Benchmark indices fell by more than 2 percent each on October 15 after rallying for 10-days.

The Sensex ended more than 1,000 points to end at 39,728 and the Nifty closed nearly 300 points lower at 11,680.

"On the daily chart, the Nifty has formed a bearish outside bar along with an engulfing bear candle. The index seems to have stepped into a consolidation phase that can last for the next few sessions," said Gaurav Ratnaparkhi, Senior Technical Analyst, Sharekhan by BNP Paribas.

"On the downside, 11,500 is likely to act as a lower boundary for the consolidation, whereas on the higher side, the psychological mark of 12,000 will act as resistance," he added.

We have collated 14 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty The Nifty closed 2.43 percent lower at 11,680.35. According to pivot charts, the key support level for the index is placed at 11,552.57, followed by 11,424.83. If the index moves up, the key resistance levels to watch out for are 11,916.77 and 12,153.23.

Nifty Bank index The Bank Nifty underperformed frontline indices, plunging 802 points, or 3.36 percent, to 23,072.40. The important pivot level, which will act as crucial support for the index, is placed at 22,666.27, followed by 22,260.13. On the upside, key resistance levels are placed at 23,783.17 and 24,493.93.

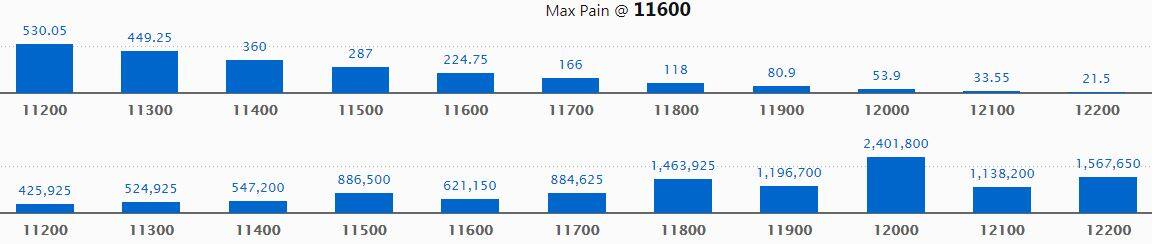

Call option data The highest call OI of 24.02 lakh contracts was seen at 12,000 strike, which will act as crucial resistance in the October series.

This is followed by 12,200, which holds 15.68 lakh contracts, and 11,800 strikes, which has accumulated 14.64 lakh contracts.

Call writing was seen at 12,000, which added 6.51 lakh contracts, followed by 11,800 strikes, which added 3.63 lakh contracts.

Call unwinding was seen at 11,300, which shed 24,525 contracts, followed by 11,200 strikes, which shed 7,500 contracts.

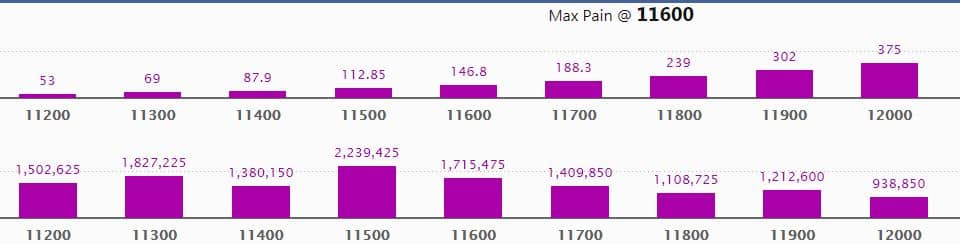

Put option data The highest put OI of 22.39 lakh contracts was seen at 11,500 strike, which will act as crucial support in the October series.

This is followed by 11,300, which holds 18.27 lakh contracts, and 11,600 strikes, which has accumulated 17.15 lakh contracts.

Put writing was seen at 11,400, which added 3.07 lakh contracts, followed by 11,300 strikes, which added 2.65 lakh contracts.

