BUSINESS

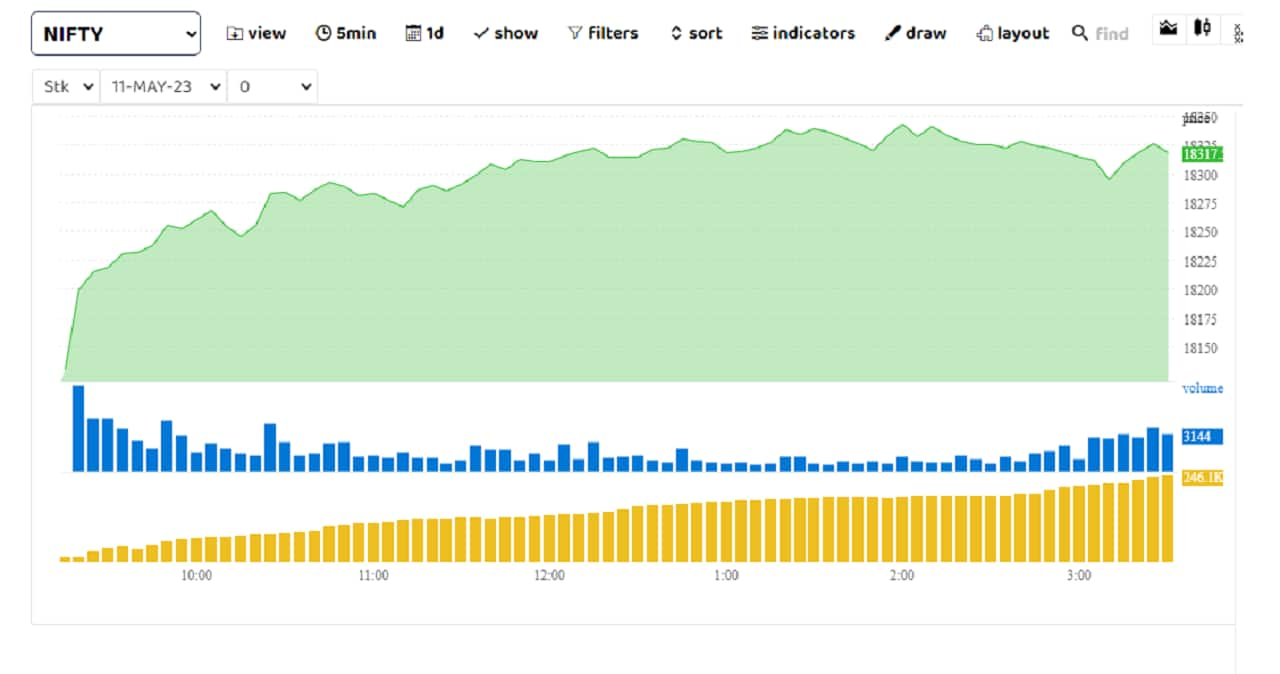

F&O Manual: Selling in last few days is a buying opportunity at support, say analysts

The June monthly expiry which had a high concentration of sold 18500 PE, got converted to short straddles of the 18500 strike by market participants.

BUSINESS

F&O Manual: Initiate short straddle at 18,600 to trade expiry day with low risk

Hindustan Aeronautics was among those that saw short buildup with open interest jumping 90 percent.

BUSINESS

F&O Manual: Nifty may see some sluggishness before hitting all-time highs

For this week's series, the Nifty still has high OI concentration of call writers at 18,600, 18,700 and 18,800 levels

BUSINESS

F&O Manual: Initiate a short straddle at the 18,250 level to play weekly expiry

After a flat start, the Nifty gradually drifted lower. However, a rebound in the last hour of trading helped the index recoup some losses.

BUSINESS

F&O Manual: Amid bulls' domination, analysts see resistance at 18,500

OFSS saw a long buildup with open interest rising 30 percent.

BUSINESS

F&O Manual: Nifty bulls cheer as outlook turns rosy; analysts suggest buying calls

The Bank Nifty continued to move higher during the day ahead of key earnings of constituent stocks.

BUSINESS

F&O Manual: As Nifty finds its mojo, 17,500 strong support for the index

The corrective move of the Nifty Index has taken support at the 200-Day SMA and has swiftly bounced from there.

BUSINESS

F&O Manual: 20-DMA at 17,500 crucial for Nifty as sideways show continues

The Bank Nifty index continued to trade in a narrow range one day before the weekly expiry.

BUSINESS

F&O Manual: ‘Initiate cross calendar spreads on the call side on Bank Nifty’

Nifty has reacted perfectly from its congestion zone between 17650 and 17900.

