BUSINESS

Trade Spotlight: What should investors do GMR Infra, NTPC, & Adani Ports?

GMR Infrastructure rallied more than 9 percent to hit a fresh 52-week high, NTPC was up nearly 4 percent and Adani Ports ended with gains of over 5 percent on June 21.

BUSINESS

DAILY VOICE: Auto could be a contra bet! This sector could surprise over the next 12 months: Rajat Chandak of ICICI Prudential AMC

One of the key risks which could play spoilsport is rising inflation. This is despite the understanding that some amount of inflation tends to be good for equities as an asset class, as it supports nominal growth in GDP as well as corporate earnings.

BUSINESS

After The Bell: Smart recovery from lows! What should investors do on Tuesday?

Nifty has to hold above 15700 zones to witness an up move towards 15900 and 16000 zones, while on the downside support can be seen at 15600 and 15550 zones, says Chandan Taparia of Motilal Oswal Financial Services

BUSINESS

Small & Midcap Mantra | After rallying more than 300% in a year, this stock is headed even higher

The stock has given rounding bottom formation breakout at 1,450-1,500 after a double bottom formation at 1,150 level. It is continuously forming higher highs and higher lows on weekly charts and is comfortably placed above all its major moving averages

BUSINESS

A 3-10% correction will be a healthy correction for D-Street: Experts

The Nifty50 is trading above crucial moving averages which is a positive sign. The short-term moving average i.e. 50-Days Moving Average is placed at 15,063 on the daily charts.

BUSINESS

AI-focused IT companies, pharma, chemical & semiconductor firms to create new multibaggers: Amit Jain of Ashika Wealth

Any correction in the market will be an excellent opportunity to invest in midsized companies in these sectors, says Jain.

BUSINESS

Experts advise caution at higher levels, pick 10 names ahead of June F&O expiry based on technical analysis

As far as levels are concerned, 15,820 – 15,880 are immediate resistances, whereas 15,550 – 15,450 – 15,400 are support levels, suggest experts.

BUSINESS

Gold Price Today: Yellow metal trades higher, but below Rs 47,000; Silver July futures flat

On the domestic front, MCX Gold August futures will continue bearish momentum below Rs 46,900 levels. Support is at Rs 46,600-46,400 levels. Resistance is at Rs 47,000-47,150 levels, suggest experts.

BUSINESS

15400 a decisive support for Nifty; stay selective and stick to quality in small & midcaps: Mehul Kothari of AnandRathi

Kothari is bullish on UBL, Sun Pharma and Aurobindo Pharma for the short term

BUSINESS

DAILY VOICE | 3 reasons why correction in largecaps could be limited: Shyamsunder Bhat of Exide Life Insurance

The Nifty is quoting at possibly 19xFY23 expected earnings. The index may see some near-term consolidation or possibly a small correction as well, says Bhat

BUSINESS

Nifty50 may move towards 16000-16200 levels in coming weeks: Sumeet Bagadia of Choice Broking

Bagadia is bullish on Bajaj Auto, Avenue Supermarts and HDFC Life Insurance for the short term

BUSINESS

FMCG a dark horse! Dip in market likely in the run-up to the Q1 results: Naveen Kulkarni of Axis Securities

This dip could be a good opportunity to accumulate, says Kulkarni

BUSINESS

A 3-5% dip will be healthy for D-Street, says Nirali Shah of Samco Securities

The Nifty made four consecutive weekly green candles before closing in the red this week. With high uncertainty due to the third wave and new delta variant, the benchmark index has been rising on slow momentum, says Shah.

BUSINESS

Small & midcaps underperform, 15 BSE500 stocks fall 10-20% during the week

The market is likely to remain volatile in the coming week ahead of the June F&O expiry. The immediate support for the NIfty is placed around 15,450-15,550, while on the higher side, 15,800-15,900 will act as resistance, say experts

BUSINESS

D-Street Talk: 2023 will be the first full year of earnings recovery, says Kenneth Andrade

We favor export-facing businesses, companies that have the cost advantage in their favor, and two we are a little averse to buy too many domestic consumer-facing businesses, says Andrade.

BUSINESS

Small & Midcap Mantra: Why you should not give the stock that rose over 50% in 3 months, a miss

Caplin Point with a strong presence in Central America, is on track to surpass its 52-week high of Rs 694.40 and reach closer to Rs 780 in the coming months, an upside of 16% from current levels

BUSINESS

Gold Price Today: Yellow metal above Rs 47,000, silver July futures up over 1%

Investors are advised to buy in gold around Rs 46,800 with a stop loss of Rs 46,600 for a target of Rs 47,300 and in silver around Rs 67,200 with a stop loss of Rs 66,600 for a target of Rs 68,500, say experts.

