F&O Manual: Some recovery likely, buy 17,500 call tomorrow, say analysts

On the option front, 17,400 levels saw building up of call positions as the level became the local resistance for the index.

1/6

The weakness continued in the market for the seventh consecutive session on February 27 and Nifty closed the day lower by 73 points with an upside recovery note. Analysts believe some bounce back may be seen now. (Blue bars show volume and golden bars open interest (OI).)

2/6

On the option front, 17,400 levels saw building up of call positions as the level became the local resistance for the index. However, put writing was also seen at that level, signalling some fightback from bulls. “Nifty recovered smartly from the lows. I see some recovery tomorrow. Traders should buy 17,500 for March 9 expiry,” said Nandish Shah, Senior Derivative and Technical Analyst, Assistant Vice President, Retail Research, HDFC Securities. (Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.)

3/6

The Bank Nifty bulls came back strong for the lower levels and managed to hold the support of 39,700. “The index immediate resistance is at the 40,500 level and if it sustains above it can witness a pullback rally till 41,000 where fresh call writing is visible. The index remains in a buy-on-dip mode as long as the mentioned support is held,” said Kunal Shah, Senior Technical Analyst at LKP Securities. (Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.)

4/6

Bank of Baroda saw long buildup. A long build-up is a bullish sign that happens when open interest and volume increase with the rise in share price. ICICI Bank, Canara Bank and Power Grid were others that saw heavy long buildup. (Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.)

5/6

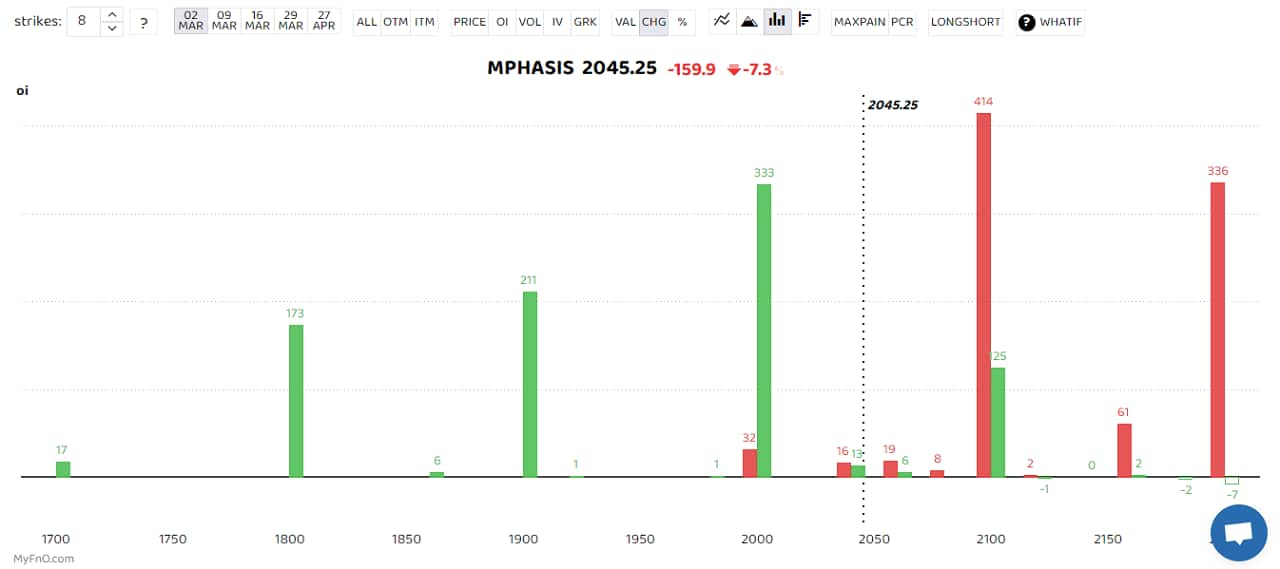

Mpahsis saw massive trader interest as OI rose to 19 percent to the highest of the month. The short build-up is a bearish sign that takes place when the price of a stock falls, along with high open interest and volume. (Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.)

6/6

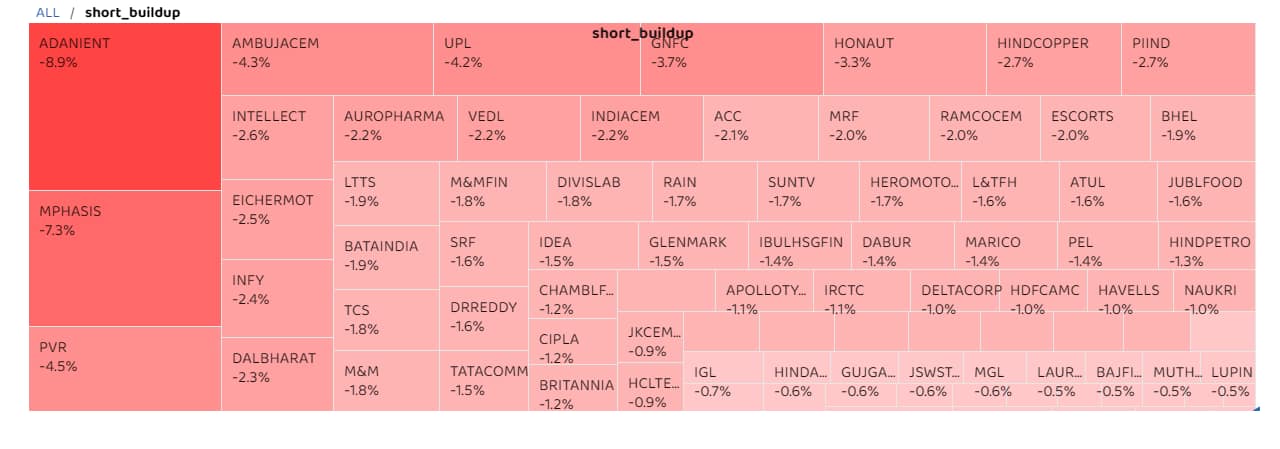

Adani Enterprises, PVR, Ambuja Cement, UPL, GNFC and Honeywell Automation were others that saw short buildup. (Percentage reflect change in futures price during the day.)

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!