The Indian market snapped its four-week winning streak to close in the red on June 18. The S&P BSE Sensex fell 0.25 percent, the Nifty50 was down 0.73 percent and a big selloff was seen in the broader markets during the well.

The market closed lower in three of five trading sessions of the week, largely weighed down by weak global cues. The benchmark indices, however, managed to close above crucial psychological levels, which is a positive sign for the bulls and shows strength at lower levels.

The BSE midcap index fell 3 percent and the smallcap index 1.8 percent for the week ended June 18, data from AceEquity showed.

Around Rs 4 lakh crore of investor wealth lost during the week. The average market capitalisation of the BSE-listed companies fell from Rs 231.11 lakh crore on June 11 to Rs 227.33 crore on June 18.

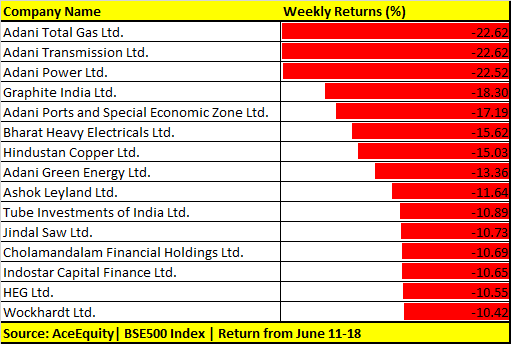

Tracking the muted momentum, 15 stocks in BSE 500 index fell 10-20 percent during the week. These include names like HEG, Tube Investment, Adani Green Energy, Graphite India, Adani Power and Adani Total Gas.

Experts say the near-term underperformance should not be mistaken with a downtrend in the small and midcaps because it is still a bull market.

“The midcaps and small caps have been seeing a correction and this could continue for some more time as commodity stocks also correct. The reason is multifold, ranging from the earlier rise in interest rates to muted expectations from Q1FY22,” Naveen Kulkarni, Chief Investment Officer, Axis Securities, said.

But, the near-term underperformance of small and midcaps was unlikely to last long and they would be back in favour as many were seeing a strong earnings cycle emanating, he said.

Where is Nifty headed?The Nifty closed with losses of 0.7 percent for the week. It failed to hold on to the crucial level of 15,901 recorded on June 15 but it is still trading above the 50-day moving average (DMA) placed at 15,063.

The market is likely to remain volatile in the coming week ahead of the June monthly F&O expiry on June 24. The immediate support to watch out for would be 15,450-15,550, while on the higher side, 15,800-15,900 will act as resistance, say experts.

“We are now stepping into a monthly expiry week and looking at overall positioning of our market, we expect the volatility to increase a bit,” Sameet Chavan, chief analyst-technical & derivatives, Angel Broking, said.

“As far as levels are concerned, 15,820–15,880 to be seen as immediate resistances; whereas on the lower side, 15,550–15,450–15,400 are to be seen as support levels,” he said.

Chavan advised traders to lighten up positions at higher levels and take one step at a time.

Among sectors, despite tepid market conditions, strong buying was seen in FMCG and IT stocks, whereas sustained selling saw the metal index shed more than 6 percent.

Technically, after the strong rally, the Nifty and Sensex formed a Hammer candlestick, indicating indecisiveness in the market.

“The medium-term texture of the benchmark indices is still bullish and likely to continue in the short run. We are of the view that post strong uptrend rally the market is hovering in the range of 15,450 to 15,900/ 51,900-52,850 levels,” Shrikant Chouhan, Executive Vice President, Equity Technical Research, Kotak Securities, said.

The texture of the chart suggests 15,400/ 51,800 should be the sacrosanct level for the bulls and as long as these were upheld, the uptrend would likely continue to 15,800-15,900/52,600-52,850 levels,” he said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.