BUSINESS

Chart of the Day: Why is manufacturing's share in total GVA in FY25 same as in FY07?

The schemes being rolled out to boost India’s manufacturing sector don’t seem to be working

BUDGET

Union Budget 2025: Key expectations for GIFT IFSC growth

Stakeholders anticipate crucial reforms in the Union Budget 2025 to enhance GIFT IFSC’s appeal. Key expectations include tax parity for resident investors, inclusion of non-residents in OTC transactions, green bond incentives, and clarity on post-tax holiday taxability.

TRENDS

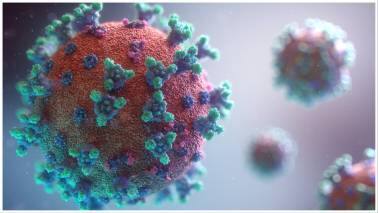

Human Metapneumovirus in India: Separating fact from fear

Human Metapneumovirus (hMPV) cases in India spark anxiety, but officials assure the situation is under control, with existing surveillance systems and preventive measures in place to mitigate its spread

BUSINESS

Can gold maintain its shine in 2025 amidst global turmoil?

The World Gold Council (WGC) suggests the peak may be behind us, predicting that gold could remain rangebound throughout 2025

BUSINESS

Green Channel Route via CCI: Challenges in streamlining M&A approvals

The Green Channel route introduced to expedite M&A approvals has become less effective due to stricter interpretations and complex new rules. The CCI should reconsider changes to foster a more business-friendly and efficient regulatory environment for non-problematic transactions

BUSINESS

The Reading List: January 3, 2025

Our research and opinion teams have curated a selection of articles and social media gems from the world of economy, business and finance for your weekend read.

WORLD

‘When I am about ninety I will re-evaluate whether the institution of the Dalai Lama should continue or not’

The Dalai Lama will turn 90 in July. Dalai Lamas, who functioned as the political and spiritual heads of Tibet for over three centuries, have been chosen as reincarnations. Given the threat of the Chinese Communist Party interjecting itself in the selection process, the current Dalai Lama in 2011 wrote an article explaining the background of the belief in reincarnation and cautioning people about the danger of others being propped up to serve political ends. Moneycontrol reproduces edited extracts of the Dalai Lama’s article, where he concludes by saying that the continuity of the institution will be re-evaluated when he reaches the age of 90

BUSINESS

Budget Snapshot: Fiscal deficit track record got better in current decade

Fiscal deficit for FY26 is expected to be lower than the current year

BUSINESS

Budget Snapshot: STT collections to take a beating, thanks to SEBI curbs

While current STT collections may exceed budget forecasts for this fiscal year, a steep decline in revenue from STT for the next fiscal year is likely due to reduced trading volumes

TRENDS

The Mandala of Organisational Wellness: A blueprint for success

The Mandala of Organisational Wellness offers a framework for measuring organisational health through three key circles: Core metrics (financial health), Cardinal metrics (long-term growth), and Vital metrics (social responsibility). This holistic approach fosters sustainable success and transformation in 2025

BUSINESS

Retrospect your debt patterns to improve your credit score in 2025

As the new year begins, focusing on improving your credit score can enhance financial opportunities. By reviewing reports, paying on time, diversifying credit, and setting goals, you can strengthen your financial profile and unlock better interest rates and loans

BUSINESS

Chart of the Day | India's import dependence for L-ion batteries to come off sharply

Rapid growth in adoption of electrification, evolving technology and large-scale manufacturing of L-ion cells is likely to see reduction in costs

BUSINESS

Overreliance on fiscal policy harms India’s economic growth prospects

A lower-than-expected GDP growth rate in the July-September quarter was on account of inadequate public investment. This points to lop-sidedness in growth drivers. Therefore, RBI’s MPC should consider a reduction of half a percentage point in the repo rate over two phases in early 2025.

TRENDS

Manmohan Singh: A gentle colossus

Two consequential developments of his prime ministership were an unprecedented economic growth spurt and a reset in India’s strategic position through the nuclear deal with the U.S. A London-based writer says that while Manmohan Singh’s grasp of economics was well known, his understanding of international affairs was possibly second only to his knowledge of economic issues. Unsurprisingly, he was appreciated abroad with awe and admiration

BUSINESS

Jobs conundrum in a red-hot economy

India’s economy bounced back sharply after the pandemic-induced contraction. However, the job market hasn’t seen an equivalent improvement, thereby emerging as one of the big political-economy issues of 2024. An economist sifts the data to distinguish between quantity and quality in the job market and suggests ways to improve things

BUSINESS

The Reading List: December 27, 2024

A selection of articles and social media gems from the world of economy, business and finance, curated by our research and opinion teams

BUSINESS

Chart of the Day: RBI’s forex position shows why a CRR cut was coming in December

The RBI’s forex operations are the biggest drag on liquidity

BUSINESS

What founders should know before approaching venture capital funds in 2025

While investor confidence and VC funding activity revived in 2024, funds are looking for certain specific qualities in the startups they are willing to fund

BUSINESS

Pre-IPO Playbook: Setting the stage for a successful public listing

A well-executed pre-IPO strategy is crucial for a smooth public debut, involving careful planning, investor alignment, and a strategic approach to timing, valuation, and investor engagement to attract top-tier public market investors and ensure long-term success.

BUSINESS

Chart of the Day: Finding opportunity amid market turmoil

Amid widespread fall in equities, some sectors have shown signs of being winners

BUSINESS

The Reading List: December 20, 2024

A selection of articles and social media gems from the world of economy, business and finance, curated by our research and opinion teams

BUSINESS

A solution for the conundrum of GST on food delivery charges

Platforms are intermediaries matching demand with supply. GST law however puts the onus of tax collection from both sides of the transactions on platforms. But the law doesn’t cover gig workers who deliver. Authorities are reluctant to let this service go untaxed. There’s a way out to balance all interests

BUSINESS

Chart of the Day: EM currencies are in for a pounding next year

Volatility will rule and investors are clueless on EM trades

BUSINESS

The import risk Chinese overcapacity poses to Asian countries

With the US raising tariffs on Chinese imports, there could be a flood of Chinese goods to other Asian economies. While countries such as Thailand and Indonesia are particularly vulnerable, sectors such as metals in India may be hit