BUSINESS

F&O Manual: Setup positive but expect some profit booking, say analysts

The Bank Nifty saw call unwinding at lower levels while puts were written at 41500 and 41400 as they are emerging as local support levels.

BUSINESS

F&O Manual: Divided market opinion over Nifty signals tough days for traders

Some traders believe the rally may take a pause and that presents a short term shorting opportunity now. While others are relatively more bullish.

BUSINESS

F&O Manual: Market momentum likely to bring more gains, say analysts

The Bank nifty bulls came back strong and the index managed to hold the support of 41,000 on the downside.

BUSINESS

F&O Manual: Buy calls on dips as Nifty regains its mojo, say analysts

The Bank Nifty index witnessed some selling pressure from higher levels but the broader trend remains bullish and one should keep a buy-on-dip approach.

BUSINESS

F&O Manual: Buy call or deploy bull call spread on Nifty, say analysts

The Bank Nifty remained positive throughout the day following a consolidation breakout on the daily chart. During the day, it moved closer to 14-DMA.

BUSINESS

F&O Manual: Some recovery likely, buy 17,500 call tomorrow, say analysts

On the option front, 17,400 levels saw building up of call positions as the level became the local resistance for the index.

BUSINESS

F&O Manual: Traders can initiate cross-calendar put spreads on Bank Nifty

Nifty saw a significant unwinding of the 18,000 short straddles for the February expiry but there was no formation of fresh short straddles, indicating traders are waiting for tomorrow's open to create their straddle positions

BUSINESS

F&O Manual: Initiate ITM short straddle on call side if Nifty sees gap-up opening

Bank Nifty saw a huge shorting of the 41,500 PE and an unwinding of the 41,500 CE which also made Bank Nifty move up in the later part of the day.

BUSINESS

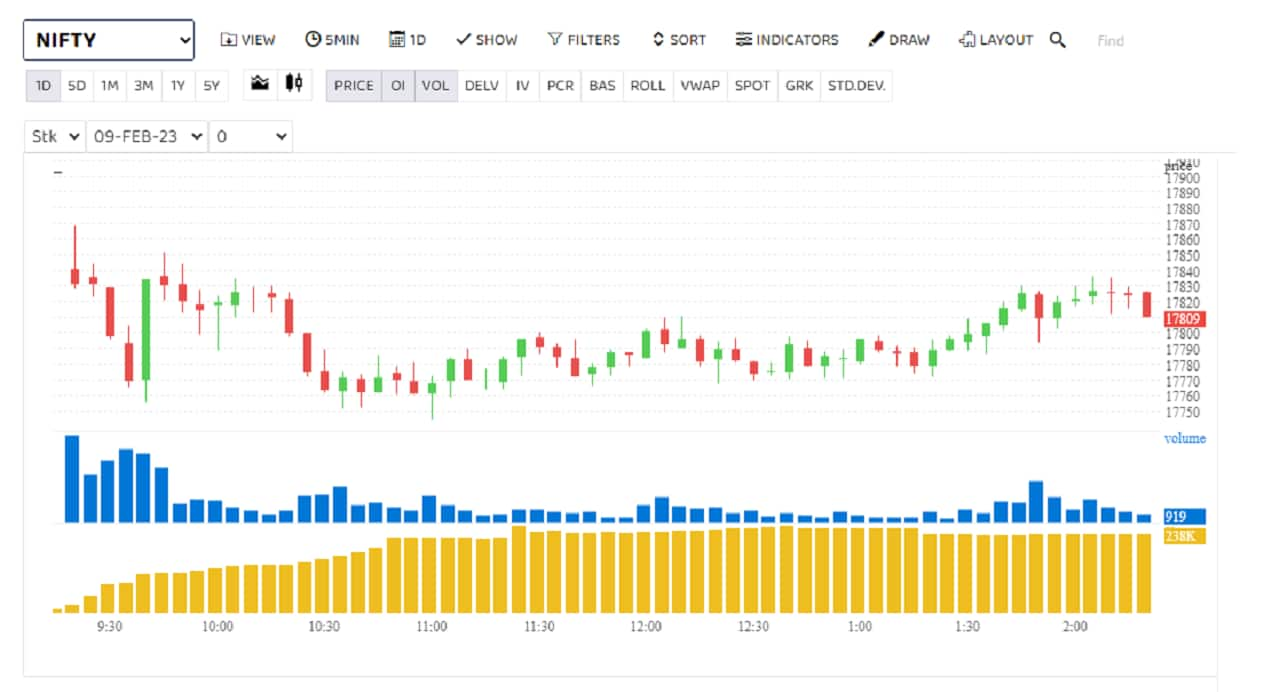

F&O Manual: Weakness continues in Nifty; buying opportunity in Auro Pharma

On the option front, 17,800 has seen most call writing as the strike emerged as the resistance. The same strike saw put unwinding as they shifted to lower strikes. Call writing was also seen at 17,900 and 18,000.

