BUSINESS

MC Explains | Why are banks issuing electronic bank guarantees? 5 questions answered

HDFC Bank and ICICI Bank recently issued electronic bank guarantees to deliver quick, digital, paperless services. Will more banks follow?

BUSINESS

Banks concerned about MSME exposure as inflation becomes new pain point

As inflation threatens to increase MSMEs input costs and the RBI’s COVID-related forbearance comes to an end, banks’ non-performing assets and slippages in the MSME segment are expected to inch higher in the coming quarters, say experts

BUSINESS

AT1 bonds make a comeback with Rs 18,000 cr issuances this year, more banks likely to join

With attractive yields, banks are looking to quickly raise capital through the instrument. Experts see issuances topping Rs 30,000 crore this fiscal as investors get more confident in banks' financial health

BUSINESS

Small finance banks may continue to offer higher FD rates but face pressure on margins, say bankers

FD rates offered by SFBs are in the range of 7-7.5 percent but are still lower than the 8 percent to 9 percent they were offering in 2018

BUSINESS

RBI’s digital lending norms balance innovation and consumer interest, says deputy governor Rao

The RBI, on August 10, released norms to regulate digital lending.

BUSINESS

Zero coupon bonds are back in flavour. Will the party continue?

In August, NBFCs such as TMF Holdings, Tata Motors Finance, Tata Capital Financial Services and L&T Finance raised an aggregate Rs 1,683 crore via zero coupon bonds maturing in two years to four years

BUSINESS

With nearly 500,000 homes worth Rs 4.48 lakh crore stuck, banks raise red flag

Banks have increased credit exposure to the commercial and residential real estate segment over the years

BUSINESS

GDP | RBI likely to stay on rate hike path despite lower-than-estimated growth figures, say economists

India’s economy grew 13.5 percent in April-June, the fastest in four quarters, but well below market expectations of 15 percent and the RBI’s own forecast of 16.2 percent

