In 2020, VC exits fell 70% while SaaS matured: Report

Venture capital exits fell 70% in 2020- a result of the pandemic, but SaaS emerged as a rapidly maturing space for startups.

Mumbai / March 17, 2021 / 12:19 IST

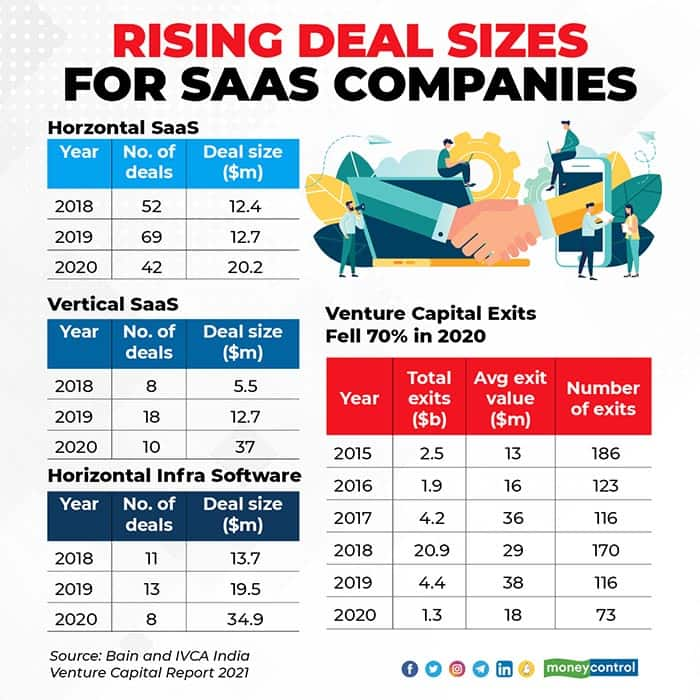

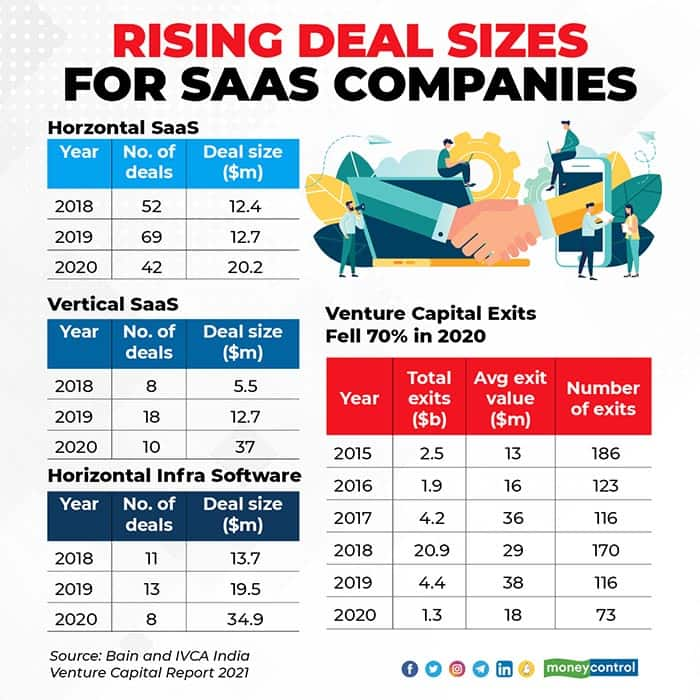

Venture capital exits fell 70% year-on-year in 2020 as investors were unsure of valuations during the COVID-19 pandemic while enterprise software seemed to come of age, a new report says.Exits- the returns are seen by venture capitalists- fell 70% to $1.3 billion across 73 deals, compared to $4.4 billion across 116 deals, says the report from consultancy firm Bain and Co along with the Indian Private Equity and Venture Capital Association (IVCA).$1.3 billion is also the lowest figure in the last six years, although it must be considered that 2020 could be an aberration due to the pandemic. “The exit outlook remains positive for the next few years as most of the top VC funds portfolio is yet to reach maturity...2021 will mark the dawn of the IPO era for our ecosystem, providing more exits as growth accelerates across segments and an increasing number of companies start to hit scale,” the report said.2020’s largest exits included ed-tech firm Byju’s acquiring coding upstart WhiteHat Jr for $300 million, and secondary share sales in food delivery firm Swiggy for $220 million, and insurance marketplace Policybazaar for $130 million, where early investors sold their stakes.Largely, internet startups bounced back quickly from the pandemic and raised large rounds towards the end of the year as more users used digital platforms and some startups had emerged stronger with better economics. Despite this, the average deal size fell for the first time in five years, from $14.7 million in 2019 to $12.4 million in 2020.Software-as-service (SaaS) startups were an exception here, with deal sizes jumping across specific verticals, although overall SaaS deals grew only 10% year-on-year. Horizontal SaaS deal sizes went from $12.7 million in 2019 to $20.2 million in 2020, while vertical SaaS deal sizes zoomed from $12.7 million to $37 million. Horizontal infrastructure software went from $19.5 million to $34.9 million. The sector saw two unicorns- API firm Postman and spa and salon SaaS firm Zenoti, with SoftBank, also doing its first Indian SaaS deal in Mindtickle.

Indian SaaS across the board is maturing because of a number of factors- Indian IT giants such as Infosys and TCS have developed large pools of engineering talent; Amazon Web Services, Google Cloud, etc have given rise to public clouds; trained product managers and executives starting up after stints with large global technology companies and better access to capital. Moneycontrol explained the SaaS boom here.

Invite your friends and family to sign up for MC Tech 3, our daily newsletter that breaks down the biggest tech and startup stories of the day

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!