BUSINESS

A Nasdaq meltdown, like China’s big tech in 2021?

The US is risking a massive devaluation of growth stocks

BUSINESS

Hong Kong-Dollar peg makes less sense than ever

A rate divergence between the US and China erodes the city’s lure as a cheap place for companies to raise funds. It’s time to move on

BUSINESS

A better way to make billions as Chinese companies look abroad

Investors can ask which companies will be disrupted — or receive unexpected windfalls — as Chinese firms rush abroad

BUSINESS

China stimulus requires investors’ patience and sophistication

Debt restructuring is a central part of Beijing’s stimulus package. It demands investor patience and sophistication

BUSINESS

China's Guotai, Haitong securities merger resembles the Swiss model

The biggest brokerage merger in years looks more like a bailout, masking billion-dollar losses from bond underwriting

BUSINESS

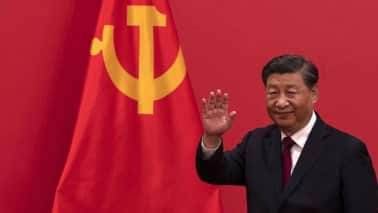

Xi Jinping’s supply-side panacea has lost its magic

Three reasons why an old solution to rein in industrial excess capacity won’t work again

BUSINESS

China’s attempts to halt its bond rally can misfire

Beijing’s attempts to halt the bond rally can lead to mass redemptions and a spike in yields

BUSINESS

Hong Kong grows wealth; Singapore preserves it, stop comparing

They sit in very different corners of the financial system. The rise of one doesn’t spell the demise of the other

BUSINESS

Private credit and mini-millionaires don’t mix

The push to fundraise from wealthy individuals is turning managers into high-end concierge services

BUSINESS

China’s housing crisis is stressing Xi Jinping’s state-owned developers

Beijing is opening the door to a real estate bazooka. But only a few developers will benefit

BUSINESS

Behind the Hong Kong market’s fast and mysterious rally

Global investors are playing a zero-sum game in northern Asia, tussling between Japan, Taiwan and China

BUSINESS

China’s magical growth of 5.3 percent has puzzled the Chinese

Strong first-quarter numbers are puzzling the Chinese, who witness a stagnant economy daily. Two factors reconcile the difference

BUSINESS

Missed Chances: Don’t ask star fund manager Cathie Wood about Nvidia, or TSMC

She mistimed the offloaded of shares in both companies, an epic miscalculation given how AI is giving chip companies a second wind. Cathie Wood is now sounding the alarm on chip stocks. Given her track record, one has to take Wood’s comments with a grain of salt. Among providers of mutual and exchange-traded funds, her firm Ark topped the chart in wealth destruction. But her caution nonetheless resonates with those who worry we are nearing another dot-com burst

BUSINESS

Private credit has had its 15 minutes of fame

The conditions that led to the private credit boom are unwinding. After two years of ceding turf to direct lenders, investment banks, which are the public credit markets’ gatekeepers, are striking back. With confidence growing of a Fed interest-rate cut, private credit funds will have to cut their premiums. But they wont mind cheap public debt, as many sit on a “towering backlog” of unsold investments amid anemic IPOs and are in need of more cash

BUSINESS

Vanke, the developer that will break China’s back if allowed to default

A state bailout will be in the government’s own interest. After all, municipalities need a few developers to survive, to build projects and purchase land, without which China may fall off a fiscal cliff this year

BUSINESS

An (almost) inverted yield curve is worrying China

An inverted yield curve has a bad rap. In normal times, notes with longer maturities offer higher rates to compensate lenders for tying up their money for an extended period. When those yields sink close to or below shorter ones, it’s an indication that investors are pessimistic about an economy’s growth prospects

BUSINESS

China has a quant quake because there’s no Citadel

China's crackdown on quantitative trading shows how inexperienced the Chinese quants are. The country has largely blocked out the world’s best hedge funds. In other words, they were not baptized by the likes of Citadel, which relentlessly sifts out untalented traders and portfolio managers and speeds up industry consolidation in whichever markets they operate. By allowing in the best, Beijing can ensure the bad ones can’t thrive and create havoc

TRENDS

When Lionel Messi disappointed a Hong Kong desperate for good cheer

Messi’s no-play is rubbing salt into the wounds of a wealthy financial centre that has been taken for granted again and again. The city got a second draconian national security law, and is losing its place in the global mindspace at a fast clip

BUSINESS

China's jobless youth are travelling and reshaping consumer habits

Young people are busy traveling, taking advantage of the free time — there are few good jobs out there — as well as the consumer power that comes with a deflationary economy

BUSINESS

Hedge funds are playing a dangerous game on Japan and China

This year, everyone loves Japan and hates China. But don’t construct a long-short trade either way. Macro funds work well when there are clear trends, such as the unstoppable dollar rally in 2022. As the Bank of Japan and President Xi Jinping keep markets in the dark, one can be caught out by either side

BUSINESS

China Economy: Hong Kong is facing a repeat of 1998 Asia financial crisis

As a small open economy, Hong Kong is vulnerable to financial contagion and capital flights. Since 2009, hot money has flown in to be closer to China, just as it did in the 1990s en route to Southeast Asia. People nowadays question the city’s viability as a financial centre, reminiscent of the prevailing sentiment in the aftermath of the 1997 handover

BUSINESS

Blackstone and BlackRock master the art of moneymaking

After blowing past major milestones — the pair now manages over $1 trillion and $10 trillion, respectively — Blackstone and BlackRock needed to show investors they still have a good story to tell. The two multi-billion dollar deals they just sealed showcase just that

BUSINESS

Private credit has even more reasons to thrive in Asia

Overseeing about $2.9 trillion in assets under management, private equity has blossomed in Asia. But with the public offerings market shut and exit deals sparse, PE firms will want to lever up their portfolio companies and boost equity value to appease impatient investors. Private credit will be a useful tool

BUSINESS

Hong Kong bankers’ uneasy dance with property tycoons

Next year, close to $25.6 billion of bank loans taken out by Hong Kong’s property developers will be due, and only 15% of them have been — or are close to being — refinanced. Whether banks will continue lending to the business elites has become a hot issue, as commercial real estate woes plague the world’s biggest cities