BUSINESS

Married Women’s Property Act: What’s hers, stays hers

The MWP Act must be invoked at the time of buying a new life insurance policy; it cannot be retroactively applied

BUSINESS

Inheritance planning: Why you must talk legacy with loved ones

When you’re ready to discuss your estate plan with your family, careful preparation is key. Be transparent about your intentions and ensure that your loved ones understand the rationale behind your decisions.

BUSINESS

Estate planning: How to navigate the emotional journey of passing on your assets

It is often the anticipation of having to deal with emotional discomfort that discourages many families from devising an estate plan. It is important to recognise these emotions and deal with them constructively instead of leaving them unattended.

BUSINESS

Nationality, residency, domicile: Why they matter for families with global assets

Legacy planning across borders is important if you live in one country but are a resident of another. For those of you who hold assets in foreign countries but pay their taxes in India, make sure that your estate planning has accounted for such assets.

BUSINESS

Worried about a specially-abled child? A Private Family Trust can help steer financial matters after you

Creating a tailored estate plan, with careful attention to details, that addresses these financial and non-financial concerns as well as the unique set of requirements of the differently abled, can give the family the peace of mind that their loved one will be attended to in a responsible way.

BUSINESS

How women can make a solid estate plan

A Will is a must if you want to pass on your assets as per your wishes, but that comes into effect only after the testator passes on. A trust and a power of attorney takes care of people when they are alive. A solid estate plan includes all three.

BUSINESS

Women's Day: Why women should have an estate plan

Women need to create an estate plan, so that they get to choose the beneficiaries of their wealth and are able to manage their financial affairs, in the event of incapacitation.

BUSINESS

Five reasons why it is important for women to take charge of their finances

Involvement of women especially in money matters can definitely be a game changer in the manner in which wealth is not only managed but also inherited.

BUSINESS

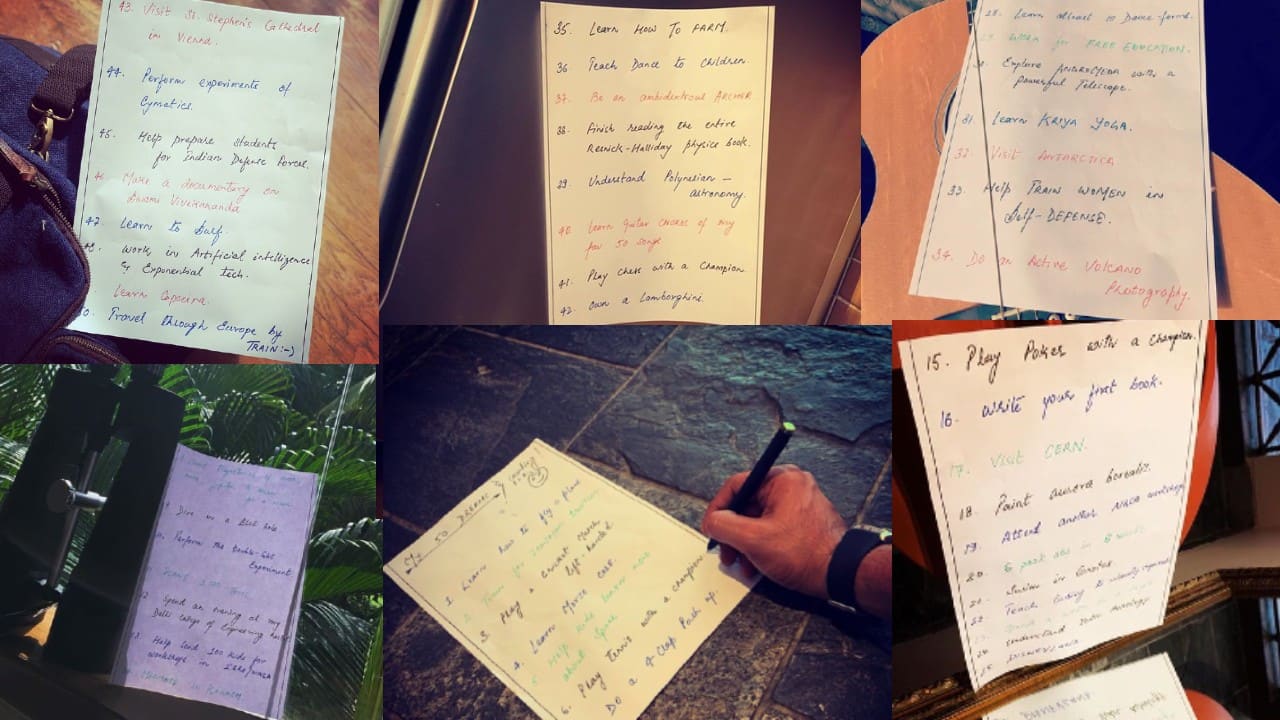

7 easy steps to draw your estate plan

Writing a will is just one aspect of drawing up your estate plan. You need to take stock of your assets and liabilities and who your beneficiaries are. Some of your beneficiaries may also be conditional.

BUSINESS

Where there’s a Will there’s a way: Avoid making these common mistakes with yours

Estate planning is often left for the last minute, kept secret even from beneficiaries, and not given priority. Such mistakes can be harmful.

BUSINESS

Family governance: A conflict-free structure for passing on your wealth to heirs

Family governance is a set of rules put together by a family. This set of formal and informal rules structures the decision-making processes in family businesses

BUSINESS

Will or Trust? The key choice to make in estate planning

A good estate plan not only addresses your current needs, but also assesses all possible tools considering your unique circumstances

BUSINESS

Why writing a Will is not a one-time exercise

You should keep reviewing your Will periodically. It must factor situations such as birth, death, marriage of a family member, purchase of new assets and legislative changes

BUSINESS

Estate planning: A necessity at all life stages and for income levels

In the absence of a Will, intestacy laws will ascertain how your assets are passed on, which may go against the interests of your loved ones

BUSINESS

How to make a solid estate plan during these pandemic times

If you do not have an estate plan in place, the distribution of your assets would done according to the government’s intestate succession laws

BUSINESS

Afraid to write your Will? Here is how to overcome your fears

Aside from thinking of death when it comes to making a Will, many of us procrastinate on our estate planning because we think it could lead to a family feud later. Ironically, not leaving a Will behind can lead to a family feud later.