BUSINESS

Our primary focus is to remain on protection biz, says ACKO Life's CEO Sandip Goenka

We’ll continue to focus on protection, mainly term insurance, while also planning to develop pensions and annuities to tackle longevity risk before shifting to savings, Goenka says

BUSINESS

Fire insurance premiums could surge 60% in 2025

This hike could be anticipated amid an 80 percent property rate in January, 2025, which was aimed to restore solvency after a period of aggressive discounting, aimed at maintaining solvency, according to industry analysts

BUSINESS

Axis Max Life aims to dial back ULIP exposure amid margin decline

Product mix shift, high ULIP sales, and new surrender norms impacted margins by 4 percent, said CFO Amrit Singh in an interaction

BUSINESS

Explainer: The DICGC as a safety net in the New India Co-operative bank crisis

The DICGC acts as a crucial safeguard in this scenario, ensuring that depositors of the New India Co-operative Bank are not left entirely out of pocket

BUSINESS

Explained: Why your cost of loan has not reduced despite a repo cut

The actual impact depends on several factors, including the type of loan you have and the interest rates are determined

BUSINESS

Health insurance dominates non-life with 40% share despite slow growth, while motor at 29.3% despite being mandatory

A critical issue for motor insurance is the high percentage of uninsured vehicles because of non-compliance with mandatory insurance laws," says Galaxy Health Insurance CEO

BUSINESS

Non-life insurance sector grows 6.58% in Jan 2025; Health insurers lead with 17.76% surge

In terms of market dynamics, general insurance maintained an 84.65 percent share of the total premiums for January 2025, with health insurers capturing 11.72 percent and specialised insurers at 3.63 percent

BUSINESS

Life insurance premiums drop 8% in Jan 2025; PNB MetLife, Godigit shine amidst LIC’s decline

Life insurance sector is facing sustained headwinds, with both LIC and private insurers experiencing challenges in premium growth

BUSINESS

Explained | Open architecture in insurance: Push for choice, debate on impact, and industry's stance

While this proposal aims to enhance consumer choice and potentially drive competition, reports have surfaced indicating that major companies oppose the open architecture model for individual agents

