June 21, 2021 / 13:23 IST

Indian market has rallied more than 12 percent so far in the year 2021 pushing benchmark indices to record highs in June but the latest US Fed jitters with respect to sooner than expected hike in interest rates led to some profit-taking in equity markets across the globe, including India. After a steep rally of 12 percent in the Nifty50 and about 10 percent rally in the S&P BSE Sensex so far in the year 2021, experts feel that even if there is a correction of 3-10 percent from current levels, it will be a healthy dip and investors should buy the dip. A dip of say 3-10% from the current levels of 15,683 recorded on June 18 would effectively take the index towards 15,200-14,114 levels. The Nifty50 hit a record high of 15,901.60 last week on June 15 and then investors booked profit and pushed the index below 15,700 levels for the week ended June 18. The index is still trading above the crucial levels of 15,400-15,200. Investors/traders should effectively look at buying the dip towards 15,000-14,000 levels. But, there is a plenty of demand at lower levels which would effectively protect the downside. “Settling of the 3rd wave can be temporary and hence the markets would still remain under the ambiguity of Covid–19. Volatility is likely to stay for few more months,” Mehul Kothari, AVP – Technical Research at AnandRathi. “In such a scenario, a 10% dip can still be a healthy dip for which the investors should not be worried about. However, anything below 14,000 in the Nifty would be a cause of concern for few more months. For the very short term, 15,400 – 15,000 could be a strong support area,” he said. The Nifty50 is trading above crucial moving averages which is a positive sign. The short-term moving average i.e. 50-Days Moving Average is placed at 15,063 on the daily charts. A close below this short-term moving average would tilt the trend towards bears. The 100-Days Moving Average is placed at 14,926, and the long term moving average i.e. 200-Days Moving Average is placed at 13,761. Moneycontrol Technical rating is still very bullish for the Nifty50. Most of the technical indicators such as RSI, MACD, ROC etc. are bullish.

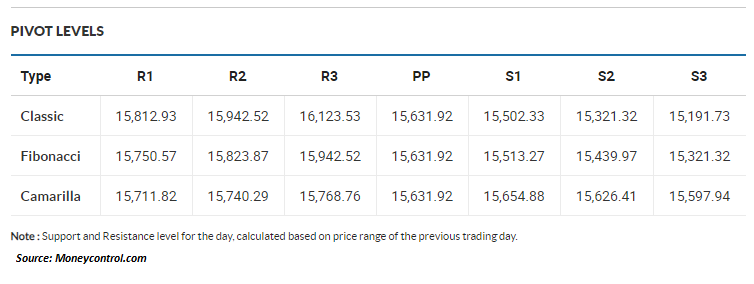

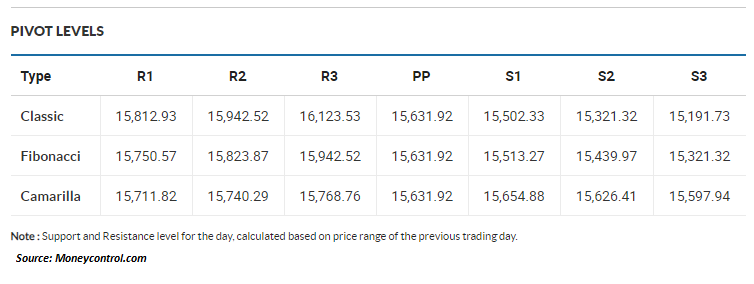

Track Technicals for Nifty here -

All eyes will be on June quarter earnings, and the impact of the second COVID wave on India Inc. Apart from that possible Third-wave along with vaccination progress will dictate the trend of the markets. More lockdown in the coming months could further limit the upside for D-Street, but stock-specific action will continue. “As the second wave started receding towards the end of last month, states have been relaxing curbs and mobility restrictions across India which has been the primary driver of economic trade activity picking up,” Nirali Shah, Head of Equity Research, Samco Securities said. “Also, the consumer-side of demand is starting to pick up as people moved on to reallocate their savings and funds towards normal spending. These twin factors are key drivers for the overall recovery,” she added. “Markets are discounting all these future earnings growth even in the distressed sectors which could face hindrances in case of a Third wave. A correction of 3-5% would be considered healthy in the near time. Investors can use the dip to invest and bring down their average cost price,” explains Shah.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

All eyes will be on June quarter earnings, and the impact of the second COVID wave on India Inc. Apart from that possible Third-wave along with vaccination progress will dictate the trend of the markets. More lockdown in the coming months could further limit the upside for D-Street, but stock-specific action will continue. “As the second wave started receding towards the end of last month, states have been relaxing curbs and mobility restrictions across India which has been the primary driver of economic trade activity picking up,” Nirali Shah, Head of Equity Research, Samco Securities said. “Also, the consumer-side of demand is starting to pick up as people moved on to reallocate their savings and funds towards normal spending. These twin factors are key drivers for the overall recovery,” she added. “Markets are discounting all these future earnings growth even in the distressed sectors which could face hindrances in case of a Third wave. A correction of 3-5% would be considered healthy in the near time. Investors can use the dip to invest and bring down their average cost price,” explains Shah. Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

All eyes will be on June quarter earnings, and the impact of the second COVID wave on India Inc. Apart from that possible Third-wave along with vaccination progress will dictate the trend of the markets. More lockdown in the coming months could further limit the upside for D-Street, but stock-specific action will continue. “As the second wave started receding towards the end of last month, states have been relaxing curbs and mobility restrictions across India which has been the primary driver of economic trade activity picking up,” Nirali Shah, Head of Equity Research, Samco Securities said. “Also, the consumer-side of demand is starting to pick up as people moved on to reallocate their savings and funds towards normal spending. These twin factors are key drivers for the overall recovery,” she added. “Markets are discounting all these future earnings growth even in the distressed sectors which could face hindrances in case of a Third wave. A correction of 3-5% would be considered healthy in the near time. Investors can use the dip to invest and bring down their average cost price,” explains Shah. Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.