F&O Corner: Employ sell on rise strategy in Bank Nifty, 44,000 biggest hurdle

Nifty has formed lower top lower bottom on the daily chart, which is a bearish sign for the short term.

1/9

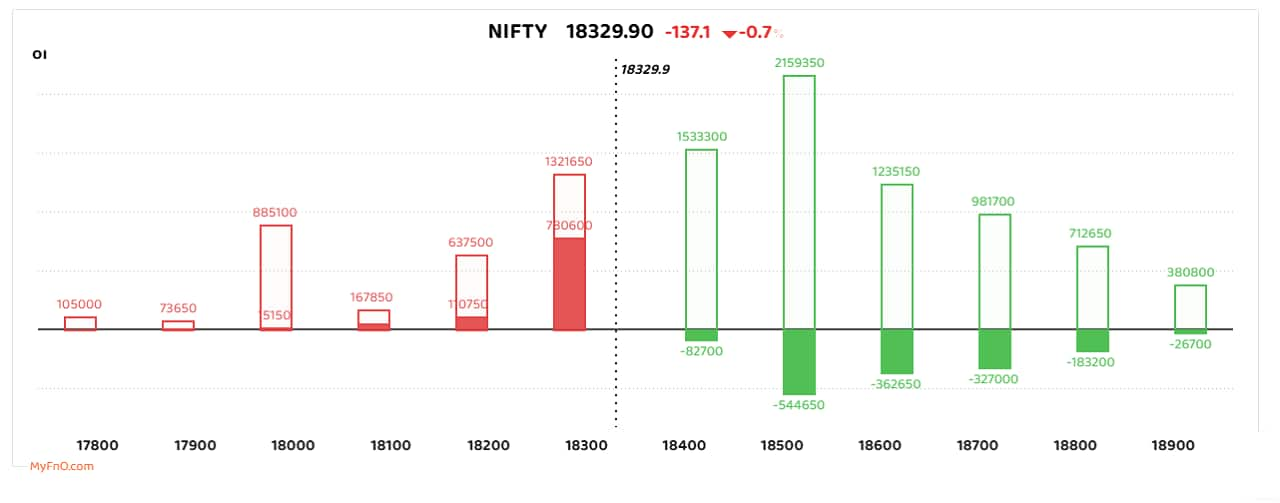

Another day but a similar story as benchmark indices plunged in the second half of the session on December 16. However, the fall was not as sharp as the day prior which means premiums did not fluctuate that much. NSE Nifty index fell 145.90 points or 0.79 percent to 18,269, a one-month-low level as Russia intensified strikes in Ukraine. Nifty futures premium, though, expanded slightly and the the derivative closed the day at 18,329.90. “Nifty has formed lower top lower bottom on the daily chart, which is a bearish sign for the short term. Index on the daily chart has closed below its 9 & 21 – day exponential moving average and RSI on the other hand has drifted below 50 levels with bearish crossover,” said Apurva Sheth, Head of Market Perspectives, Samco Securities. (Blue bars represent volume and golden bars open interest)

2/9

On the option front, in the money (ITM) strikes saw greater activity in the near month contract. 18,500 level has the largest open interest, as it is becoming a big hurdle for the index while 18,000 has the largest support. “India VIX, witnessed a bounce of more than 20 percent in a week indicating some uncertainty creeping at higher levels. On the technical ground, the support for the Index is placed near 18,100 and any move below the same will extend the fall till 17900 levels. Similarly on the higher side 18,500 will be the immediate resistance and followed by 18,650 levels,” said Seth. (Image shows positioning in ITM strikes with today's change in solid bars - red for calls and green for puts)