BUSINESS

F&O Manual: Market remains flat; collar strategy in Bank Nifty can work, say analysts

For Nifty, 17,900 can emerge as the new battle zone for next week’s expiry.

BUSINESS

F&O Manual: Deploy double debit spreads on Bank Nifty as volatility cools off

On Nifty, 17800 remains the most immediate hurdle for the index. Call writers were also active at 17,900 and 18,000 strikes. Some put writers were present at 17,700 strike as that still remains the biggest support to the index.

BUSINESS

F&O Manual: Volatility to continue, deploy cross calendar spread on Nifty, say analysts

On the option front, 17800 remains the most immediate hurdle for the index. Call writers were also active at 17,900 and 18,000 strikes.

BUSINESS

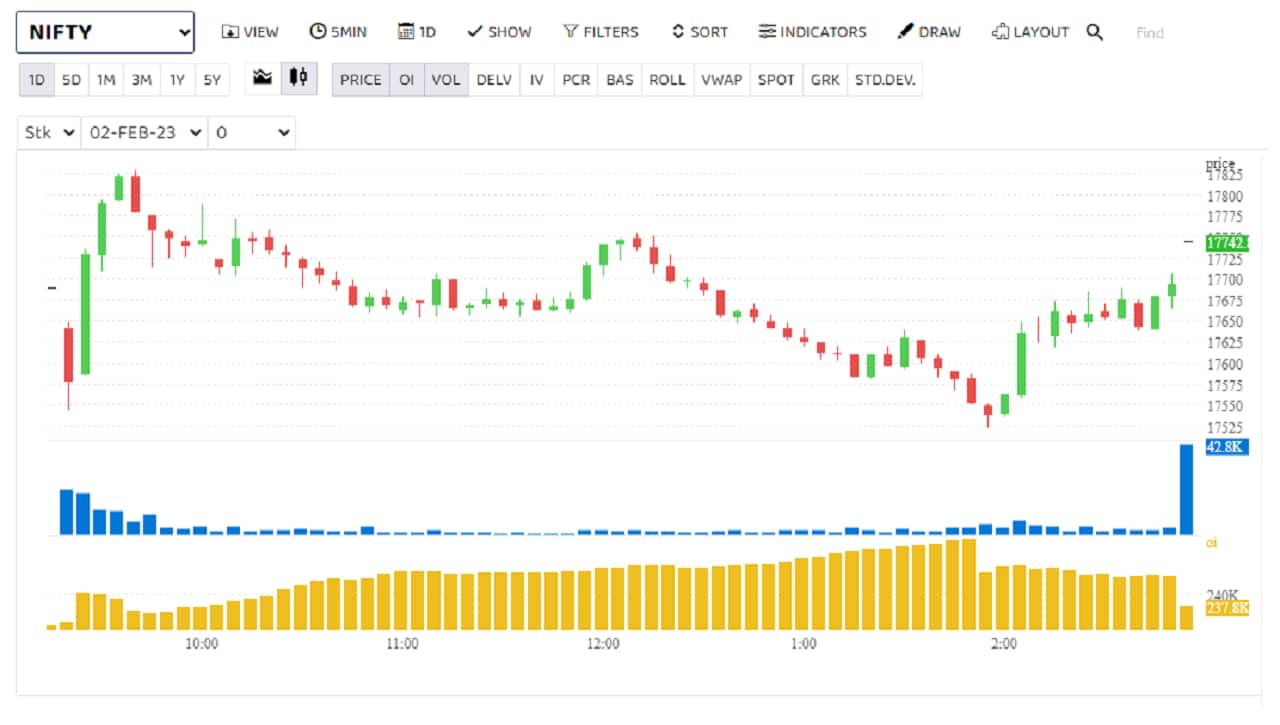

F&O Manual: Volatility very high, experts to take a call after market opens tomorrow

Volatility will be high as February 2 is the weekly expiry and the market will also react to the US Fed outcome

BUSINESS

F&O Manual: Expect high volatility on budget day; buy on dips, say analysts

On the options front, call writing shifted to 17,900 from 17,800 level, a signal that traders are expecting some bounce-back from current levels

BUSINESS

F&O Manual: Volatility remains high, analysts suggest keeping positions hedged

On the option front, 17,800 remains the biggest hurdle for the index. During the day, 17,500 was in the battle zone as the strike saw both put and call writing.