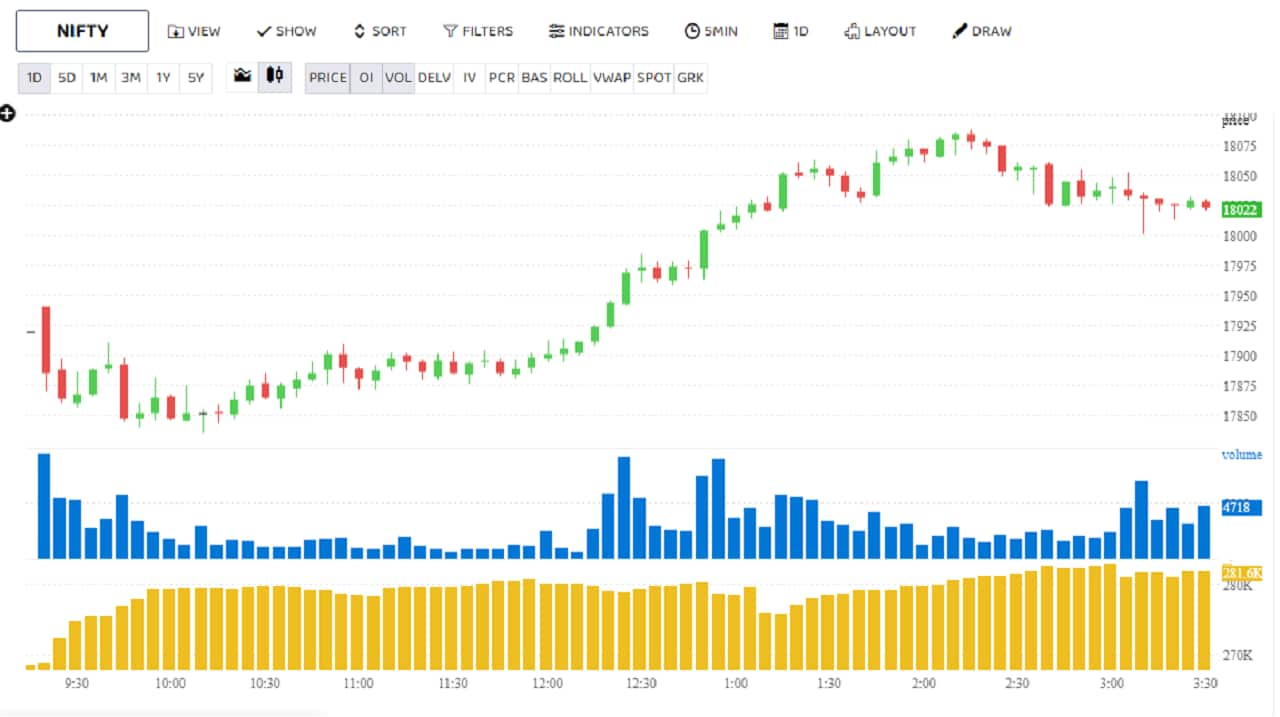

F&O Manual: More recovery in offing, Nifty can rise to 18,100 next week

On the options front, for the January 19 contract, 17,900 and 17,800 saw an accumulation of puts as they emerged as new support levels; 18,100 is the resistance

1/6

A smart recovery in the market was seen on January 13, ending the week with gains. The Nifty closed up 98.40 points, or 0.55 percent, at 17,956.60, bouncing from the support of 17,774 once again. For the next few sessions, the 100-day simple moving average (SMA), or 17,900, would act as sacrosanct support, said analysts. A pullback formation above it can drive the index to 20-day SMA or 18,075. (The blue bars show volume and the golden bars open interest (OI).)

