BUSINESS

F&O Manual: Muted trade likely, deploy short strangle on Nifty

Tata Motors saw massive long buildup as OI rose 14 percent to its highest in the year.

BUSINESS

F&O Manual: Buy 18,100 calls if Nifty opens higher

Bank Nifty closed with a cut of about 0.3 percent at 42,328.85. Maximum call writing was seen at the 42,500 level which will act as the hurdle for the index now.

BUSINESS

F&O Manual: Employ bull call spread to capture further upsides in Nifty

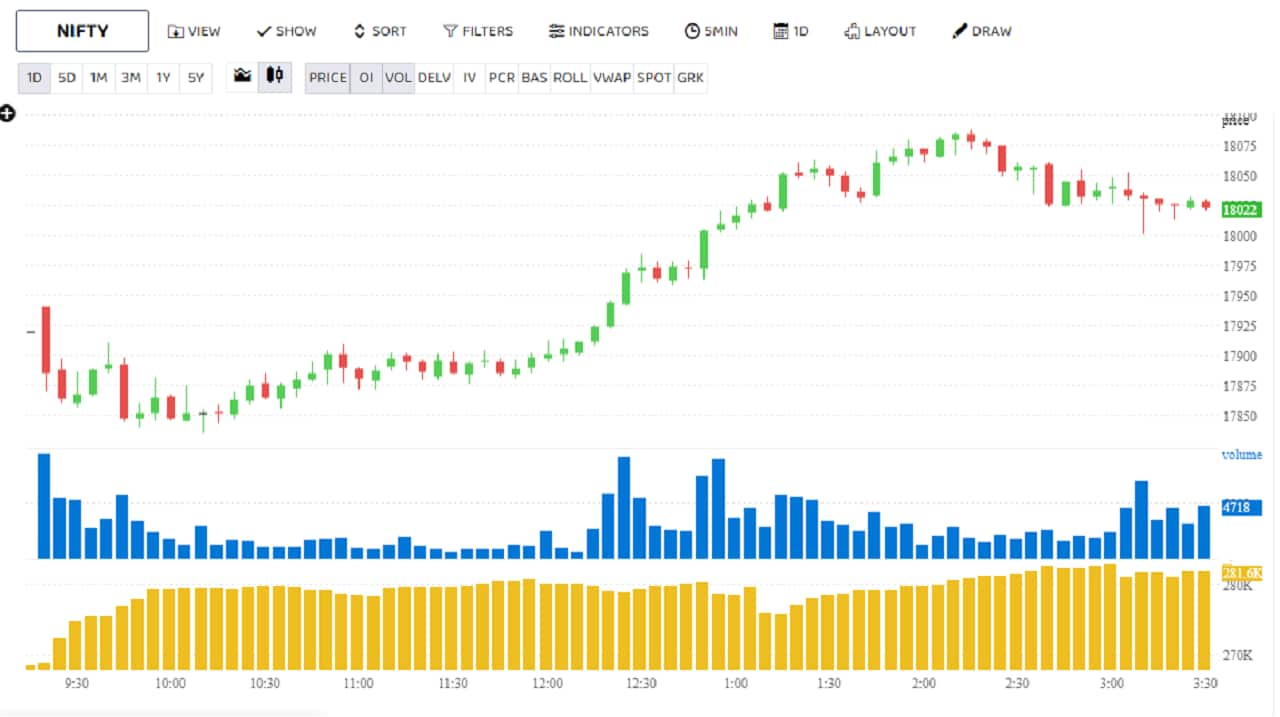

Some analysts believe the recovery to extend further but also caution that the upside seems capped, given restricted participation and hurdles around the 18,250-mark.

BUSINESS

F&O Manual: Buy Nifty 18,900 calls on dips, say analysts

Stock market today: Bank Nifty settled with a cut of about 0.5 percent at 42,167.55. All out-of-the-money strikes saw activity with the highest call activity at 42,500 and call activity at 42,000.