BUSINESS

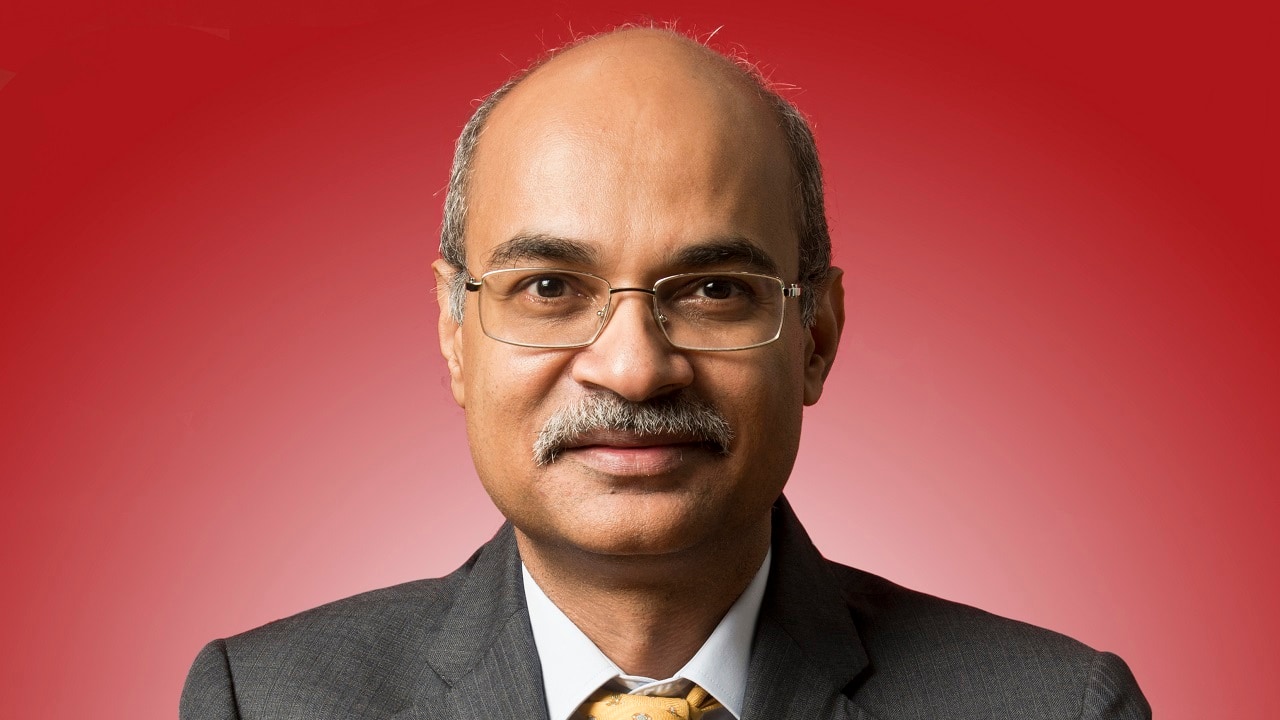

DAILY VOICE | Market at elevated levels, investors need to be cautious and stick to their asset allocation: Sanjay Dongre of UTI AMC

On a trailing 12-month P/B multiple basis, the market is trading at about 3.2 times compared to the last ten averages of 2.6 times. If we go by the history of the last 30 years, such a high valuation has never sustained beyond few quarters, he said

BUSINESS

Trade Spotlight: What should investors do with Radico, Tata Consumer & APL Apollo Tubes?

Stocks that were in focus on June 17 included Radico Khaitan that rallied nearly 7 percent to hit a fresh 52-week high, Tata Consumer rose 1.2 percent and APL Apollo Tubes closed with gains of more than 5 percent.

BUSINESS

After The Bell: Hawkish Fed stalls D-St rally, what should investors do on Friday?

The index has to hold above 15,700 for an up move towards 15,800 and 15,900, while on the downside, support can be seen at 15,600 and 15,550 zones, say experts.

BUSINESS

Small & Midcap Mantra | BLS International has rallied 200% in a year, is on the verge of another breakout

Traders can accumulate the stock on "every meaningful dip" for a price target of Rs 170–175. The ideal accumulation range will be around Rs 115–105, say experts.

BUSINESS

Gold Price Today: Yellow metal down over 1% on hawkish US Fed comments

Traders can sell gold below Rs 48,200 with a stop loss of Rs 48,600 for the target of Rs 47,500, suggest experts.

BUSINESS

Trade Spotlight: What should investors do with Jubilant FoodWorks and Jai Corp?

Stocks that were in focus included Jubilant FoodWorks, which closed with gains of nearly 2 percent, and Jai Corp that rallied over 15 percent on Wednesday. All the stocks hit a fresh 52-week high.

BUSINESS

DAILY VOICE | This fund manager with over Rs 70,000 crore in AUM sees a big shift in automobile space

Sampath Reddy of Bajaj Allianz Life feels that auto sector will be a disruptor going ahead. Taking about the earnings, he said Nifty companies, on aggregate, have delivered over 15 percent growth in FY21 despite the shutdowns last year.