BUSINESS

Stick with short-term debt funds and bank FDs, for now

Look for spikes in bond yields to shift from short-term debt funds to long-term debt funds. If you wish to invest in fixed deposits, prevailing rates are attractive. Do not chase yields as it may indicate higher credit risk

TRENDS

HDFC AMC changes asset allocation of retirement fund; what should you do?

The fund house will keep net equity exposure in the scheme in the range of 5-30 percent but use spot-future arbitrage to maintain the gross equity allocation above 35 percent.

BUSINESS

Coming soon: Govt security with 50-year maturity. Should you invest?

Government security, or g-secs, come with very little to negligible credit risk. But some g-secs are liquid, mostly the 10-year benchmark. However, long-term government bonds are generally bought by institutional investors, not so much by individual investors. Here’s a look at its prospects.

BUSINESS

Debt funds: Are the yields attractive enough to buy?

Though inflation is not expected to pick up materially, rate cuts may still take time. So this could be a good time to invest in debt funds.

BUSINESS

Got an email from your mutual fund? It could be important

In order to make mutual funds more transparent, SEBI has over the years mandated that asset management companies inform investors of important changes via email, if it affects their money. These could be a change of the fund's mandate to a change in its investment objective.

BUSINESS

Why is Aditya Birla Sun Life AMC changing the investment strategy of its focused fund?

The fund house has decided to make the Aditya Birla Sun Life Focused Equity Fund a multi-cap portfolio compared to the large-cap equity portfolio now. The fund house has also given an exit option to investors until October 13, 2023, without any exit load.

BUSINESS

Why are large-cap funds losing money?

The chase for recent performers has led many investors to exit large-cap funds and shift to small- and mid-cap funds. But giving up on large-cap funds is a mistake. When markets fall, largecaps limit your downslide

BUSINESS

Sovereign Gold Bond Scheme 2023-2024 Series II opens today; should you buy?

Sovereign Gold Bond 2023: Gold can be a good diversifier for most portfolios. SGB can be used to achieve long-term exposure to gold in a tax-efficient manner.

BUSINESS

Why WhiteOak Capital’s new fund doesn’t offer a dividend option

The dividend option aims to periodically put some money in the hands of investors. But it is at the sole discretion of the fund house. WhiteOak Capital’s strategy is contrary to fund houses that opened close-ended schemes with only dividend options

