F&O Manual: ‘Initiate cross calendar spreads on the call side on Bank Nifty’

Nifty has reacted perfectly from its congestion zone between 17650 and 17900.

1/5

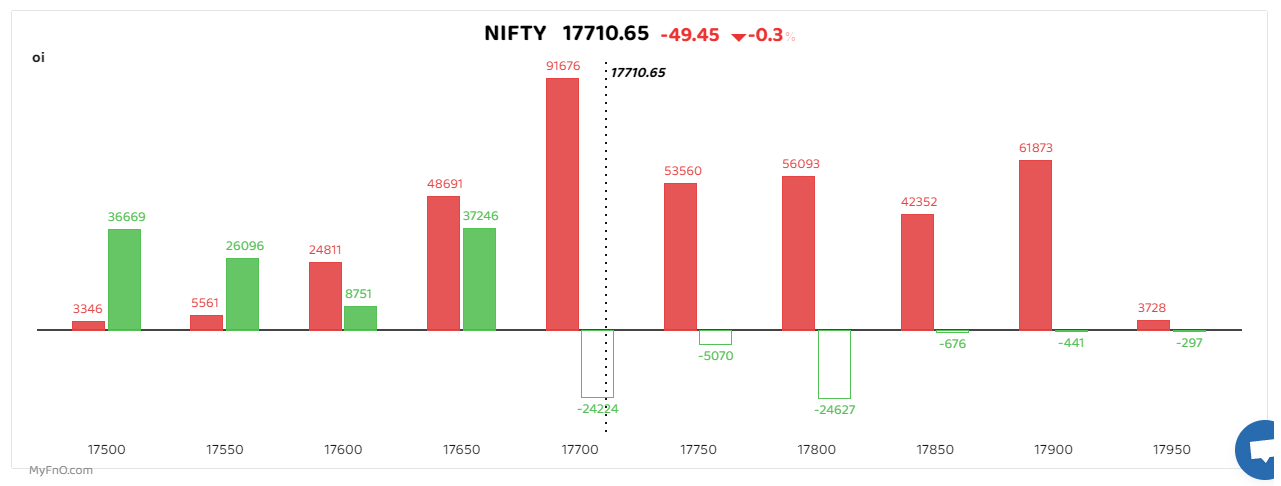

The Nifty 50 index failed to find its mojo and fell for another day on April 18 thanks to profit booking. The index dropped 46.70 points or 0.26 percent to 17,660.15 led by selective profit-taking in banking, power & FMCG stocks. However, buying in realty and metal stocks limited the downside. (Blue bars show volume and golden bars open interest (OI).)

2/5

Nifty has reacted perfectly from its congestion zone between 17,650 and 17,900. “It has the highest open interest at the 18,000 CE level and 17,000 PE level, which indicates that even though it is a buy-on-dips market, there is more room on the downside with the current data and hence traders should initiate only hedged positions if done on the long side in Nifty,” said Rahul Ghose, Founder & CEO – Hedged. (Bars reflect the change in OI during the day. Red bars show call option OI and green bars show put option OI.)

3/5

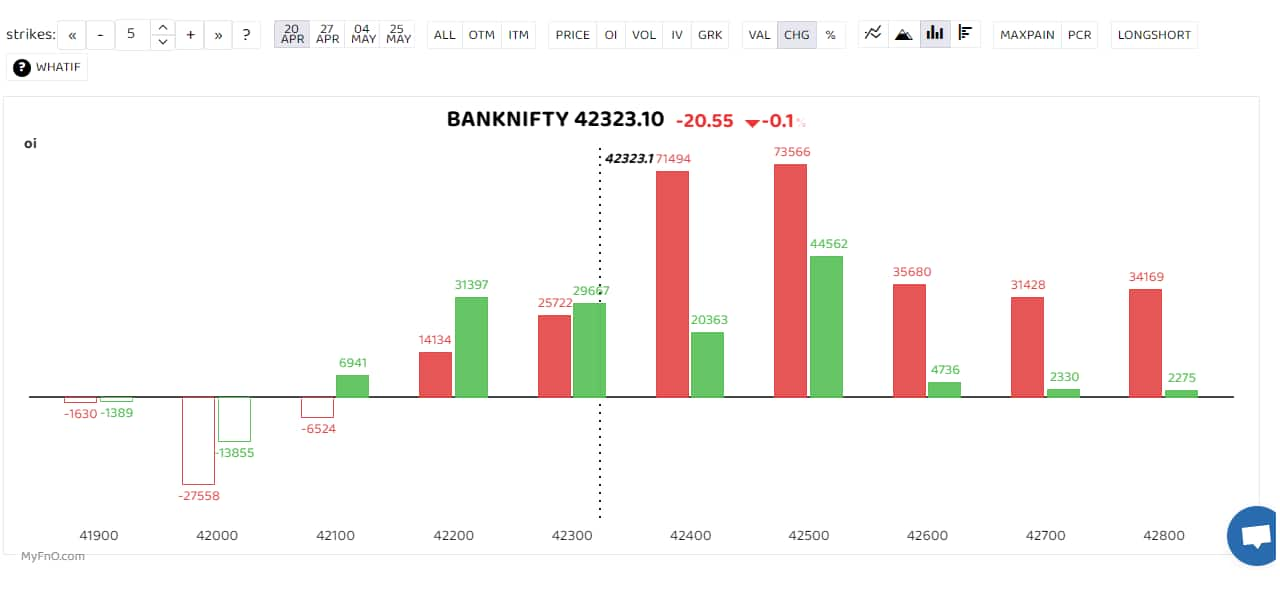

The Bank Nifty saw call and put unwinding at lower levels while calls were written at 42,400 and 42,500 as they are emerging as local resistance levels. “Out of the two indices, Bank Nifty is the stronger Index and a dip below 42000 can make traders initiate cross calendar spreads on the call side in this index. Traders can use both the monthly and weekly expiries of 42,000 and 43,000 to do this. Bank Nifty also has huge put writing at the 42,000, 41,500 and 41,000 strikes in the monthly expiries, indicating that any fall can be a buying opportunity in this Index,” said Ghose. (Bars reflect the change in OI during the day. Red bars show call option OI and green bars show put option OI.)

4/5

Navin Fluorine saw a long buildup with open interest rising 17 percent. A long build-up is a bullish sign that happens when open interest and volume increase with the rise in share price. BHEL, PI Industries and Biocon were others that saw heavy long buildup. (Bars reflect the change in OI during the day. Red bars show call option OI and green put option OI.)

5/5

Tata Chemicals was among those that saw a short buildup with open interest jumping 76 percent. The short build-up is a bearish sign that takes place when the price of a stock falls, along with high open interest and volume. (Bars reflect the change in OI during the day. Red bars show call option OI and green put option OI.)

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!