BUSINESS

F&O Manual: More recovery in offing, Nifty can rise to 18,100 next week

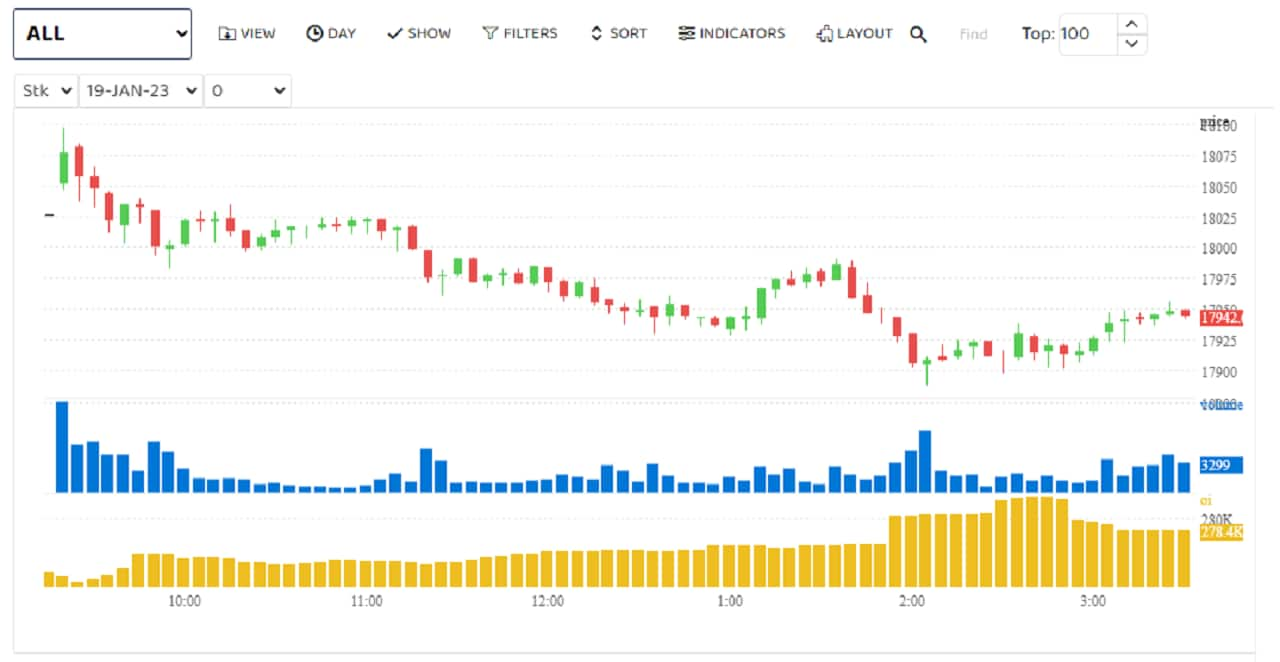

On the options front, for the January 19 contract, 17,900 and 17,800 saw an accumulation of puts as they emerged as new support levels; 18,100 is the resistance

BUSINESS

F&O Manual: Slight bullishness seeps in; buy 17,900 call tomorrow

Navin Fluorine, which broke out of major resistance level, saw a massive long buildup

BUSINESS

F&O Manual: No trend visible in Nifty; deploy bull call spread, say analysts

Bank Nifty, meanwhile, rose about 0.52 percent at 42,232.70

BUSINESS

F&O Manual: Range-bound trade to continue; buy 19,000 calls if Nifty slips again

Analysts say the index is trading in a range. A bearish engulfing pattern on the daily chart points to a further correction

BUSINESS

F&O Manual: Deploy bull call ladder to gain from range-bound market

Analysts say traders should expect range-bound trade on January 6 as well

BUSINESS

F&O Manual: Market still directionless; buy 18,000 call if Nifty falls

Bank Nifty also closed with a drop of over a percent led by selling in PSU Banking names. The index witnessed a false breakout on the upside early in the day but bears hammered it back lower.