BUSINESS

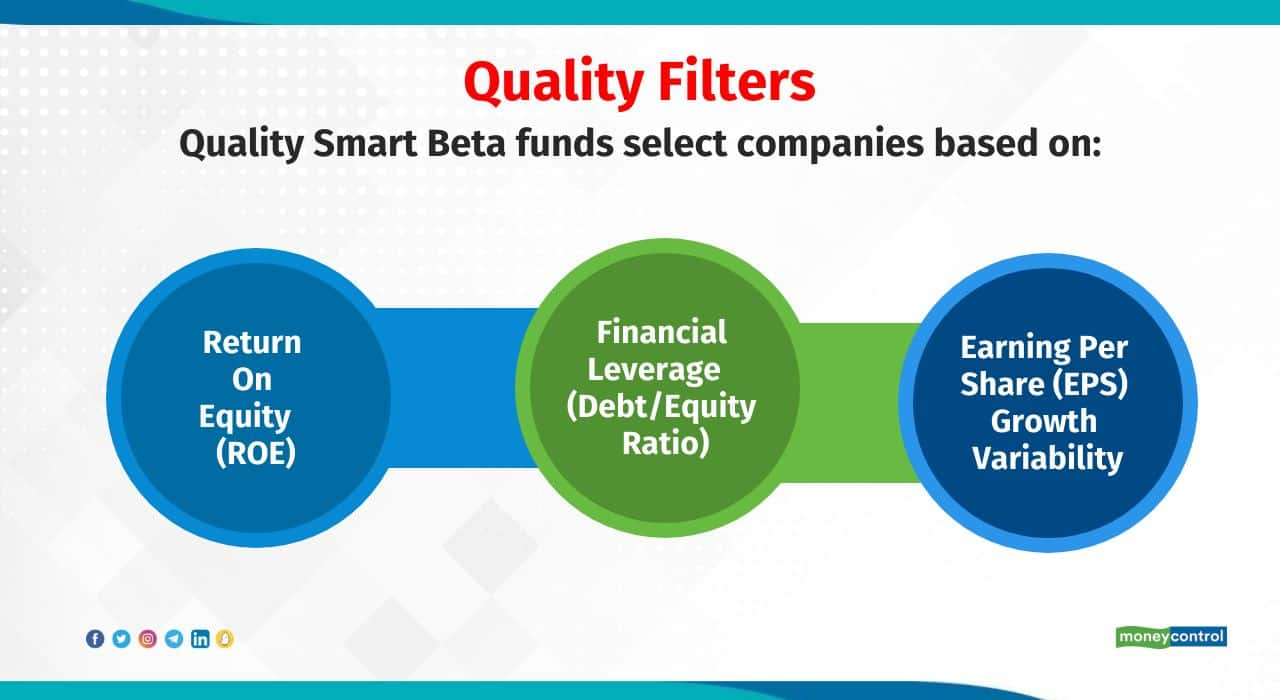

The quality test: Should you invest in smart beta funds focusing on quality?

Smart beta funds focusing on quality prefer to invest in quality companies with high valuation and strong cash flows. These funds are likely to offer good downside protection and tend to outperform in bear markets

BUSINESS

PGIM India Mutual Fund consolidates its debt funds

The proposed mergers of schemes at PGIM Mutual Fund are a change in their fundamental attributes. Hence, in line with mutual fund regulations, the fund house has given an exit option (without exit load) to investors

BUSINESS

Does an equal-weight index strategy work in mutual funds?

Mutual funds trying to outpace indices have been launching equal-weight index funds where each stock within the index is given equal weight. The recent outperformance has brought these funds into the spotlight.

BUSINESS

Bottom-fishing: Mutual funds launch tech funds as IT sector bleeds

The IT sector funds have returned a paltry 5.06% in the last year. But that hasn’t stopped fund houses from being bullish on tech-sector funds. Most of such schemes invest primarily in IT companies listed in India. Should you invest when the sector has fallen so much?

BUSINESS

Greed is creeping in now. Instead, it’s time to fix your past mistakes: Nishant Agarwal of ASK Private Wealth

While there may be one or two interest rate hikes in the US and India, these are priced in, says Nishant Agarwal, Senior Managing Partner, ASK Private Wealth. Expect equities to give a long-term average return of around 15 percent, he says. Agarwal also throws some light on the themes he likes

BUSINESS

SEBI reduces exit option window to 15 days in case of change in control of AMC

SEBI has reduced the exit window period to not less than 15 calendar days in case of change in control of AMC. The regulator has asked the AMCs to make necessary changes to facilitate implementation of the same before September 11

BUSINESS

Bandhan Balanced Advantage Fund changes asset allocation model; should you be worried?

From relying just on the Nifty 50’s PE ratio, the fund will now look at multiple factors. The last date for investors to exit if they do not approve of this change, is August 11.

BUSINESS

RBI’s worry on inflation can impact debt funds. Here is what investors should do

Liquid, money market funds received high net inflows in June 2023. Such schemes can help investors to benefit from the current attractive yields.

BUSINESS

Retail investors prefer index funds over ETF while going passive: Motilal Oswal AMC Survey

61 percent of the respondents revealed that they have invested in at least one passive fund. Low cost, simplicity and market returns were important reasons cited behind investing in a passive fund

BUSINESS

Mutual Fund Folio decoded: How to streamline and manage your investments effectively

Mutual funds allow zero-balance folios which can be tapped to make an investment at a future date. All MF folios need to have contact details — emails and mobile numbers seeded and nominations updated, or the investors have to explicitly opt out of it.

BUSINESS

When fund managers leave, should investors follow?

Acting in a hurry may hurt your portfolio. It is better to take an informed decision after observing the scheme’s performance

BUSINESS

Motilal Oswal AMC proposes merger of two schemes: What should you do?

Motilal Oswal Asset Management Company will merge its target maturity fund into a fund of funds investing in benchmark government security

BUSINESS

Gilt Funds: Is it time to jump on to the roller coaster of returns?

In the long term, gilt funds can outperform most other fixed-income funds. But they can be volatile in the short term as seen in the returns of the last couple of years

BUSINESS

Finance Minister inaugurates bail-out facility for debt funds

On July 28, the Finance Minister Nirmala Sitharaman launched the back-stop facility for debt funds, to buy back debt securities in extreme illiquid markets.

BUSINESS

SEBI issues guidelines for emergency facility for debt funds in unfavourable market conditions

On July 28, the finance minister is expected to launch the corpus that aims to provide liquidity to debt mutual funds in troubled times. On July 27, SEBI issued detailed guidelines on how debt funds will make use of this facility.