BUSINESS

LIC evaluating stake in health insurer, deal unlikely in FY25: CEO

Factors such as regulatory approvals and valuation will take time, says Mohanty

BUSINESS

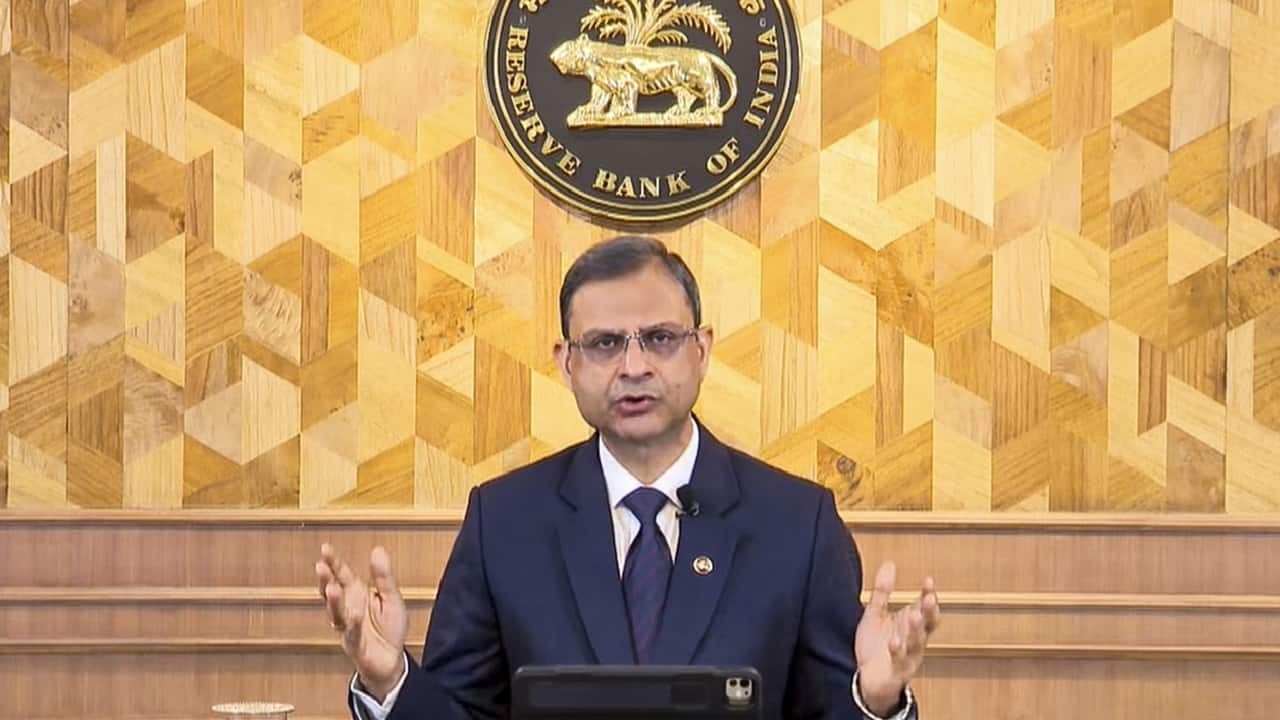

RBI's repo rate cut welcomed by bank leaders, expected to ensure liquidity while monitoring inflation

However, some banks acknowledged the short-term impact on their profitability, with expectations of eventual recovery

BUSINESS

RBI cuts repo rate by 25 bps to 6.25%, Deposit rate transmission to take two quarters

The Standing Deposit Facility (SDF) rate remains unchanged at 6.5 percent, as do the Marginal Standing Facility (MSF) and bank rates, indicating a cautious yet accommodative monetary policy stance, says RBI Guv

BUSINESS

RBI to introduce new guidelines on conduct of banks to tackle the issue of mis-selling

This move comes as part of an effort to curb practices that lead to consumer detriment and to ensure a level playing field in the financial services sector, he said.

BUSINESS

RBI has reduced inflation forecast for FY26, FY25 forecast remains unchanged

Malhotra projected the retail inflation at 4.2 percent for next financial year beginning April while retaining the forecast for 2025 at 4.8 per cent

BUSINESS

Insurance companies see no benefit from open architecture; Leaders cite unemployment, mis-selling concerns

Moreover, companies have not seen much success with the open architecture model

BUSINESS

Centre's ULIP tax clarification may push insurers, policyholders towards new products

While ULIP sales have significantly driven premium growth for private insurers, a downturn in market stability typically leads to reduced demand for ULIPs, with effects usually seen nine to twelve months later

BUSINESS

ULIP taxation clarified in Budget 2025

The new reform dictates that ULIPs with annual premiums over Rs 2.5 lakh will face a 12.5 percent tax on gains, if held for more than one year

BUSINESS

Centre revises classification criteria for MSMEs to boost growth and access to capital in Budget 2025

The government has raised investment limit for MSMEs by 2.5 times and the turnover limit by 2 times

BUSINESS

Centre clarifies tax regulations for ULIPs; Premium cap and capital gains tax on non-exempt policies

Under the previous rules, if the annual premium for ULIPs was up to Rs 2.5 lakh, the maturity amount was tax-free after a five-year lock-in period

BUSINESS

Loans to MSMEs made easier and cheaper through credit cards

Customised credit cards with a limit of Rs 5 lakhs to be issued to micro enterprises registered on Udyam Portal; There are currently 7.5 crore people employed under MSME, contributing 36 percent to manufacturing and 45 percent to exports

BUSINESS

FM paves way for 100% FDI in insurance sector

Known to be one of the longest standing requests of the insurance industry, this move creates room for increased participation from foreign players in India's insurance landscape. But the real tes

BUSINESS

Agricultural sector likely to see relief due to increase in KCC loan limit

The sector, which had been under stress for a prolonged period of time may likely see relief through increase in KCC loan limit, helping 17 million farmers, says analyst

BUSINESS

FM announces only one reform from new Insurance Bill, others left out

The other reforms, for reasons unknown to me, have been deferred, but will likely be introduced in the very near future, says Ex-IRDAI member

BUDGET

MSMEs get a boost with enhanced credit access, Kisan Credit Card loan limit raised

The step aims to provide farmers with better access to formal credit and reduce their dependence on high-interest informal borrowing, FM says