BUSINESS

Tyre stocks poised for a smooth run; Balkrishna, MRF, CEAT on analysts' radar

In Q2FY21, all the tryre companies registered strong EBITDA margins due to cost-cutting, scale benefits and lower commodity and raw material prices.

BUSINESS

Trade setup for Thursday: Top 15 things to know before Opening Bell

Key support levels for the Nifty are placed at 13469.5, followed by 13409.9. If the index moves up, the key resistance levels to watch out for are 13568.8 and 13608.5.

BUSINESS

Equity mutual funds see exit in November, fifth month in a row; here's why

The redemptions from equity schemes stood at Rs 27,113 crore, while fresh inflows were at Rs 14,195 crore. The redemptions were 33 percent higher than in the previous month.

BUSINESS

This stock held by Rakesh Jhunjhunwala has underperformed in 2020, brokerages now see a 39% upside

Rakesh Jhunjhunwala, his wife Rekha Jhunjhunwala, and group companies increased shareholding in NCC to 13.7 percent.

BUSINESS

Market ended higher for the week but will the trend hold? Here's what analysts have to say

Foreign institutional investors continued to remain net buyers while domestic institutional investors were net sellers in the week gone by.

BUSINESS

After The Bell: Market logs gains for 4th consecutive session; what should investors do on Thursday?

Volatility may remain high due to mixed global cues and earnings season.

BUSINESS

Should you tender shares in Wipro buyback? Here is what analysts have to say

The buyback size is 4.16 percent of the total paid-up equity share capital of the company. The promoter group will also participate in the buyback.

BUSINESS

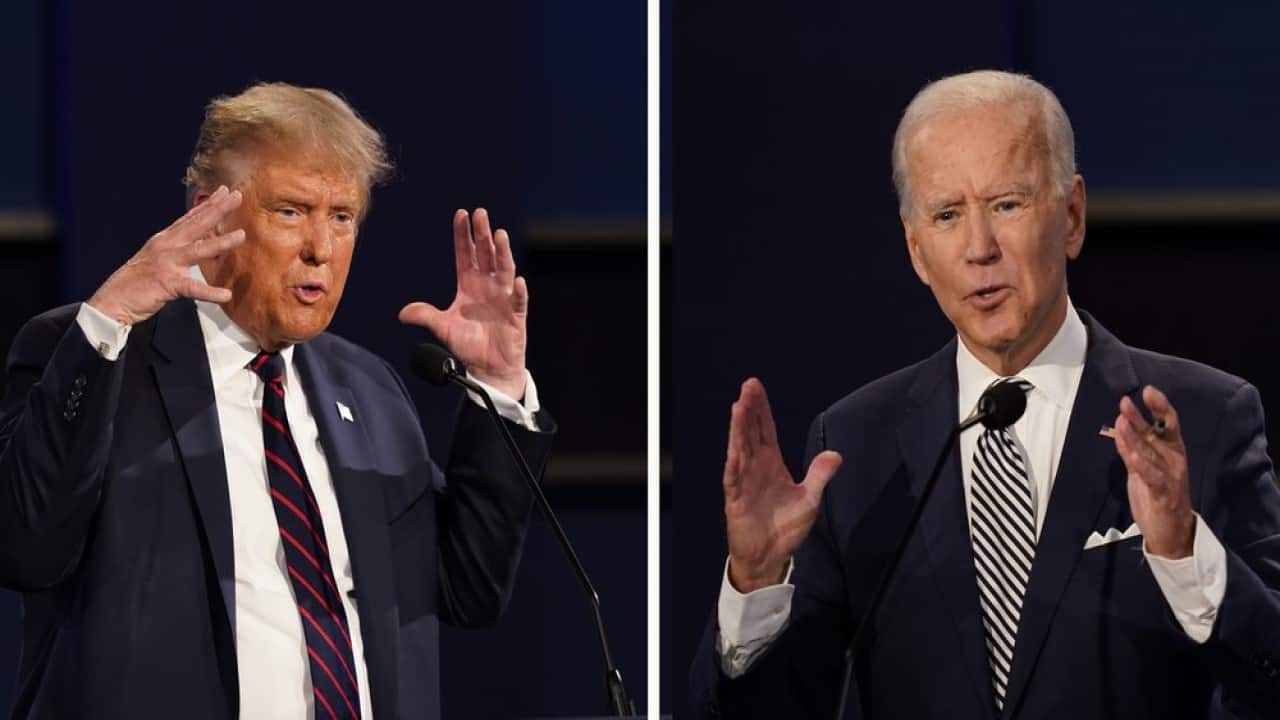

US elections 2020 a significant event for the Indian market, but not the Trump vs Biden debate

The market is likely to witness heightened volatility as we approach the US elections. The US will conclude its 59th quadrennial on November 3, 2020.

