F&O Manual: Range-bound trade to continue; buy 19,000 calls if Nifty slips again

Analysts say the index is trading in a range. A bearish engulfing pattern on the daily chart points to a further correction

1/6

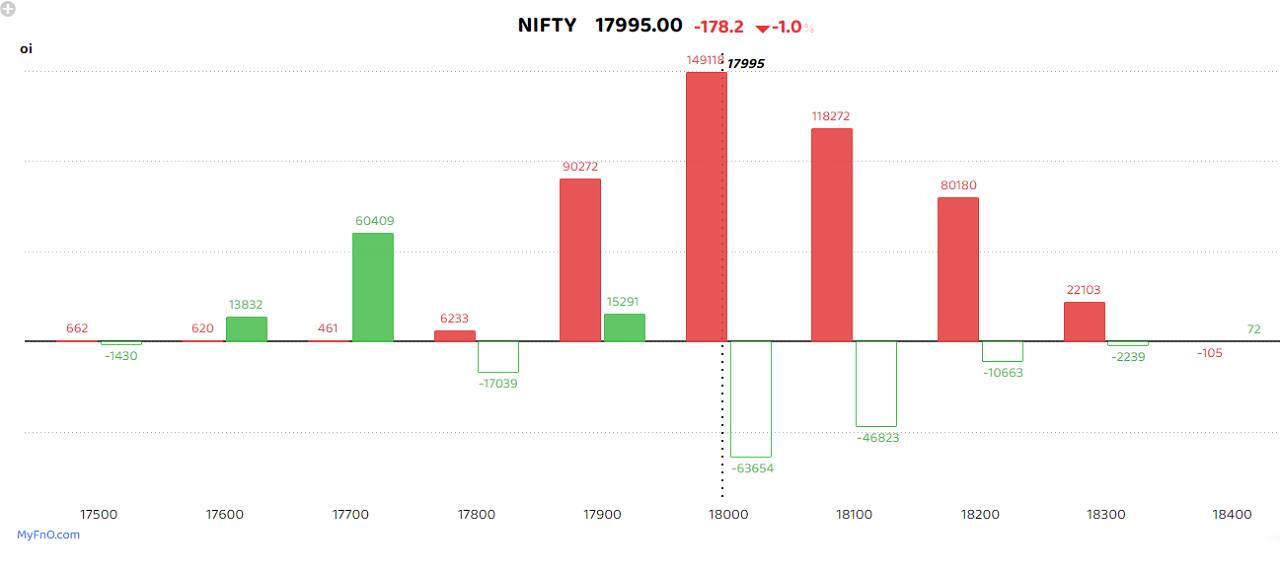

Bulls were on the back foot again on January 10 as the participants grew cautious ahead of the US Fed chairman’s speech. The Nifty closed 187.05 points or 1.03 percent down at 17,914.15. Nifty futures also fell 1 percent to end at 17,995. Analysts said the index is trading in a range. A bearish engulfing pattern on the daily chart points to a further correction, they added. (Blue bars show volume and golden bars open interest (OI).)

2/6

On the options front, 18,000 saw heavy call writing and emerged as a key hurdle for the index. Put unwinding was seen at 18,000 and 18,100 levels. “The Nifty is trading in a range of 17,800-18,200 and there is no clear trend as of now. Thus, traders should take intraday positions. One can buy 17,900 calls if the Nifty comes to 17,850,” said Nandish Shah, derivatives analyst at HDFC Securities. (Bars reflect changes in OI during the day. Red bars show call option OI and green put option OI.)

3/6

The Bank Nifty also closed 1.5 percent down at 41,960. Call writing was seen across strikes, while put unwinding was seen in in-the-money strikes. “The index faces stiff resistance on the upside at the 43,000 level, where the highest open interest is built up on the call side. The downside is supported at 42,000, and if it is breached, further selling pressure will be directed toward the 41,500-41,400 zone, which will be the last line of defence for bulls," said Kunal Shah, Senior Technical Analyst, LKP Securities. (Bars reflect changes in OI during the day. Red bars show call option OI and green put option OI.)

4/6

Tata Motors, which reported good sales numbers for Jaguar Land Rover, saw a massive long buildup. A long build-up is a bullish sign that happens when open interest and volume increase with the rise in share price. Max Financial Services, Hindustan Copper and Zydus Life were the others to see a long buildup. (Bars reflect changes in OI during the day. Red bars show call option OI and green put option OI.)

5/6

Adani Enterprises, one of the highest beta stocks, saw a massive short buildup as open interest in the counter surged 17 percent. A short buildup is a bearish sign that takes place when the price of a stock falls, along with high open interest and volume. (Bars reflect changes in OI during the day. Red bars show call option OI and green put option OI.)

6/6

PNB, Intellect Design, Concor, City Union Bank and Canara Bank were scrips to see a short buildup. (Numbers reflect changes in futures prices.)

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!