemic, 2020 was a great year for early-stage firms. Startups raised $327 million for seed rounds in 2020, the highest in five years, according to data from Venture Intelligence. While Series A deals in 2020 were slower than the previous two years, their size increased.

In the first quarter of 2021, startups have raised Series A rounds of $266 million across 42 rounds, with an average deal size of $6.33 million, the highest so far, and more than double the average size of $2.94 million in 2017. And yet, data doesn’t tell the whole story because many of the hottest deals haven’t closed yet or haven’t been announced.

In midst of the funding frenzy, many founders are now raising $3-5 million (Rs 21-35 crore) simply for an idea. The sum used to be a crore a decade ago and probably around Rs 7 crore a couple of years ago. If founders are from a program such as Y Combinator or Sequoia Capital’s Surge, they raise millions purely on brand and reputation. These seed rounds have led to $15-25 million Series A in companies such as SaaS firm Hubilo, fintech Flexiloans, B2B firm Pagarbook and edtech firm InterviewBit.

“There is too much aggression. Some founders are not even able to properly justify why they are raising so much,” said Anand Lunia, managing partner at India Quotient, an early-stage investor. A grounded founder would stand out in this environment, he added.

Investors are also paying for stakes in these companies because they believe that these startups can become unicorns or multibillion-dollar firms in the next few years.

India has nearly 40 unicorns, with four added in the last three months alone and a record 12 in 2020. Further, the nature of unicorns is also changing to indicate sustainability.

While consumer internet firms have for long gobbled billions of dollars with ease, investors are also excited about enterprise software and business-to-business marketplaces, which need lesser money to show a large outcome. For the first time, investors say that B2B is hotter than B2C- which has itself has large deals across stages.

But because B2B and SaaS firms need less money, investors chase them even more. Across companies and sectors, board meetings are increasingly dominated by funding discussions. Everything else—growth, strategy and hiring—is taking a backseat.

The founder of a SaaS company was happily mystified by his recent pitching experience to a growth-stage investor. He began with his vision and ideas—a well-rehearsed half-an-hour pitch. Five minutes into it, the investor interrupted to say, “Yes yes, I think I get it. Now tell me how much I can invest.” The investor mailed the term sheet a day later and the terms were finalised a day after that.

For growth and later-stage deals while the sentiment is still aggressive, and there could be a bubble in the making.

Risk ahead

Many early-stage deals though are still predicated on the proverbial pot of gold at the end of the rainbow. While that is the nature of the beast, increasingly larger rounds for unproven firms with fuzzy metrics indicate a growing risk appetite.

“The metrics are fuzzy but I can still live with that if the founder wants to prove himself. In some cases all the founder has is a good idea with terrible numbers—and it's still fundable. Don't make it sound like your business is proven when investors don't always need that. Say that you want to prove it as you build,” said Lunia of India Quotient

Investors find themselves in a bind. For instance, two leading VC funds are seeing some portfolio companies—barely two years old—raise their next round even though the business hasn’t proven itself and doesn’t deserve to raise money again- that too at a higher price.

The VCs who led the seed round in these companies have a front-row seat to the startup’s progress. They receive numbers every month, they help the firms with hiring, play an active role, and feel they have possibly backed the wrong horse. Typically, VCs make most of their returns from a few breakout companies, while others have middling to poor outcomes.

What is uncommon is that these firms are getting follow-on capital at higher valuations from new investors. And the existing investors are flummoxed because they are expected to double down on their bet. If a new investor commits but you don't top up, it reflects poorly on your conviction. So what do you do?

“It is a really, really hard situation. I keep questioning my own beliefs, whether I am missing something in this company’s story. I am trying to tell myself that in this industry things change very fast, so let me just wait and watch,” sad a partner at a VC firm.

Of the dozen founders and investors Moneycontrol spoke to, each one of them likened the situation to 2015 when a similar funding frenzy gripped the industry. Every hyperlocal and real estate startup in town got funded. Investors were exuberant, rounds were large and valuations aggressive. Eventually, many of them shut down or sold to other companies. The turbulence at Housing.com and online retailer Snapdeal ended the frenzy.

"There is a bit of a bloodbath in consumer investing because it's a rat race. And because so much money is chasing few companies, valuations zoom,” said Manish Singhal, managing partner at piVentures, which invests in AI and deep tech startups. His atypical thesis kept him from engaging in this fear-of-missing-out (FOMO) investing, Singhal said.

So what happens when the music stops? Who cleans up the party house and who picks the tab?

A tweet from Pratik Poddar, Principal at Nexus Venture Partners, summed up things perfectly, “In the current boom market, every VC I am talking to is thinking he has a great portfolio and he timed the market right but what is not in his portfolio is overvalued.”

But not all investors are taken in by the excitement. They are looking hard for founders who are invested in a company for seven-10 years at least and not someone who wants to raise money because it is a great time.

"The momentum is pretty wild but we have to be careful because when the money stops flowing, the founder still needs to be there. Finding those long-term founders is a much harder ask now,” said Ritu Verma, managing partner at Ankur Capital, an early-stage impact investor.

Compared to 2015, the market size and opportunity are far more real today, say founders and VCs. After the pandemic, millions more are shopping online, gaming online, paying for cloud-based software, and using new-age local social networks.

According to Bain’s 2021 Venture Capital report, India’s GDP is expected to grow 11.5 percent in 2021, leading Asian growth along with China, and grow at a healthy 7-8 percent annually till 2025. If this, and some proposed internet IPOs pan out successfully, many of these investments, valuations and theses could end up looking spectacular.

But if past economic cycles are anything to go by, then where there’s a boom, a bust is never too far behind.

"As entry valuations go up, it's important that exit outcomes in the end state also match up. Bull and bear markets come and go but we are in the long game.... we are always looking for founders who want to build category game-changers, for the long term,” said Nath of Blume Ventures.

The upcoming consumer IPOs—Zomato, Nykaa, Policybazaar and Delhivery —in India and the SaaS unicorns building for the world are a positive sign that large exits from India are indeed possible, he says.

If the IPOs are well received, they could trigger a whole new level of excitement and dollars percolating to early-stage firms, investors say. If essentially the same number of companies will be courted by more investors jostling for hottest deals, it raises questions whether the house could come crashing down. More so in sectors such as fintech and social commerce, where sustainable business models are yet to be discovered in India.

When sentiment has gone from cautious to exuberant in the blink of an eye, the reverse could happen, too, if macroeconomic indicators disappoint. Like most times, some pockets will thrive, others will survive and a few may go bust but for now, the party is on.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!