2/6

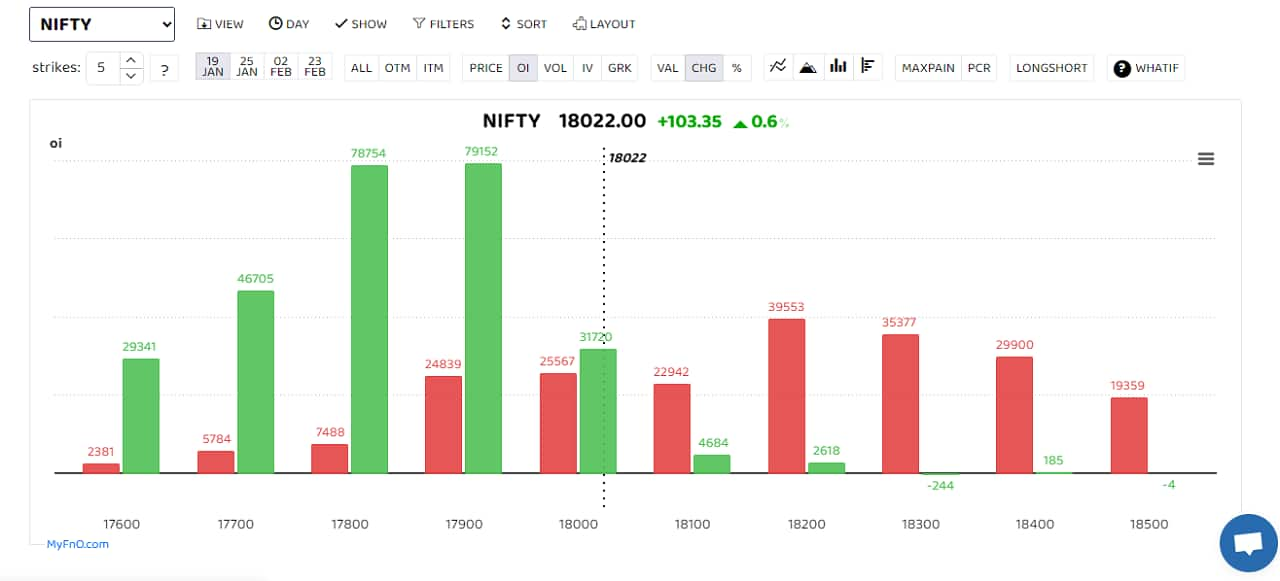

On the options front, for the January 19 contract, 17,900 and 17,800 saw an accumulation of puts as they emerged as new support levels. 18,100 is the resistance and upper end of the recent rangebound trade. “Some more recovery should come and we can see 18,100 next week. We have also seen long buildup in many largecap stocks,” said Rajesh Palviya, derivatives analyst at Axis Securities. (The bars reflect the change in OI during the day. The red bars show call option OI and the green put option OI.)

3/6

Bank Nifty also closed with a gain of about 0.7 percent at 42,371.25. Almost all strikes saw activity, with the highest put activity at 42,000 and call activity at 42,500. “The Bank Nifty bulls managed to hold the support level of 41,700 on the downside and the index moved higher throughout the day. However, to reclaim their full control, the index will have to surpass the level of 43,000 on a continuing basis. The undertone remains bullish and traders should continue to buy on dips as long as the index remains above 41,700," said Kunal Shah, Senior Technical Analyst at LKP Securities. (The bars reflect the change in OI during the day. The red bars show call option OI and the green put option OI.)