BUSINESS

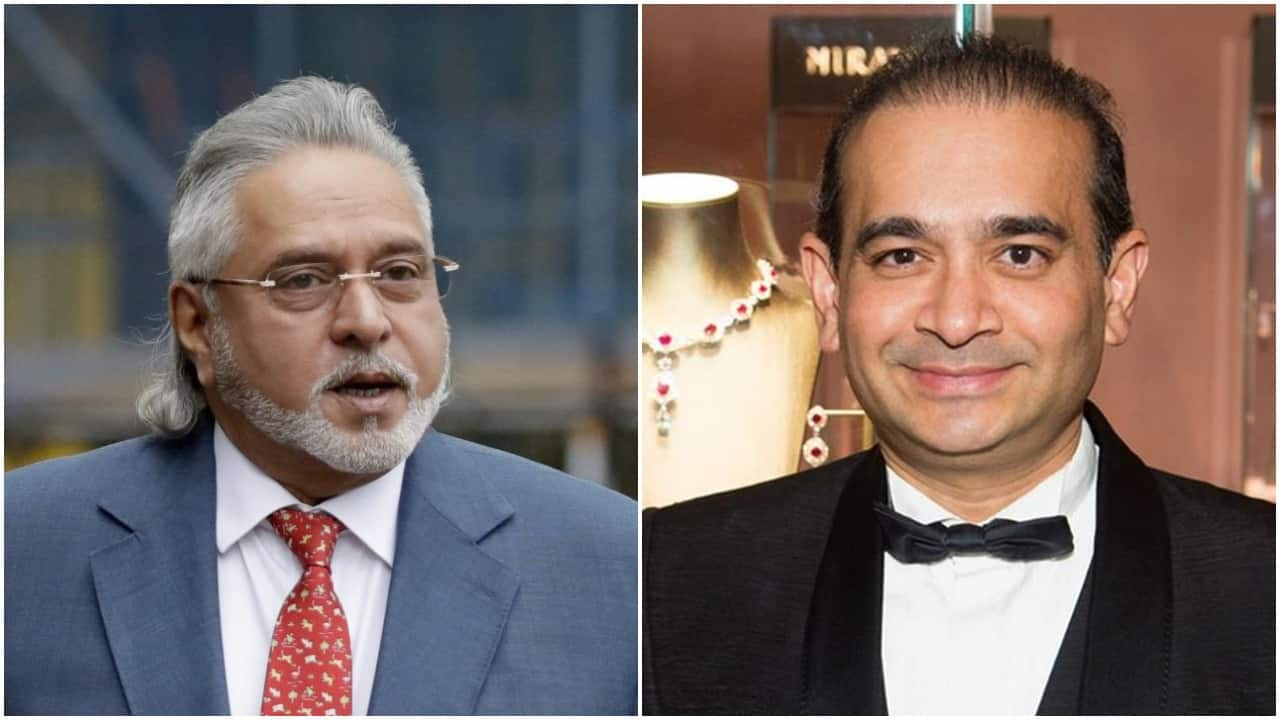

Five promoters who siphoned funds overseas, defrauded Indian banks

Prior to the government’s new overseas investment rules, bankers learned some hard lessons in the corporate loan business

BUSINESS

MC Explains | Why do firms prefer private placement of bonds over public issues

In FY22, the amount raised through public issuances of corporate bonds was just about two percent of the amount raised through private placements

BUSINESS

Banks adequately capitalised, but higher credit growth could see fund-raising: CRISIL’s Krishnan Sitaraman

Rating agency’s senior director and deputy chief ratings officer expects banks’ credit growth to pick up to 11-12 percent in FY23. CRISIL may also look at revising this forecast upwards, he said

BUSINESS

RBI’s assessment of inflation falling to 4% over next 2 years seems accurate, say economists

RBI governor Shaktikanta Das in a recent interview had said the central bank has set itself a two-year timeframe to bring inflation closer to its 4 percent target

BUSINESS

Must examine why firms prefer private placement of corporate bonds, says RBI Deputy Governor Rabi Sankar

In FY22, the amount of money raised through public issuances of corporate bonds was Rs 11,589 crore – just about 2 percent of the amount of money raised through private placement at Rs 5.88 lakh crore, Rabi Sankar said

BUSINESS

Govt’s new overseas investment rules to aid banks’ loan recovery, stop asset theft: Bankers

The government’s new norms for overseas investment make it tougher for loan defaulters and others being probed by investigative agencies and regulators to siphon off funds out of the country

BUSINESS

Banks step up credit card play ahead of festive season

Outstanding credit cards in force increased from 7.03 crore to 7.87 crore between January and June this year, according to central bank data. Total credit card spends have stayed above the Rs 1 lakh crore mark for four consecutive months through June

BUSINESS

MPC members batted for front loading of rate hikes, show minutes

The MPC has hiked the repo rate by a total of 140 basis points over the last three-and-a-half months to quell inflationary pressures in the economy

BUSINESS

Money market signals | Inter-bank call rate can align with repo rate by Oct-March, say experts

The weighted average call rate has risen from around 3.35 percent in February to 5.28 percent in August, even as the repo rate has risen only 140 basis points during the period

BUSINESS

India’s Cooperative Mess Part - 4 | Rupee Co-operative Bank’s collapse leaves many depositors in distress

Rupee Co-operative Bank's depositors are dealing with financial hardships and navigating family emergencies as they struggle to access their own money

BUSINESS

RBI may go slow on next round of rate hike as retail inflation cools off to 6.71%

India's headline retail inflation rate, as measured by the Consumer Price Index (CPI), fell to a five-month low of 6.71 percent in July, data released on August 12 showed.

BUSINESS

Explained | What are RBI’s new digital lending norms? 5 questions answered

The RBI’s first set of norms aim to regularise digital lending for regulated entities and crack down on unlawful activities

BUSINESS

RBI cancels licence of Pune-based Rupee Cooperative Bank

As per the data submitted by the bank, more than 99 percent of the depositors are entitled to receive full amount of their deposits from DICGC.

BUSINESS

Banks’ margins improved in Q1, but faster deposit mobilisation could limit upside in FY23, say experts

Some banks may choose to mobilise deposits by adopting a relatively more aggressive pricing strategy, which could limit the upside on NIMs, analysts said.

BUSINESS

RBI says first loss default guarantee recommendations for digital lending are under examination

FLDG is a lending model between digital lending fintechs and their partner banks and non-banking finance companies

BUSINESS

India’s cooperative mess | CKP Cooperative Bank depositors are fighting an uphill battle

Depositors of CKP Cooperative Bank grappled with the Covid lockdown, waded through medical emergencies and are struggling to get back their own money