Put unwinding was witnessed at 11,700, which shed 4.09 lakh contracts, followed by 11,500 strikes, which shed 1.57 lakh contracts.

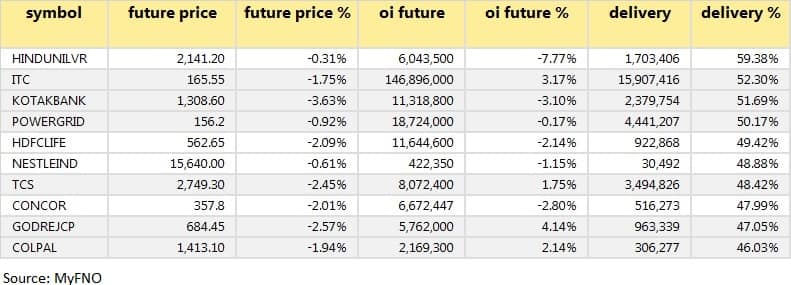

Stocks with a high delivery percentage A high delivery percentage suggests that investors are showing interest in these stocks.

No stock saw long build-up No long build-up was seen on October 15.

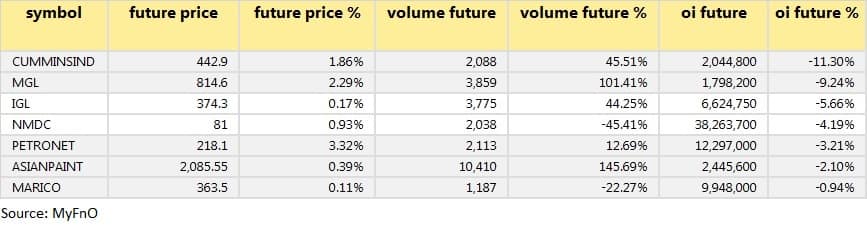

84 stocks saw long unwinding Based on the OI future percentage, here are the top 10 stocks in which long unwinding was seen.

46 stocks saw short build-up An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

7 stocks witnessed short-covering

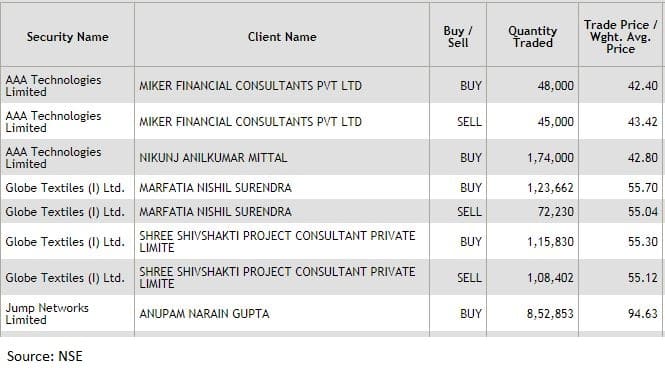

Bulk deals  (For more bulk deals, click here)

(For more bulk deals, click here)

Results on October 16: HCL Technologies, Bajaj Consumer Care, Federal Bank, Tata Communications, Tinplate Company, and Phillips Carbon Black.

Stocks in the news Persistent Systems enters into an agreement to acquire Palo Alto-based CAPIOT

Indian Bank - India Ratings & Research reaffirmed ratings of Indian Bank's outstanding Tier II bonds

Coforge - Board meeting on October 22 to consider financial result for the quarter-ended September 30

Dhanuka Agritech - Buyback to open on October 20 and close on November 2

CreditAccess Grameen to issue non-convertible debentures (NCDs) worth Rs 100 crore

MindTree Q2 net profit jumps 19% QoQ to Rs 253.7 crore. Rupee revenue stood at Rs 1,926 crore against Rs 1,909 crore

AstraZeneca Pharma will launch Calquence in India on October 21

Fund flow

FII and DII data Foreign institutional investors (FIIs) and domestic institutional investors (DIIs) net sold shares worth Rs 604.07 crore and Rs 808.29 crore on October 15, as per provisional data available on the NSE.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!