3/9

Bank Nifty index also mirrored the trend in Nifty. Bank Nifty registered cuts for another day and closed at 43,219.50. Bank Nifty futures’ ended the day at 43,309 - slight premium to the underlying. On the options front, activity was equally distributed among out of the money (OTM) and ITM strikes. The 43,500 is emerging as the biggest resistance level for the index while 43,000 remains the support. “The index remains in a sell-on-rise mode with resistance visible at the 43,600-43,800 zone,” said Kunal Shah, Senior Technical Analyst at LKP Securities. “To resume its uptrend, it needs to surpass the level of 44,000 where the highest open interest is built up on the call side. The index immediate support on the downside is at the 43,000-42,800 zone and if breached will lead to further selling pressure.” (Red bars represent call OI and green put OI)

4/9

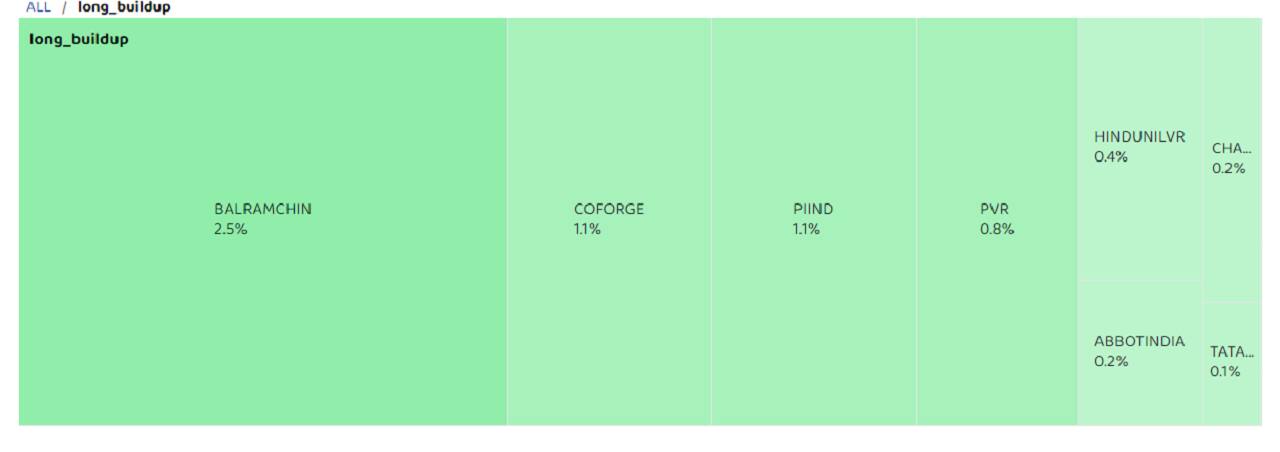

As per the available data, Balrampur Chini Mills was among the most active stocks on the radar of traders with a long build-up happening in the scrip. A long build-up is a bullish sign that happens when open interest and volume increase with the rise in share price. (Red bars represent call OI and green put OI. Solid bars reflect today’s change)

5/9

Coforge, PI Industries, PVR, HUL, Abbott India and Chambal Fertilisers were others that saw long build-up coupled with high open interest. (Percentage is the day's change in futures prices)

6/9

Heavy short building was seen in Polycab India. Futures contracts also saw a big drop in prices. The short build-up is a bearish sign that takes place when the price of a stock falls, along with high open interest and volume. (Red bars represent call OI and green put OI. Solid bars reflect today’s change)

7/9

Among others, short build-up was seen in India Cements, Glenmark Pharma, Oberoi Realty, Bharat Electronics, Concor, SRF, Navin Fluorine and Zee Entertainment. (Percentage is the day's change in futures prices)

8/9

Colgate Palmolive and LTI Mindtree were only two names that saw short covering. Short covering happens when open interest falls, but the stock price rises. This is a moderately bullish sign, and also indicates that the stock may have hit a bottom. (Red bars represent call OI and green put OI. Solid bars reflect today’s change)

9/9

Long unwinding, a scenario where open interest and stock prices fall in tandem, was seen in PNB, City Union Bank, Bharat Heavy Electronics, GNFC, REC, Indigo and IRCTC among others. It signals that the stock may have hit a top and is a sign of a weakening rally. (Percentage is day's change in futures prices) Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!