BUSINESS

Dixon Technologies: Mobile and EMS business shines bright in Q2

The company is well placed to capture opportunities in the electronic outsourcing business

BUSINESS

Asian Paints – Compounding machine at rich valuation

Heated competition, amid sizeable capacity, from large players will be a key factor to watch

BUSINESS

Voltas Q2: Concerns on AC market share linger

Provisions related to the delay in overseas project collections for electro-mechanical projects business took a knock on margins.

BUSINESS

Havells India Q2: Stuck in the slow lane

As demand remains weak, revenue growth will take time to pick up

BUSINESS

UltraTech’s Q2 earnings tick all the boxes

Macro uncertainties, high premium, and market competition make risk-reward prospects unfavourable

BUSINESS

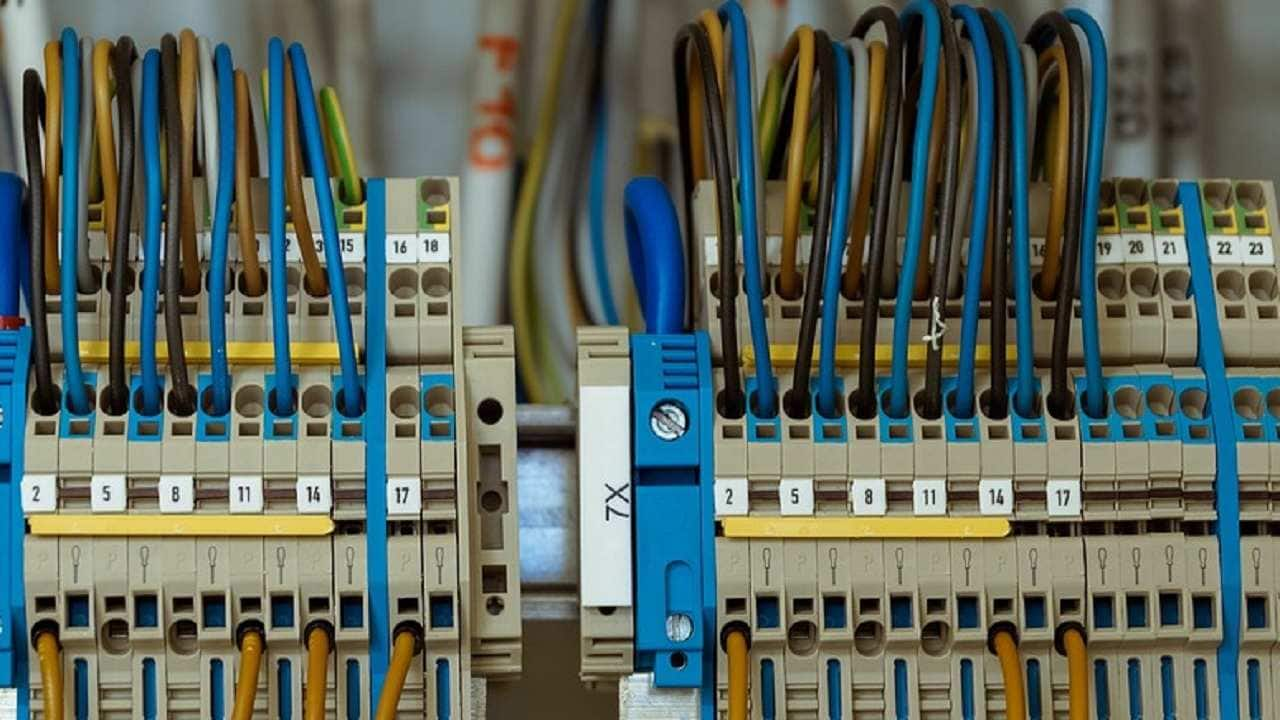

Polycab India Q2: Incredible execution justifies the phenomenal stock rally

The stock price has doubled in one year. Going by the recent quarterly performance, Polycab appears well-positioned to achieve its FY26 revenue target of Rs 20,000 crore, much ahead of the stipulated timeline

BUSINESS

Dalmia Bharat Q2: Profitability on the mend

While high raw material prices impacted gross margins, stable cement prices and favourable power and fuel costs should enhance operating profits by Rs 150-200 per tonne, going ahead

BUSINESS

PG Electroplast: Making impressive progress

Planned capacity expansion positions the business well for a strong growth in the coming years. Diversification into newer product lines also on the anvil.

BUSINESS

GM Breweries: A value play worth considering

Resilient demand and a strong balance sheet make it a solid defensive bet over the medium to long term. Cheerful consumer sentiments around the upcoming festival season and winter could drive an uptick in volumes in H2FY24.

BUSINESS

Blue Star: Latest fund mop-up set to serve as a growth catalyst

The stock has delivered decent returns in the last one year and seems to factor in many of the business positives

BUSINESS

Discovery Series | This company is well-placed to ride the digital transformation wave

There are several key catalysts that are going to support eMudhra’s scalability, going forward

BUSINESS

Sagar Cements – Margin expansion is taking hold

The debt on the balance sheet is of concern in an uncertain macro scenario

BUSINESS

Is the gaming industry going downhill?

Since extant local tax rates are lower than the global average, there is the risk of higher liability in the future

BUSINESS

Borosil Renewables: What are the pain points?

Though BRL is expanding capacities quite rapidly, competition in the sector remains a constant threat. Also, challenges on realisations and margins are expected to persist for at least two quarters.

BUSINESS

RR Kabel IPO: Can it electrify an investor’s portfolio?

Though the business enjoys sound fundamentals, the risk-reward appears unfavourable

BUSINESS

Krsnaa Diagnostics: Approaching an inflection point

The company has a solid and differentiated business model, with promising growth potential

BUSINESS

Sirca Paints Q1 FY24: Numbers paint the town red, growth curve bending up

Sirca’s growth trajectory, stable financial track record, and competitive market positioning are positives. The company expects the current growth rates to continue and it is targeting Rs 400 crore top line in the next couple of years.

BUSINESS

Visaka Industries: Margin concerns linger

Demand slowdown and input-cost inflation are eating into profit margins

BUSINESS

Blue Star, Voltas hold up in Q1 amid weather disruptions

Growth is expected to continue but margins could be under pressure because of competition

BUSINESS

Radico Khaitan: Market share gains underpin Q1 earnings

The management is executing well towards growing profitably, while investing in its business to fortify leadership position.

BUSINESS

V-Guard Q1: Margins on the mend

VIL’s growth trajectory looks promising on the back of its financial track record, business strategy, and competitive market positioning

BUSINESS

Concor: Q1 performance marred by multiple disruptions

A slowdown in global demand may take its toll on Concor’s business volumes in the near term

BUSINESS

Crompton Greaves Consumer Electricals: Transforming itself for the future

Operational efficiencies and wider market reach should translate into healthy earnings growth going forward

BUSINESS

Pidilite Q1: Solid execution gets traction

Though demand may grow in the coming quarters, the company faces potential challenges