BUSINESS

Should you 'neither a borrower nor a lender be' when it comes to friends & family?

Lending money to friends and relatives can be tricky. Learn to say no, lend for right reasons, set clear terms, and document the loan terms to avoid financial stress.

BUSINESS

Your checklist for identifying a genuine SEBI-registered Investment Adviser

Merely locating the RIA name on the SEBI website is not enough. Cross check and verify the phone/email with the details on the adviser website

BUSINESS

Profit From The Past: Lessons from history for investing in cyclical stocks

Investors who have direct exposure to capital goods companies, or through sectoral / thematic mutual funds, should be aware of the cyclical nature of the sector

BUSINESS

Why debt funds score over equity, hybrid schemes for systematic withdrawals

Hybrid funds are suitable for SWPs only if you can stomach the periodic volatility in the markets. Else, a debt mutual fund would be the best option to withdraw from for peace of mind.

BUSINESS

Real estate investing: Why you must do due diligence before making the big leap

Don’t look at the price in isolation. If you’re buying to rent, look at the rental yield. Most importantly, asset allocation matters most—meet your debt and equity targets first before considering real estate.

BUSINESS

Financial planning: How core-and-satellite approach to equity investing can help retail investors

For most, a mutual fund is the best way to invest in equities. A systematic investment plan mandates discipline and mitigates risk. Another, less-known, approach is the core and satellite strategy.

BUSINESS

How the self-employed can set their personal finances in order

Many small and mid-sized businessmen tend to mix their business and personal cash flows. This can interfere with a prudent management of their personal finances. They must take into account only the net income coming out of their business and invest it regularly to grow their personal wealth.

BUSINESS

In retirement, do you need a longer life insurance cover or investments?

Life insurance is not about leaving behind a legacy for your children. A term insurance is a cover that compensates family members who are financially dependent on you. However, when you cross 60, they’re typically financially independent by then.

BUSINESS

Why the awareness about SEBI Registered Investment Advisers (RIA) is abysmally low?

Despite having around 3.4 crore unique mutual fund account holders and 6 crore unique demat accounts, India has just 1,300 registered investment advisors.

BUSINESS

Old real-estate ripe for redevelopment: Should you invest in them?

A property that has the potential to go under redevelopment is an uncertain bet. Apart from differences between existing tenants on a variety of issues, including the choice of the builder and the size of flats that get allotted to them post the redevelopment, you need to check if you have the patience to hold on.

BUSINESS

Should you invest in infrastructure mutual funds? Know the risks and opportunities

Infrastructure as a sector is cyclical. Revenues of infrastructure companies depend upon economic growth and take a hit when the economy is down. Hence, mutual funds investing in infrastructure companies fall or go up swiftly and their year-on-year returns can vastly vary. It is thus important to take calculated bets.

BUSINESS

Can you afford to take FinFluencers seriously?

From retiring early, how to start an MF SIP to picking tomorrow’s multibaggers shares, FinFluencers appear to have an answer to all your money questions. But finance is not meant to be jazzed up. Simple rules still work

BUSINESS

Should you go passive in the mid- and small-cap fund space just like in large-caps?

The choice between active and passively managed funds primarily boils down to one thing -- whether actively managed funds can beat their benchmarks and give additional risk-adjusted returns to investors.

BUSINESS

Can someone please tell what will be the right equity allocation for me?

Making a financial decision based on reviews, especially those seen on social media, may not always be a good idea. Also, some of the common investing tenets may not fit you. So, what’s the way out? Here are a few dos and don’ts.

BUSINESS

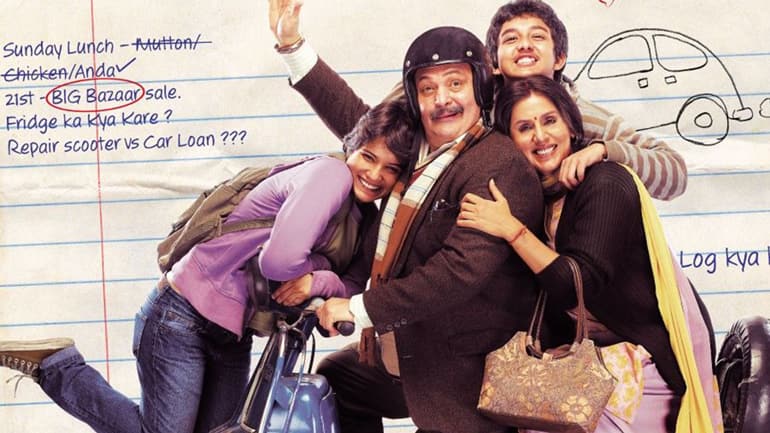

What the Duggals of Do Dooni Chaar taught us about needs and wants

The difference between buying an insurance policy and a car is the difference between a need and a want. Consumers must learn the difference between needs, wants and aspirations and learn to prioritise them.