BUSINESS

Long-term bets: HDFC and HUL among 10 stocks that analysts prefer

The market is likely to be stock-specific and experience sector rotations. Therefore, investors should adopt a buy-on-dips strategy only in quality names, said Umesh Mehta, Head of Research, Samco Group.

BUSINESS

Weekly dossier: N Jayakumar, Nischal Maheshwari, Taher Badshah and others on market, investment ideas

As the texture of the market still appears to be bullish, analysts see the market will take a leap further in the coming sessions.

BUSINESS

Trade Setup for Friday: Top 14 things to know before Opening Bell

Key support level for the Nifty is placed at 11,552.57, followed by 11,424.83. If the index moves up, the key resistance levels to watch out for are 11,916.77 and 12,153.23.

BUSINESS

MF September data shows significant churn in sector and stock allocation; what should investors do?

Mutual funds were net sellers in equities in September, in continuation of selling done in the previous three months. In October, so far, also they have continued to sell equities.

BUSINESS

Should you be cautious amid flurry of IPOs and post-listing frenzy?

It appears the Indian market is awash with IPOs. With the sharp turnaround in secondary markets after the March lows, the primary market, too, has rebounded after witnessing a dull first half.

BUSINESS

September inflation print surprises; will it cripple RBI's ability to keep rates low?

While the number was expected to be on the higher side, it was not expected to jump to this level, analysts said.

BUSINESS

FM's fiscal package a move in right direction, will boost spending, say experts

To encourage spending to spur demand, Finance Minister Nirmala Sitharaman has announced an LTC cash voucher scheme and a special festival advance scheme for employees.

BUSINESS

Vedanta's delisting seems to have failed, what next for public shareholders

Equity shares of the company and those tendered by the shareholders in the delisting offer will continue to remain listed on the exchanges for now.

BUSINESS

Sensex, Nifty jump 4% last week; will the rally sustain? Here's what 10 top analysts say

Going ahead, markets are expected to witness sectoral churning and the benchmark index might remain subdued with stock-specific movements.

BUSINESS

RBI Monetary Policy | MPC announcements boost bank stocks; Nifty Bank jumps 3%

RBI's measures to revive the economy, including enhancing liquidity support for financial markets and deepening financial inclusion, are also see as positives for the banks.

BUSINESS

Harshad Mehta scam: 10 key points of the scam that jolted India in 1992

How did the ‘Big Bull’ manage to script a scam to the tune of Rs 4,000 crore? What made banks lend him huge sums of money? How did he put the stock market on steroids and take it on a dizzying ride, lifting some stocks by more than 4,000%? And how did it all end? Read on to find out

BUSINESS

Vedanta delisting offer garners healthy response; at what price should you tender shares?

The reverse book-building process for public shareholders to tender their shares started on October 5 and will conclude on October 9.

BUSINESS

Investors building in high hopes from Q2 earnings; can tepid numbers spook market?

There seems to be a widespread hope that the September quarter numbers will show the strong emergence of India Inc. from COVID-19 gloom.

BUSINESS

Auto stocks look attractive, analysts are betting big on these players

Growth in sales in the passenger vehicle segment was a pleasant surprise. Maruti Suzuki’s monthly volumes grew 36 percent year on year in September.

BUSINESS

RBI Monetary Policy | Rate cut unlikely today, RBI may focus on curbing inflation

There is a broad consensus that the RBI MPC will adopt a status quo on the policy rate decision, which will be announced on October 9, as it will assess the sustainability of the improvement in economic indicators.

BUSINESS

10 key things to know about Vedanta delisting; brokerages say Q1 earnings better than expected

The reverse book-building process for public shareholders to tender their shares started on October 5 and will conclude on October 9.