BUSINESS

F&O Manual: Employ bull call ladder as upside capped for the week

Narrow range price formation in Bank Nifty from the last two trading sessions indicates that buyers and sellers both are being conservative and waiting for a decisive range breakout

BUSINESS

F&O manual: Market continues to be weak; buy puts on pullback, say analysts

On the option front, call and put writing was seen in out of the money (OTM) strikes. 18,200 is the most immediate hurdle for the index while 18,000 is the support, according to open interest data.

BUSINESS

F&O manual: Market trending weak; buy puts if Nifty opens higher, say analysts

On the option front, call writing was seen in out-of-the-money strikes. Some of the OTM strikes also saw put writing that signals support at around 1800-18100

BUSINESS

F&O Corner: Nifty has some steam left, buy 18,450 calls, say analysts

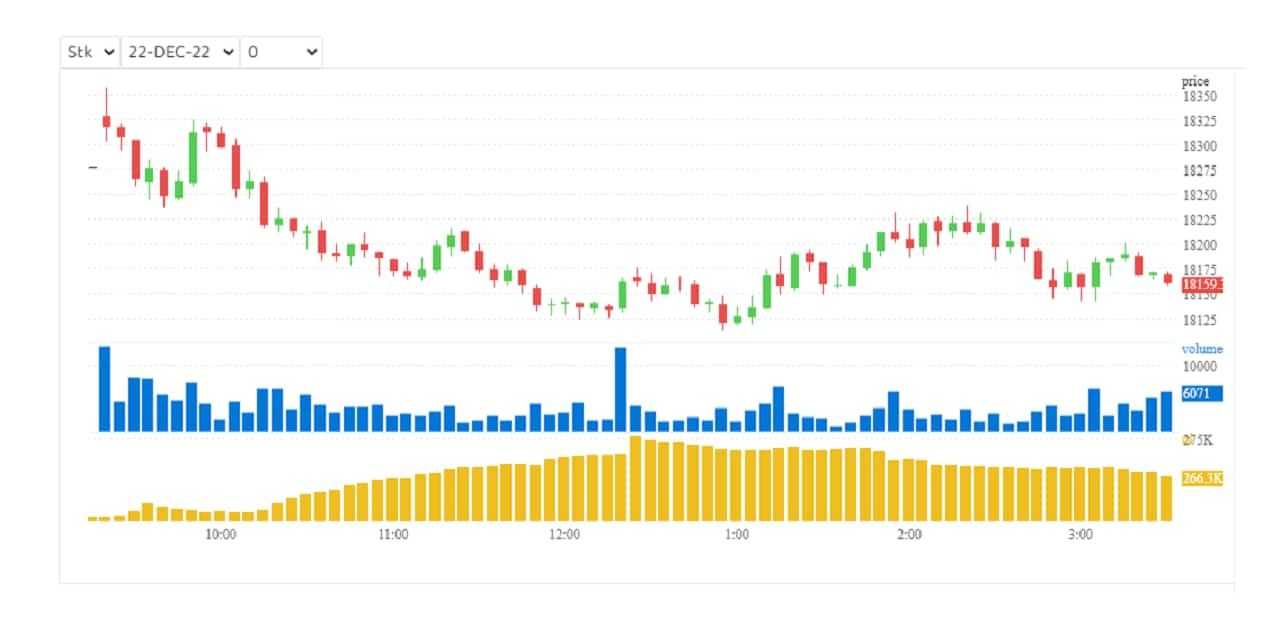

The Nifty found support near 18,250 on December 19 and reversed sharply, thereafter. The short term formation is still on the negative side, some analysts said.

BUSINESS

F&O Corner: Employ sell on rise strategy in Bank Nifty, 44,000 biggest hurdle

Nifty has formed lower top lower bottom on the daily chart, which is a bearish sign for the short term.