4/6

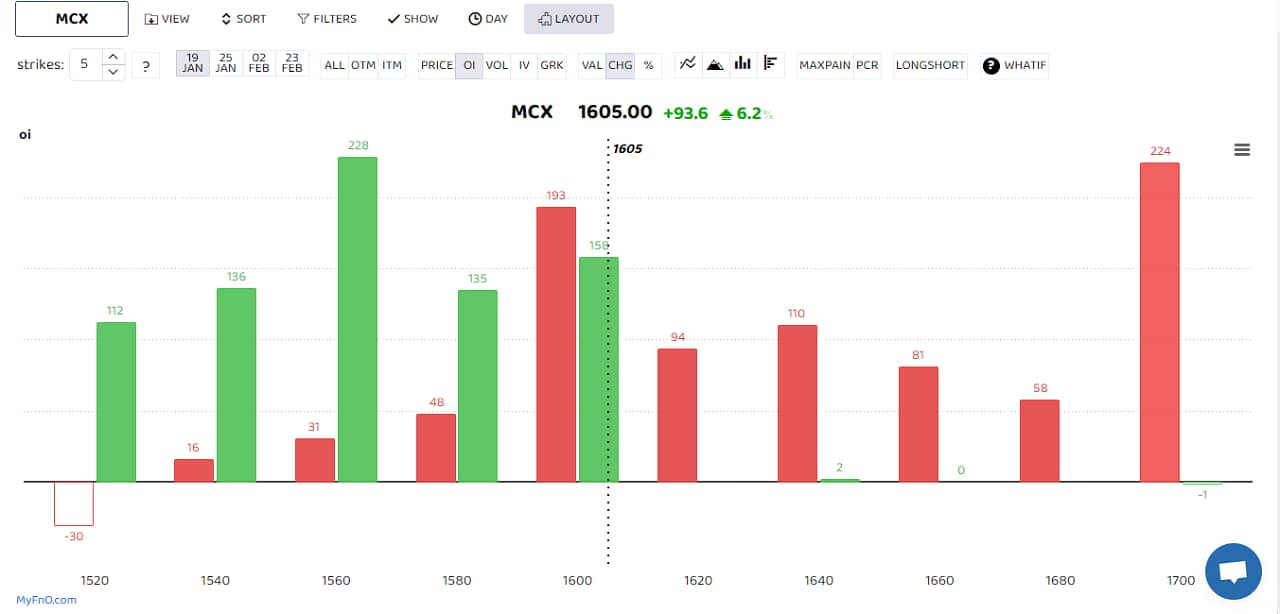

MCX saw a massive long buildup. A long build-up is a bullish sign that happens when open interest and volume increase with the rise in share price. Rain Industries, Chola Finance, Federal Bank and Power Finance were others that saw log buildup. (The bars reflect the change in OI during the day. The red bars show call option OI and the green put option OI.)

5/6

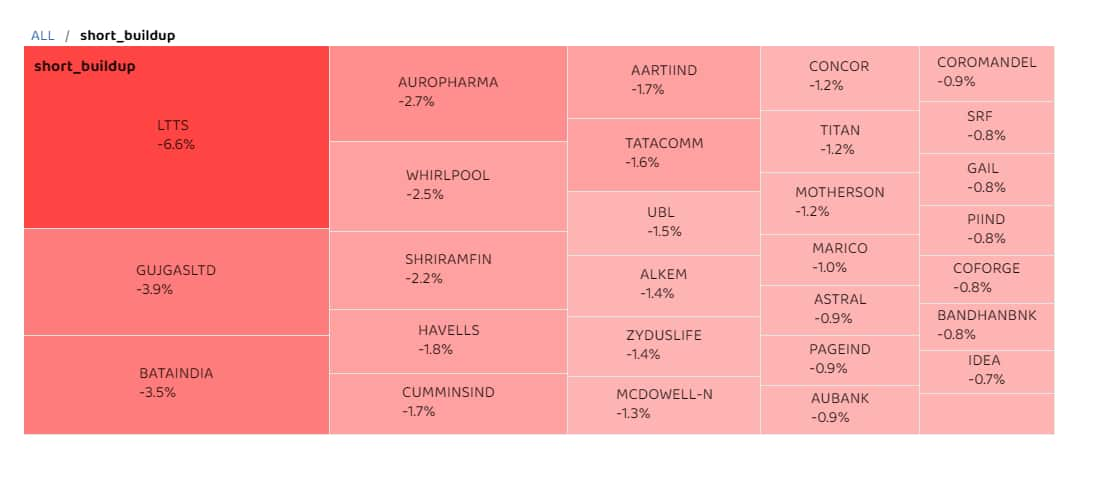

As the Q3 earnings season gathers pace, L&T Tech Services and other IT names saw massive short buildup as open interest in the counter surged 18 percent. The short buildup is a bearish sign that takes place when the price of a stock falls, along with high open interest and volume. (The bars reflect the change in OI during the day. The red bars show call option OI and green the put option OI.)

6/6

Gujarat Gas, Bata India, Aurobindo Pharma and Whirlpool of India were others that saw a short buildup. (Numbers reflect the change in futures prices.)

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!