BUSINESS

F&O Corner: Put option writers bleed; what should be your strategy tomorrow?

It was a bloodbath – as one trader described – as the market took a sharp plunge towards the end of the day.

BUSINESS

F&O corner: As Fed outcome may induce volatility, focus on stock opportunity

Overall, 19,000 level and 18500 remained the biggest hurdle and support for the index. However, call writers are gradually shifting to 19100 and 19200 strikes, which shows market expectations for potential upside is gradually getting higher.

MARKETS

The 22 stocks that richie rich fund managers can't part with

One of the ways to look for value is finding where successful money managers are investing.

MARKETS

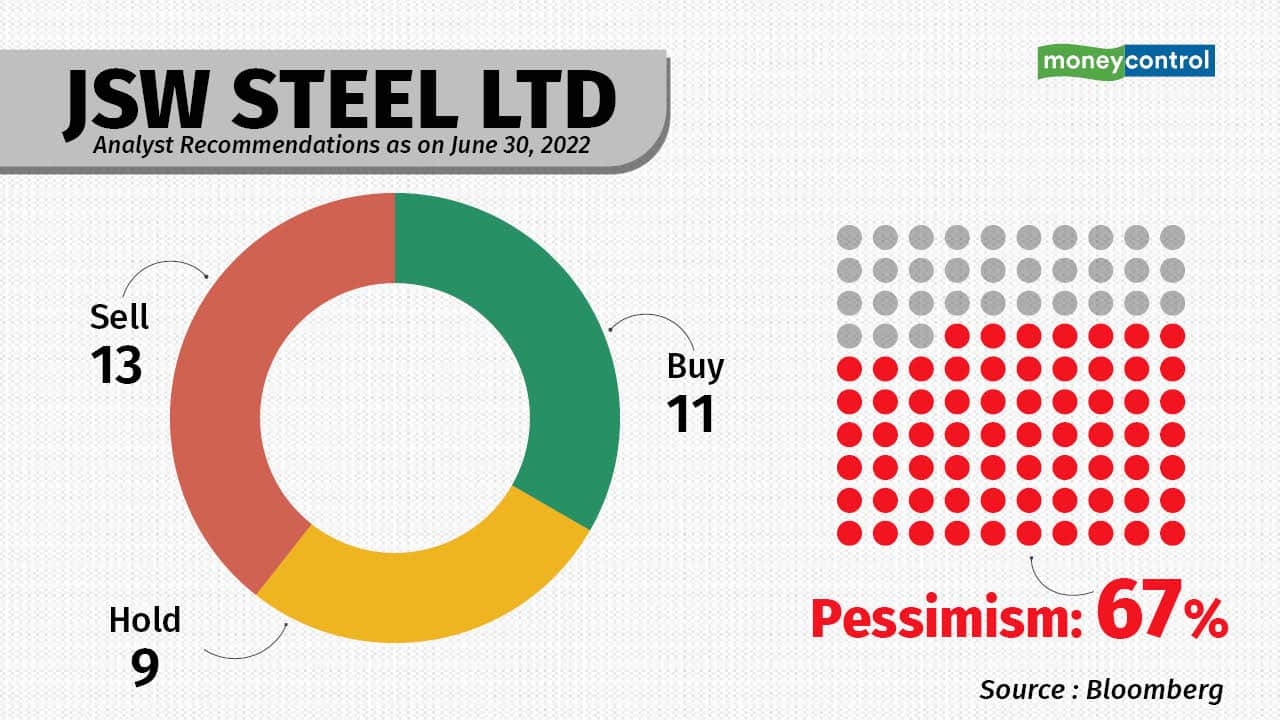

Pessimism grips metal, IT stocks most after recent spate of downgrades by analysts

Moneycontrol Analysts’ Call Tracker June 2022 reveals maximum sell calls in richly valued stocks

BUSINESS

Famous companies that were bought for less but are now raking in billions

Here are 10 smart bets from companies that were futuristic and are giving excellent returns to their owners